Financial Reporting Analysis – 11+ Examples, Format, Pdf, Tips

Though both works are part of financial management, preparing a proper report differently on both the works is important. The following description specifies the purposes and importance of financial reporting and analysis.

What is the Importance of Financial Reporting and Analysis?

Financial reporting and analysis have become the backbone of business in the contemporary competitive world of business. Because its calculation and execution are resulting in the mantra of success in many business lines. Such practices can get the organisation and the business on the track of the productivity the management might require. It also helps in financial integrity and the worth of the business and the organisation. Such practices direct the management to take proper decisions and measures for particular situations. Without financial reporting, financial analysis is not possible at times, so they go hand in hand. Its importance is specified below minutely-

-

Helps in Corporate Financial Management

It can help to know the inner plus and minus points of the business house that can determine its position in the market. It also gives ideas on the company assets and liability ration of several business periods.

-

Helps in Plan Management

Every business plan needs to be operated and functioned with some planned tactics the plan management fulfils this criterion. This management keeps a watch on all the aspects of the business to determine its success and performance.

-

Dues Management

Managing dues refers to the short and long term obligations of the organisation towards the different stakeholders. It includes all sorts of financial obligation, liabilities, and claims of creditors.

-

Suppliers and Investors Relationship

Different lenders and investors and stakeholders are connected and concerned with a business and its growth thus the businessmen need to build and maintain a good and interdependent relationship.

-

Labours

What price should be paid for the services taken on the production and could the new production balance the wage amount given to the labours is important.

11+ Financial Reporting & Analysis Examples

1. Sample Financial Reporting and Analysis Example

2. Basic Financial Reporting and Analysis Example

3. Simple Financial Reporting and Analysis

4. Non Financial Reporting and Analysis Example

5. Standard Financial Reporting and Analysis Example

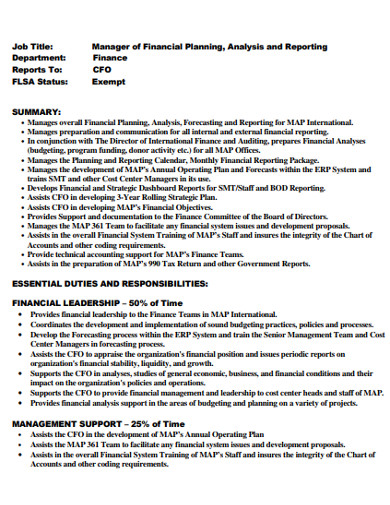

6. Financial Manager Reporting and Analysis Example

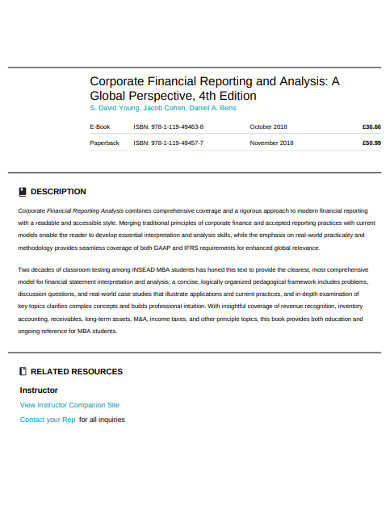

7. Corporate Financial Reporting and Analysis

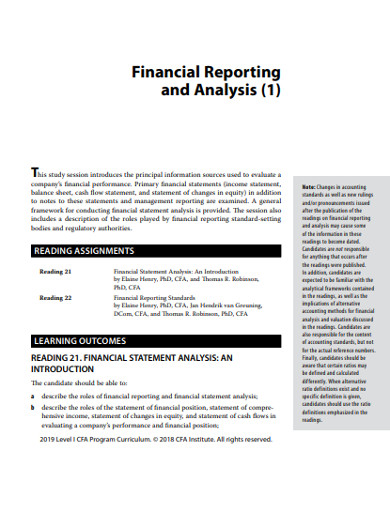

8. Financial Statements Analysis and Reporting Example

9. Sample Financial Reporting and Analysis in PDF

10. Formal Financial Reporting & Analysis Example

11. Printable Financial Reporting and Analysis

12. Financial Study Reporting and Analysis Example

What is the Purpose of Financial Reporting?

