10+ Finance for Non-financial Managers Examples to Download

In business, there are different kinds of managers, such as human resource managers, operations managers, etc. They are non-financial managers or managers that do not concern themselves when it comes to finances. However, to fully understand the business industry and for growth — if these people want a brand-new career path — here are some finance essentials for business success and even personal finance essentials. This article will help these non-financial managers understand finance and the things that come with it.

Financial Terminology and Key Accounting Concepts

Understanding how finance functions and works is a big contribution in achieving success for your business and the people that are involved in it. However, to fully grasp the essence of finance, you should start by learning from the basics such as the financial terminologies and key accounting concepts.

The former is necessary when it comes to digging into the finance essentials for small businesses if you ought to be an entrepreneur and start your own business. Examples of it are GAAP or General Accepted Accounting Principles, balance sheet, cash flow, etc. The latter, however, is crucial in learning financial accounting and auditing. The samples are the accruals concept, the conservatism concept, the consistency concept, and more.

10+ Finance for Non-financial Managers Examples in PDF | DOC

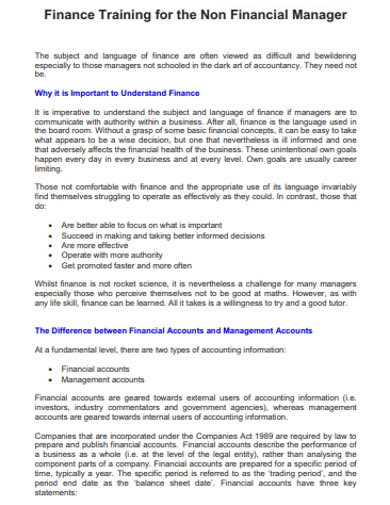

1. Finance Training for the Non Financial Manager

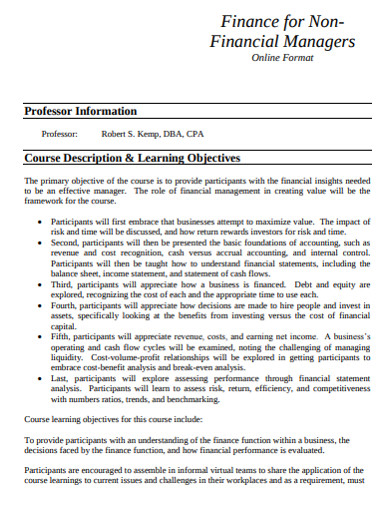

2. Finance for Non-Financial Managers in PDF

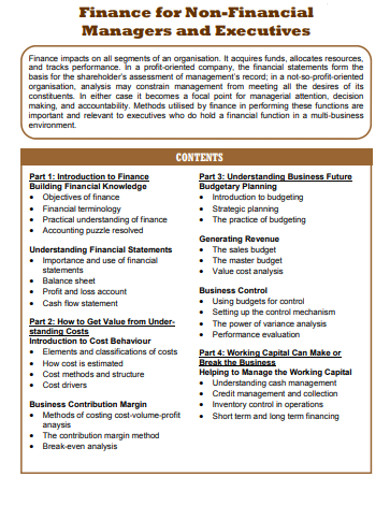

3. Finance for Non-Financial Managers and Executives

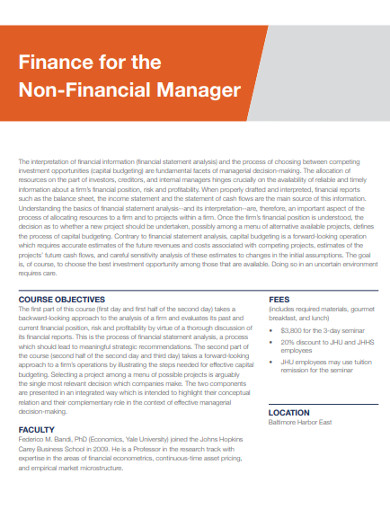

4. Sample Finance for the Non-Financial Manager

5. Finance for Non-Financial Course Outline Managers

6. Standard Finance for Non-Financial Managers

7. Finance for Non-Financial Managers and Board Members

8. Finance and Accounting Non Financial Managers

9. Financial Management for Non Financial Managers

10. Cost and Risk Finance for Non Financial Managers

11. Finance for Non-financial Managers in DOC

Why Accounts are Prepared and The Accounting Process

Financial accounts are prepared to present the investors, tax authorities, creditors, and other outer parties with exact details about a certain business. The two basic goals of companies are to gain profit while remaining creditworthy. Thus, to be successful in both areas, an accountant must present financial statements. The accounting process is a sequence of events that opens with a transaction and closes with the shutting of books. Since this procedure is repeated every reporting time, it is basically regarded as the accounting cycle with various steps that includes business transaction analysis and evaluation.

