11+ Investment Analysis Portfolio Management Examples to Download

Portfolio management and investment analysis are both different practices but inherent within one. Without the investment analysis along with several other details, a portfolio can not be managed properly. An investment analysis needs to be done highlighting all the details of financial assets, market, trends, liabilities, overall profit, and loss, etc. These details collectively can frame the portfolio of the organization.

What is the Investment Analysis in Particular?

Investment analysis is the key to design an effective portfolio for the firm as it covers all the examined and evaluated data of financial management, transactions, and profits, market and trends and gives a clear understanding of the future performance. A proper focus should be given on the investment analysis process to derive reliable results and useful data.

It works by studying ad researching the different types of investments and their possible performance in the future. It takes into account the details of the time frame of investment, costs of the stock, investment strategies and other investment details. No one needs to be pro to conduct this study, you just need to know your business and investment property.

11+ Investment Analysis & Portfolio Management Examples

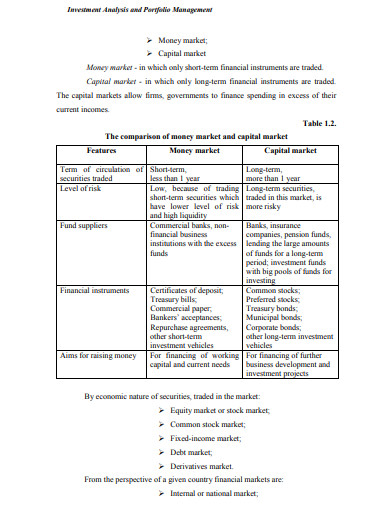

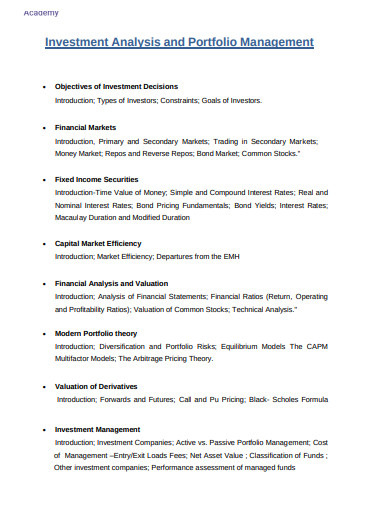

1. Investment Analysis and Portfolio Management Example

2. Investment Analysis and Portfolio Management Process

3. Investment Analysis and Portfolio Management Sample

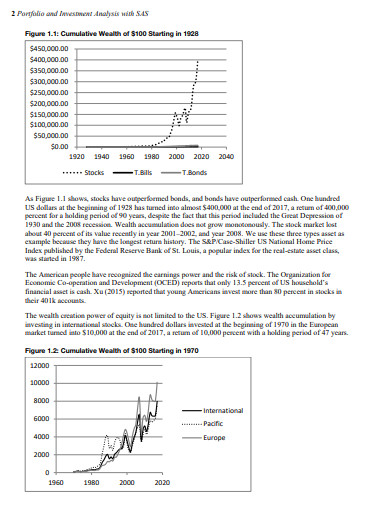

4. SAS Portfolio and Investment Analysis

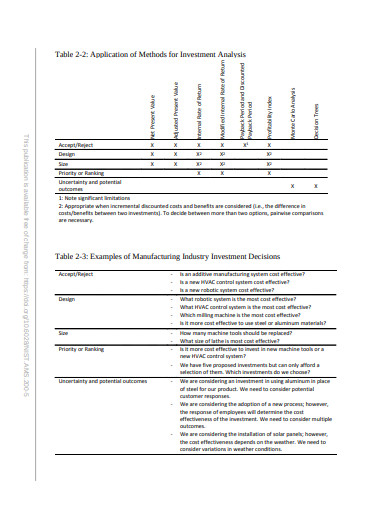

5. Methods for Investment Analysis

6. Investment Analysis and Portfolio Management Template

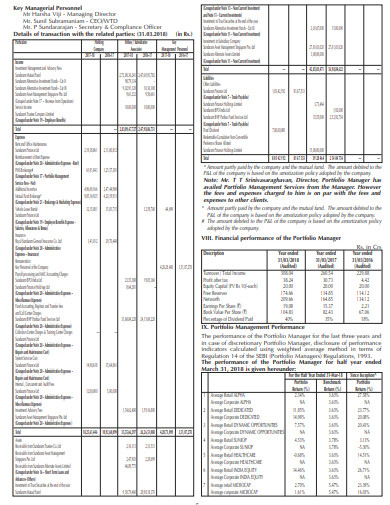

7. Portfolio Management Services

8. Primavera Portfolio Management

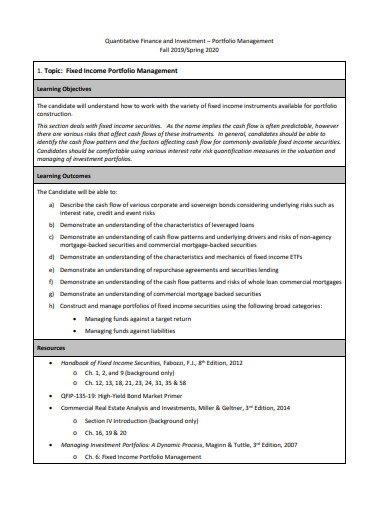

9. Quantitative Finance and Investment Portfolio Management

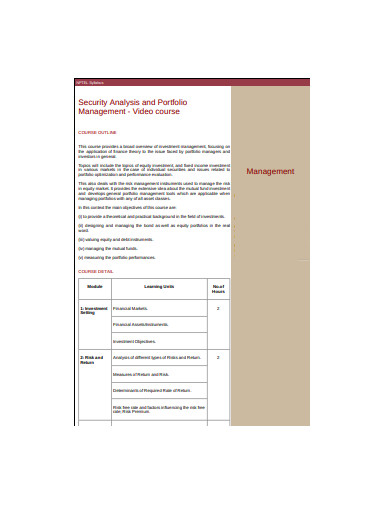

10. Security Analysis and Portfolio Management

11. Project and Portfolio Management Module

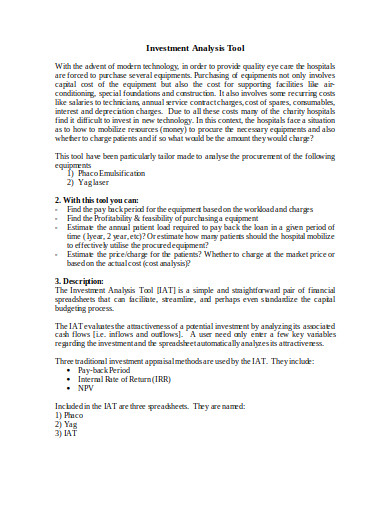

12. Investment Analysis Tool

Types of Investment Analysis

Fundamental and Technical Analysis- The financial analysis focuses on examining and maintaining the reputation and the economic status of the organisation. The analysts focus on all the details available to them on the basic and immediate data in their hands and keep on analyzing them for the organisation’s welfare. Technical analysis, on the other hand, focuses on the technical data deriving from the charts, graphs, stock prices, statistical understanding, etc. Technical analysts stress more on the evaluation by computer and statistics generated details and less on the practical values. Technical analysts’ main focus is to study the business ups and downs, charting data, other signals, price rates, etc.

