11+ Financial Accounting and Auditing Examples to Download

An audit is like an examination that evaluates the financial processes and the statements of an organization. This evaluation is done to make sure that the financial records are fair and correct. Every company and organization has an auditing session for checking and assessing the financial documents and statements.

What is the importance of An Audit?

1. Helps Reach Business Objectives:

Having the perfect and effective audit system might help the company or the organization to attain the required economic objectives. Every firm has its own objectives and visions. Only if there is this system of audit in the firms the employees will work effectively and therefore march together towards reaching the goals and following the objectives.

2. To Prevent Fraud:

If there is any kind of fraud activity happening internally, it gets detected during the audit. So an effective audit system can prevent the employees to get involved in any of such activities and therefore establish an honest and real working environment in every department.

3. Acquire Accuracy:

An effective and perfect audit system offers the accuracy of the financial statements and all the other records that the audit team assesses. After the process of auditing is completed a sense of assurance will surround the employees of the company that the statements were accurate and that everyone played their part well.

4. Constant Scrutiny:

When there is an effectively built audit system, the employees are under constant scrutiny, therefore, they do not try to defraud or indulge in any risky activity. So the employees know that the accounts will be audited and therefore work and behave accordingly.

Financial Auditing Process:

The financial auditing process refers to the checking and assessing of the financial statements and transactions of a company’s business. It is done by a body that is dedicated entirely to this work. Apart from that, the process of auditing makes sure that the financial statements and transactions that are presented to the public and the shareholders are justified and accurate.

Principles of Financial Accounting:

Revenge Recognition Principle:

According to this principle, revenue is identified in the income statement of the enterprise. It doesn’t include the amount that is collected on behalf of third parties, that is certain kinds of taxes.

Historical Cost Principle:

According to the historical cost principle, the asset is recorded in the accounting records at the price that is paid to acquire it. So accordingly if no amount is paid to acquire an asset, that won’t be considered as an asset.

Matching Principle:

According to this principle, the expenses incurred during an accounting period should match with the revenues generated during this period.

Full Disclosure Principle:

This principle says that financial statements should be a way of conveying things and not preventing. The financial statements should be able to let everyone know about the important details and information.

Objectivity Principle:

As the name says, according to this principle the accounting data should be free from any biasedness, and verifiable. Therefore the accurate data should be produced.

Three Different Types of Audit

Process Audit:

A process audit is an examination of the results that the activities, resources that cause them are being managed efficiently and effectively. This helps to verify that the processes are working within certain limits.

Product Audit:

Product audit is a kind of an examination of any product or service to check whether it matches the requirements.

System Audit:

It is an audit conducted on the management system. The analysis and evaluation that is usually carried out through the system audit have to be objective, critical and systematic in nature.

What Does a Financial Auditor Do?

An auditor analyses and assesses the financial statements of a business. He/she also makes sure that the financial processes are carried out in a proper manner and therefore the organization runs in order.

What are the Tasks of an Auditor?

There are some tasks an auditor has to perform to make sure that the work he/she is doing is in the right order. Few of them are as mentioned below:

- To examine the financial statements and check whether they are perfect

- Makes sure that there is compliance with established internal control procedures

- Verifies assets and liabilities by comparing items

- Documents audit testings and findings

- Maintains internal control systems by updating audit programs

- Recommends new policies to save money for the organization

- Contributes to team effort by performing results as needed

- Adheres to federal, state and local security legal needed by being thorough with the legislation, etc.