The main purpose of financial reporting is to know the business and in-house activities to act upon it accordingly. It helps to keep the transparency of the business ups and downs between the management and the stakeholders of the business. Because such reports are designed with all the financial information of the organisation which helps to analyse and predict future business progress and performance possibilities. Such reports also give ideas on how and what to invest in the business to derive positive results. Thus the report should be framed with proper balance sheets, financial statements and another transaction summary with controlled release for both the internal and external folk.

What is the Purpose of Financial Analysis?

Financial analysis is done by studying the various financial data and reports of the organization. The analysis of the financial details is conducted to derive the conclusion on an entity or project is worthy enough to be invested with the capital. Because nobody wants to face loss at the business the invested capital in. So, such financial investment should be preceded by a good homework and analysis of the financial records. A financial analysis study helps to build a proper plan for the business observing the contemporary economic trends. This study can direct one for proper investments.

What can be the Objectives of Financial Reporting and Analysis?

- To investigate past profit and loss and make a less vulnerable future business plan for better performance.

- Study the past performance of the firm and business.

- To study the contemporary business market and how to position one business and stocks in it efficiently.

- To get ideas on the level of profits by the assets and the level of outsourcing for the liabilities.

- For making not only the speculations and probable future productivity and profitability but also the negative future failure possibilities.

- It helps to get loans and debt management.

Tips for Financial Reporting and Analysis

- Tip 1: Record all the financial activity with proof of transaction, investments, and other details.

- Tip 2: Choosing a consistent method and approach is good for preparing and maintaining a reliable financial report.

- Tip 3: The study and analysis of all the finances and financial management should not be started before the completion of the report as it serves the basis of the study.

- Tip 4: While compiling and preparing the study all the past and present history and data should be studied and taken in concern for a better and reliable conclusion.

Financial Reporting Analysis – 11+ Examples, Format, Pdf, Tips

Financial statement reporting and analysis are two different things but of the same background. Financial reporting refers to the document that specifies and releases the financial statement and other information to its stakeholders and other public. This sort of document adds balance sheets, cash flow, net income, and other asset capital details. Whereas financial analysis is the evaluation and study of the different businesses and works to regulate its performance.

Though both works are part of financial management, preparing a proper report differently on both the works is important. The following description specifies the purposes and importance of financial reporting and analysis.

What is the Importance of Financial Reporting and Analysis?

Financial reporting and analysis have become the backbone of business in the contemporary competitive world of business. Because its calculation and execution are resulting in the mantra of success in many business lines. Such practices can get the organisation and the business on the track of the productivity the management might require. It also helps in financial integrity and the worth of the business and the organisation. Such practices direct the management to take proper decisions and measures for particular situations. Without financial reporting, financial analysis is not possible at times, so they go hand in hand. Its importance is specified below minutely-

Helps in Corporate Financial Management

It can help to know the inner plus and minus points of the business house that can determine its position in the market. It also gives ideas on the company assets and liability ration of several business periods.

Helps in Plan Management

Every business plan needs to be operated and functioned with some planned tactics the plan management fulfils this criterion. This management keeps a watch on all the aspects of the business to determine its success and performance.

Dues Management

Managing dues refers to the short and long term obligations of the organisation towards the different stakeholders. It includes all sorts of financial obligation, liabilities, and claims of creditors.

Suppliers and Investors Relationship

Different lenders and investors and stakeholders are connected and concerned with a business and its growth thus the businessmen need to build and maintain a good and interdependent relationship.

Labours

What price should be paid for the services taken on the production and could the new production balance the wage amount given to the labours is important.

