11+ Financial Modeling Examples to Download

Many people may come up with lengthy descriptions when asked to define a financial model. They may use terms such as hypothetical outcomes, cash flow, and forecast to support their descriptions. However, there is no need for you to complicate the definition. Are you curious about financial models and how financial modeling works? If you are, then this article will suit you best. Get to know more about financial modeling by reading this article.

11+ Financial Modeling Examples in PDF | DOC

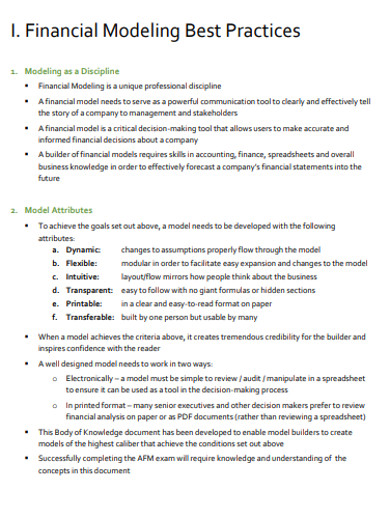

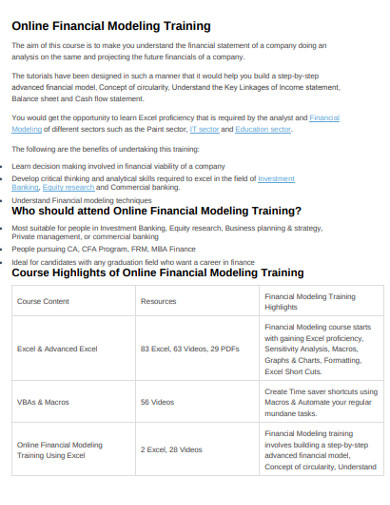

1. Financial Training Course Modelling Example

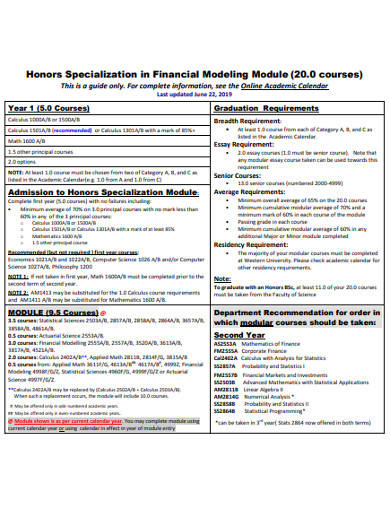

2. Financial Modeling Module Example

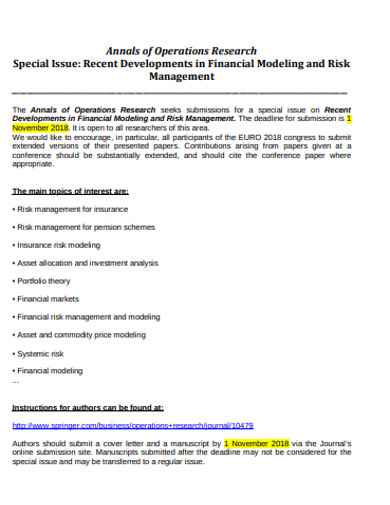

3. Advanced Financial Modelling Example

4. Financial Modeling for Investments Example

5. Financial Practice Modelling Example

6. Financial Management Modelling Example

7. Financial Training Modelling Example

8. Honors Specialization in Financial Modeling Example

9. Advanced Valuation and Financial Modeling Example

10. Financial Modeling for Innovation Example

11. Public Financial Modelling Example

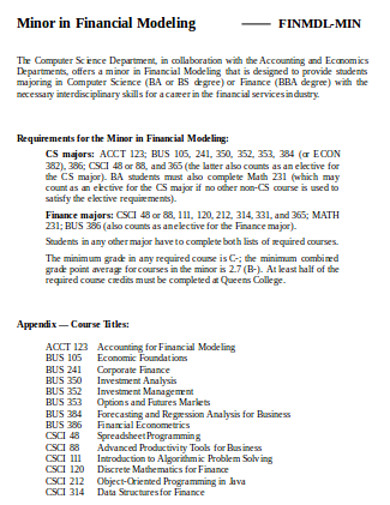

12. Minor in Financial Modeling Example

Overview of Financial Modeling

A financial model is a tool, typically built on spreadsheets, that displays feasible solutions to financial problems. Meanwhile, financial modeling is the process of creating a summary of the earnings and expenses of a company, or it is the task of creating a financial model. Accounting and financial statement analysis play a vital role in financial modeling since the former is the backbone of the latter.

Most valuation work would be nearly impossible without financial statements such as income statements, balance sheet statements, and statements of cash flows. Financial models are used by corporate financial management and by company executives to estimate the cost and project the profits of a proposed project.

Financial models are also significant to financial analysts since they use them in anticipating the impact of the changes in economic policy or any other event on a company’s stock. Moreover, they are also used in strategic planning to test various scenarios, decide on budgets, allocate corporate resources, and calculate the cost of new projects.

Who Builds Financial Models?

Anyone can build financial models as long as they have the skills to do so. However, most financial models are made by the following:

- People who are pursuing a Master’s Degree in Business Administration (MBA), Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), or anyone who has financial certifications;

- Anyone who wants to make a career in finance that has a Degree or a Diploma in technical fields; and

- Professionals who want to get into money-related decision-making matters and to anyone who wants to explore the world of finance.

