10+ Financial Planning Analysis Examples to Download

10+ Financial Planning & Analysis Examples

1. Future of Financial Planning and Analysis

2. Financial Planning and Analysis Example

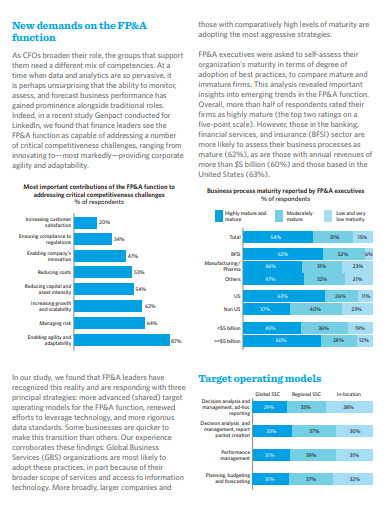

3. Financial Planning and Analysis Function

4. Financial Planning and Analysis Services

5. Financial Planning and Analysis Solution

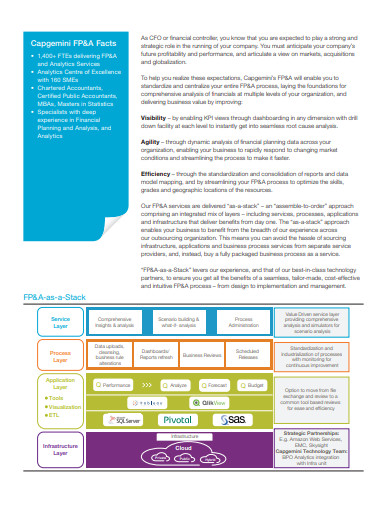

6. Financial Planning and Analysis as a Stack

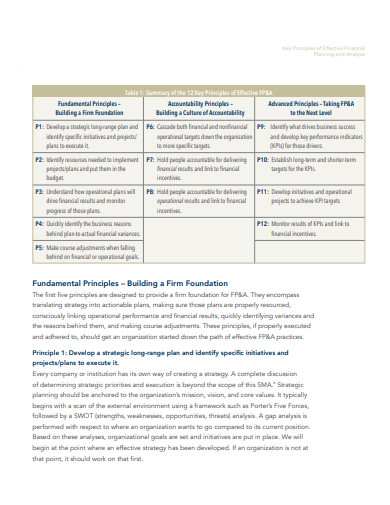

7. Key Principles of Effective Financial Planning and Analysis

8. Transforming Financial Planning and Analysis to Better Fund

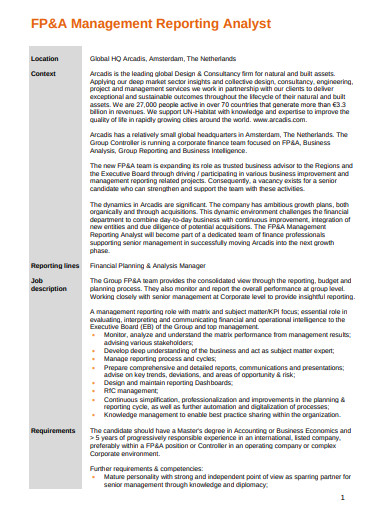

9. Financial Planning and Analysis Management Report

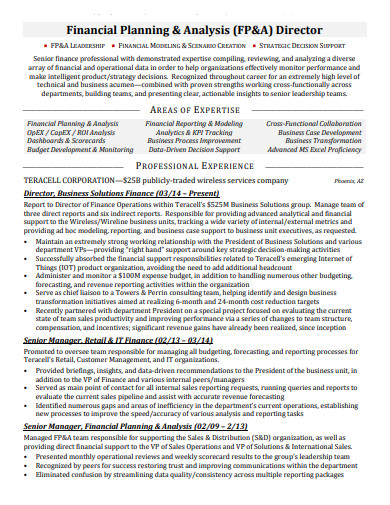

10. Director of Financial Planning and Analysis

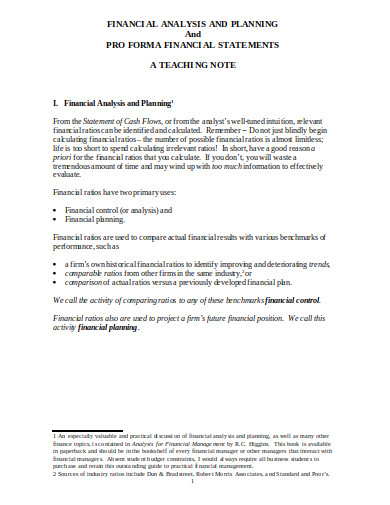

11. Financial Analysis and Planning

What are the Prerequisites of Perfect Financial Planning and Analysis?

1. People with skills

The planning members should be well versed in the different sectors of financial planning and the analysis to be able to contribute to the business.

2. Divide the Responsibility According to the Expertise

Planning is a process that needs to be done minutely and with proper study. It requires proper scientific and systematic research that is why people with good expertise in a particular field needs to be assigned with a responsible job.

3. Analysing and Evaluating the Different Data

People should be decided from the beginning who would be handling, analysing and evaluating the data produced by the team to prove its efficiency and effectiveness. Such analysis and evaluation must be done by observing different details.

4. Financial Analysis

The financial analysis should be done before the plan so that the plan can be based on a financial gain probability in the future. Future gains are very important in any business, thus the main focus of the plan should always be on different transaction, gains, loss and other financial details and statements.

5. Problem Analysis

Before making the plan it is important to analyse if the business looks or might have any sort of problem in its marketing period. Such problems should be analysed and studied minutely to prepare their counter solutions.

6. Financial Management

The best of the financial analysts of the firm needs to be chosen based on their expertise to manage the different tasks of financial planning and analysis. This step can help to work systematically and effectively.

What are the Rules for Financial Planning?

- Analyse and study your current net worth and read your financial statement of the past business properly.

- Set the goals that you are targeting and the audience among whom you want to introduce your stocks.