11+ Financial Reporting & Analysis Examples

1. Sample Financial Reporting and Analysis Example

kellogg.northwestern.edu

Details

File Format

PDF

Size: 141 KB

2. Basic Financial Reporting and Analysis Example

static-frm.ie.edu

Details

File Format

PDF

Size: 49 KB

3. Simple Financial Reporting and Analysis

icsa.org.uk

Details

File Format

PDF

Size: 108 KB

4. Non Financial Reporting and Analysis Example

res.mdpi.com

Details

File Format

PDF

Size: 248 KB

5. Standard Financial Reporting and Analysis Example

inet.smu.edu.sg

Details

File Format

PDF

Size: 114 KB

6. Financial Manager Reporting and Analysis Example

map.org

Details

File Format

PDF

Size: 50 KB

7. Corporate Financial Reporting and Analysis

wiley.com

Details

File Format

PDF

Size: 63 KB

8. Financial Statements Analysis and Reporting Example

nptel.ac.in

Details

File Format

PDF

Size: 13 MB

9. Sample Financial Reporting and Analysis in PDF

cfainstitute.org

Details

File Format

PDF

Size: 48 KB

10. Formal Financial Reporting & Analysis Example

zu.edu.jo

Details

File Format

PDF

Size: 12 MB

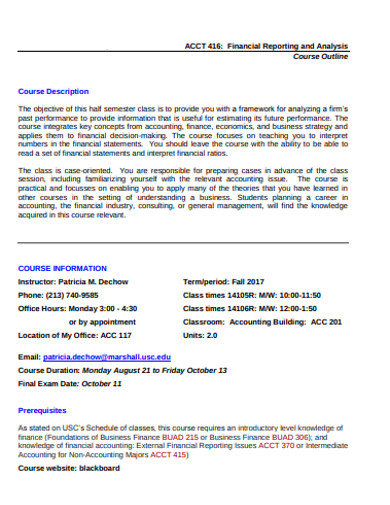

11. Printable Financial Reporting and Analysis

web-app.usc.edu

Details

File Format

PDF

Size: 509 KB

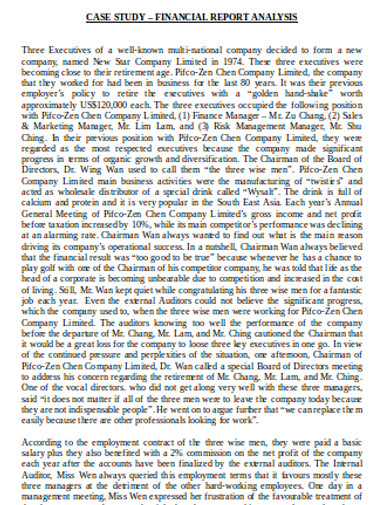

12. Financial Study Reporting and Analysis Example

cyut.edu

Details

File Format

DOC

Size: 71 KB

What is the Purpose of Financial Reporting?

The main purpose of financial reporting is to know the business and in-house activities to act upon it accordingly. It helps to keep the transparency of the business ups and downs between the management and the stakeholders of the business. Because such reports are designed with all the financial information of the organisation which helps to analyse and predict future business progress and performance possibilities. Such reports also give ideas on how and what to invest in the business to derive positive results. Thus the report should be framed with proper balance sheets, financial statements and another transaction summary with controlled release for both the internal and external folk.

What is the Purpose of Financial Analysis?

Financial analysis is done by studying the various financial data and reports of the organization. The analysis of the financial details is conducted to derive the conclusion on an entity or project is worthy enough to be invested with the capital. Because nobody wants to face loss at the business the invested capital in. So, such financial investment should be preceded by a good homework and analysis of the financial records. A financial analysis study helps to build a proper plan for the business observing the contemporary economic trends. This study can direct one for proper investments.

What can be the Objectives of Financial Reporting and Analysis?

To investigate past profit and loss and make a less vulnerable future business plan for better performance.

Study the past performance of the firm and business.

To study the contemporary business market and how to position one business and stocks in it efficiently.

To get ideas on the level of profits by the assets and the level of outsourcing for the liabilities.

For making not only the speculations and probable future productivity and profitability but also the negative future failure possibilities.

It helps to get loans and debt management.

Tips for Financial Reporting and Analysis

Tip 1: Record all the financial activity with proof of transaction, investments, and other details.

Tip 2: Choosing a consistent method and approach is good for preparing and maintaining a reliable financial report.

Tip 3: The study and analysis of all the finances and financial management should not be started before the completion of the report as it serves the basis of the study.

Tip 4: While compiling and preparing the study all the past and present history and data should be studied and taken in concern for a better and reliable conclusion.