Ways to Learn Financial Modeling

Financial modeling is a fundamental skill that you should practice and enhance if you wish to have a career in financial planning, investment banking, equity research, corporate development, and other finance-related fields. The following are the skills that you should acquire to be good at financial modeling:

- Excellent Excel Skills: Financial modeling heavily relies on Microsoft Excel since it is the perfect platform for modelers to input the necessary data. You have to be good with charts, formulas, macros, VBAS, etc. to create financial and investment models easily.

- Knowledge about Accounting, Finance, and Valuation: A basic understanding of accounting concepts is a requirement in making a career in the field of finance. As a financial modeling analyst, it is vital to know about investment appraisal techniques such as DCF, IRR, NPV, etc. Furthermore, it is crucial to learn about Financial Reporting & Analysis, as well as valuation techniques since it is a significant part of your job.

- Problem Solving Ability: The purpose of creating a financial model is to solve a specific problem or to make sure that no other problem arises. In the field of finance, it is essential to have this skill and the readiness to take responsibility for any problem.

- Decision-Making Ability: As a financial modeler, you should be able to make decisions based on your output. You should build financial models that will help the business or organization to make the right decisions since it is the primary purpose of this tool.

Best Practices in Financial Modeling

To minimize the errors in building your Accounting & Financial Statement Analysis or any other financial models, you have to be mindful of the following practices:

1. Clarify the Problem: Before building your financial model, you have to clarify or specify first the business problem and its intended goal. Determine who will be the end-users and what are they suppose to do with the model. By doing so, your effort will not be wasted.

2. Simplify: Try to keep your financial model as simple as possible. You have to breakdown its data by determining the minimum number of inputs and outputs required to build the model. Please take note that the more assumptions a model has, the more complicated it becomes.

3. Plan the Structure: You have to plan how the data will be laid out in your financial model. As much as possible, try to put your inputs in a single place, so your audience can have a quicker overview of all the data.

4. Build Structural Integrity: You have to protect the data in your financial model by limiting other users’ ability to break its structure accidentally. You can utilize Microsoft Excel tools to protect data integrity, including data validation and conditional formatting.

5. Test the Model: Before presenting your financial tool, you have to ensure that it is entirely functional. You can test it by putting in scenarios that should cause the model to grow at a flat rate, run out of cash, and other possible scenarios.

Who Uses Financial Modeling?

The following are the list of some professions that use financial modeling:

1. Investment Banking: This is the career that is typically thought of as the first financial modeling career. Bankers build Excel models to value companies for mergers and acquisitions (M&A), advisory mandates, and capitals raising (debt, equity, initial public offerings, follow-on offerings, etc.).

2. Financial Planning and Analysis (FP&A): All large operating companies have an FP&A department that is responsible for forecasting the performance of the company, comparing it to actual results, and monitoring the cash flow of the business. Analysts, Directors, and Managers of this department have to deal with and perform sophisticated financial modeling and analysis. Moreover, they place immense importance on evaluating and assessing performance.

3. Equity Research: Equity research analysts and associates are often busy building financial models, researching an industry, and performing company analysis. Their work is compiled in the form of a report that is sent to clients of the bank who use it to decide whether they should invest in public security or not.

4. Corporate Development: The professionals under this career are responsible for acquisitions, divestitures, mergers, and capital raising for the company. To execute the previously mentioned transactions, Cor Dev professionals need to have excellent financial modeling skills. Moreover, Cor Dev professionals are the counter-part of investment bankers.

5. Private Equity: It is referred to as being on the “buy-side,” therefore, private equity professionals usually build spreadsheets for a leveraged buyout. Those working in this type of industry spend much time on financial modeling.

6. Venture Capital: They sometimes use financial models to estimate the value of the businesses. This type of modeling often focuses on the company’s burn rate in the short-term.

Examples of Financial Models

Various financial modeling examples differ in type and complexity as the situation demands. These models are widely used for comparative analysis, sensitivity analysis, and valuation. Also, financial modeling is used in risk prediction, effects of synergies, pricing strategy, etc. Each model caters to its own set of requirements, specialties, and users. The following are examples of financial models:

1. Comparable Transaction Analysis: It is a method where you look at the past Merger and Acquisition transactions and value a comparable company using precedents. The steps involved in this method are identifying the transaction, determining the right transaction multiples, and calculating the transaction multiple valuations.

2. Comparative Company Analysis Model: This method works on the assumption that similar companies will have the same Enterprise Value (EV) and Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) and other valuation multiples.

3. Discounted Cash Flow Model: This method uses the concept of Time Value of Money and is considered as the most widely used method of valuation in the finance industry. Moreover, this method helps to determine the attractiveness of an investment opportunity.

4. Full Blown Three Statement Financial Modeling: This is considered as the most standard and in-depth form of a financial model that represents the complete financial scenario of a company and projections.

5. Leveraged Buyout (LBO) Model: Its purpose is to determine the amount of profit that can be generated from a deal. These models have higher levels of complexity as there are multiple ways debt can be raised wherein each has specific interest payments.

6. Merger and Acquisition Model: Investment Banking and Corporate Financing Companies generally use this tool. This model helps to determine the effect of merger and acquisition on the earnings per share (EPS) of the newly formed company after the completion of the restructuring and how it compares with the existing EPS.

7. Sum-of-the-Parts (SOTP) Financial Model: This method is suitable in the case of equity carve-outs, a spin-off, mergers, etc.