11+ Financial Accounting and Auditing Examples in PDF | DOC

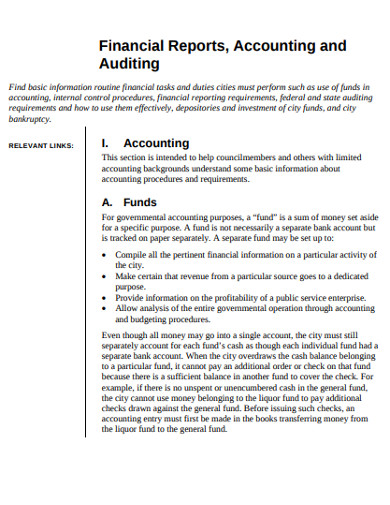

1. Financial Accounting and Auditing Report

In a financial accounting and auditing report, there is basic information of the routine financial tasks and duties. These tasks must be performed such as the use of funds, internal control procedures, financial reporting requirements, federal and state auditing requirements, etc. This also shows how to use them effectively. Download this template now and make the most of it!

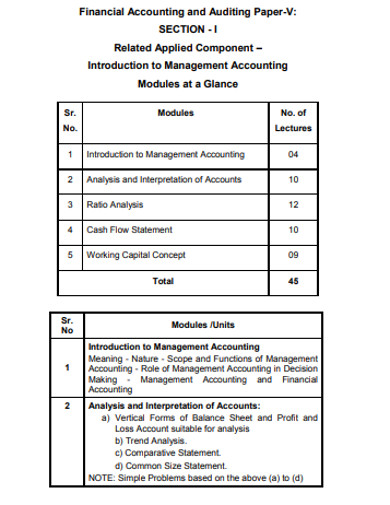

2. Financial Management Accounting and Auditing Example

A financial management accounting and auditing report helps one understand what management accounting is. It also explains the nature and the functions of management accounting, that are very important for one to know. Management accounting can be defined as management-oriented accounting. It is the study of managerial aspect of finanical accounting. The above template acts as a guide to management accounting. So, grab the oppurtinity by downloading the tempate now!

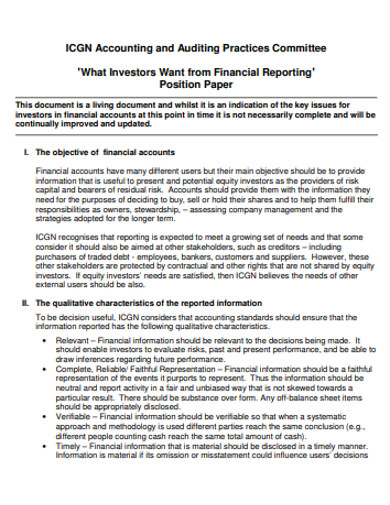

3. Financial Investors Accounting and Auditing

Financial accounts have many different users, but their main aim should be to provide useful information to potential equity investors as they are providers of risk capital. Such accounts should give them enough details for them to decide whether or not to buy, sell or hold shares they need in the market. This accounting and auditing template is of great use to perspective investors and clients to get a better idea on the shares they own.

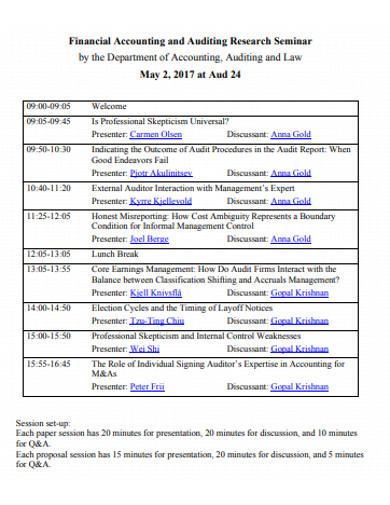

4. Financial Accounting and Auditing Research Example

The above-mentioned template is a research example for the financial accounting and auditing seminar. In a semianr like this, there are many experienced advsiors who help audience understand the importance of finance, accounting, and auditing in the world. It also helps people understand what should an auditor do and how he/she can be a great asset to the company.

5. Financial Administrative Accounting and Auditing

In any administration, finance plays an important role as that is what keeps a company running. There should always be adequate accounting records and procedures for the organization as financial accounting is an intergal part of the company. Accounts shall be structured in accordance with the program of accounting and reporing specifications. The above-mentioned template will act as the right guide for you as and when needed. Check it out now!