- The amount of investment the next project may require and the timing of the market when such investments need to be made should be studied.

- The market and the business need to e studied side by side to get the idea on which stock does the investment would be the most reward able.

- Taking the risk and managing it professionally. Without taking the risk no business can get to the shore. Thus plan the risk mitigations to avoid damage and gain high returns.

- Financial planning may require a little big amount if it is done for business purposes. So, save your money as much as you can and invest in a stock which is available at discount.

What is Financial Modeling?

Financial modelling is the synonymous face of financial planning the only difference is that it is more practical than the latter. It is an abstraction presentation of the plan based on financial analysis for a business. It is a way of presenting the hypothesis on different market conditions in numerical patterns. There are different types of financial models which are used by the financial analysts often, They are :

-

Budgeting Model

Developing the financial plan with a fixed amount.

-

Forecasting Model

An assumption based on some metrics and details to foresee the future possibility of a business.

-

Rolling Forecasts Model

Updating the time horizons of time to time.

-

Three Statement Model

The study of all the three income statement, balance sheet, and cash flow

-

Discounted Cash Flow Model

The study of adjusting the cash flows of the statement model and adding some discount to it.

-

Merger Model

Analysis of the merger or combination of the data of two companies sharing an interest in profit.

-

Leveraged Model

A transaction process often exercised to gain access to other businesses.

-

Sum of the Parts Model

Adding up several discounted cash flow components together.

-

Consolidation Model

Adding up multiple business units in one.

Tips for Financial Planning and Analysis

Tip 1: Save before you invest. A good budget is required to do financial planning for the business.

Tip 2: The funds and sources you have needs to be studied and reviewed by you when you make the plan.

Tip 3: The plan should be based on detailed research and analysis of the data available to you and not on some rough calculation.

Tip 4: Financing should be apt and certain upon which you would be planning and designing the financial management and investment process for the business.

Tip 5: Focus on different business fields for investment rather than any single business field.

Tip 6: Keeping several things and aims in mind while designing the plan can help you to save more with your investments.