What is Financial Statement and How Useful it is in Decision-Making?

Financial statements are written files that contain the business operations and the financial practice of business. Also, it is one of the corporate finance essentials. Moreover, there are three significant reports financial statements contain. These are the following: balance sheet which presents a synopsis of the assets, liabilities, and equity of stockholders as a shot in time; income statement concentrates on the profit and expenses within a specific time; cash flow statement measures the ability of a business to produce and manage money.

These statements help in decision making because it gives investors a basis for financial health analysis. Also, it aids the creditors to evaluate creditworthiness, liquidity, and such as a business.

What is Financial Management and How Different it is from Accounting?

Financial management is all about organizing, planning, controlling, and directing the financial affairs such as attainment and using funds. It also means implementing basic management principles to the finances of the company. The notable difference between financial management and accounting is that the former asks to plan future transactions while the latter requires reporting of recent financial deals. However, both terms are essential to learn and be an expert because they are two of the business essentials for startups and entrepreneurs.

How is Financial Management Essential to Growing up in the Organizational Chart?

The essence of financial management — and management in general — in developing the organizational chart is that it boosts the empowerment, effectiveness, and function of employees. What keeps a company running is not just the funds but also the workers; thus, with good financial management, the employees will feel secure about their job. As a result, the business will still be running strong and will have a large shot of expansion.

Financial Ratios and Its Implications in Various Decisions

Financial ratios are made using numerical values that are taken from the financial statements to accumulate substantial data about a business. These ratios vary and are classified based on their functions. Here is a list of the ratios that you need to learn for financial analysis for business evaluation:

- Profitability Ratios – helps in measuring the skill of a company to produce a profit.

- Liquidity Ratios – commonly used to figure out a debtor’s capability to pay off a present debt without increasing the external capital.

- Management Efficiency Ratios – it calculates a company’s capability to harness and manage its assets and liabilities respectively in an efficient manner and in the present or short-term period.

- Leverage Ratios – any of the many financial measurements that views how much asset comes in the form of loans or imposes the capability of a business to reach its financial obligations.

- Valuation and Growth Ratios – determines the relative bargain between the stock price, the EPS, and the expected growth of a company.

What is Working Capital Management?

Working capital management talks about a particular business’ strategy of managerial accounting. It is made to track and harness the components of working capital — which are the current liabilities and assets — to guarantee the best financially effective operation of the business. Moreover, its sole purpose is to assure the company keeps enough cash flow to reach its brief operating costs and debt obligations.

How and When to Use Financial Terms and Analysis Techniques?

The best time to utilize the financial terms and analysis techniques is when creating financial documents such as financial statements, bookkeeping, etc. As a financial expert, you must consider your readers so that they could comprehend and clearly process the information in your document — especially for the newbies in the financial world.

The Link Between Organizational Strategy and Financial Objectives

First, let us define the two terms given. Organizational strategy is the total of the activities a business means to take to accomplish long-term goals. Financial objectives are the aims of a company which can be presented in financial terms. These objectives directly affect the company’s financial statements. Thus, both are used to set goals for the benefit of the business.

The Flow of Money in a Business and How it is Accounted

The flow of money in a business — or cash flow, in other words — is usually calculated during a particular period or accounting time. To understand further, the cash flow is the totality of cash income and expenses within a specific time. Thus, its measurement can be utilized in computing other variables that provide details on a business’s liquidity, value, and situation. With negative cash flow, the company cannot fulfill its monetary obligations; thus, leading to bankruptcy.

In this situation, the importance of financial accounting in decision making comes in. Investors, creditors, and such will look into a company’s financial statements and view how capable they are in handling their resources. If a company fits into their standards, they may start making transactions with it. However, these investors will look for project finance essentials to gain benefits from their investments.