Top-down and Bottom-up- Top to bottom or bottom to top are two ways of calculating and measuring the details of stocks and business. The bottom-up approach consists of the study and analysis of the business values, stocks and its value, competencies, features, etc. It avoids the micro-macro market trends and conditions and focuses on the best stocks and companies performing well for long. The top-down approach highlights and studies the market trends, economic conditions, industries, etc. Following such trends, it allocates money to several companies for specific interest reasons. This approach is a practice of macroeconomic umbrella.

What is Portfolio Management In Particular?

Portfolio management is the combination and balance of different institutional and trade activities done to present the desired image of the organisation in the public. This practice is conducted to make sure that the business is meeting its goals and targets, to mitigate the vulnerable situations in the business, managing different unwanted situations, financing smoothly, etc. Portfolio management is done to know your trade minutely and keep it ready to overcome all sorts of situations.

There are two types of Portfolio Management in practice they are-

Active Portfolio Management

Active portfolio management refers to the idea of the funds and finances managed and invested effectively to take investment decisions actively. The success of such exercise can only be done after having a good understanding and research of the market trends and the stock you need to invest in. Such active and fast management also requires experienced people who can do it with perfection. They deal with the market trends, economical data effectively and study its different ups and downs minutely. The study helps in proper time decisions for different investments. It might cause risk at times but mitigation of those is possible with proper management planning.

Passive Portfolio Management

Passive portfolio management also involves the making of a mechanism that can closely study the market index and different market ups and downs. The stocks which are listed on the index are studied in detail too. It doesn’t require necessarily a management team for the decision-making process, rather it can be structured easily as the different funding and financing policies and trusts. The main purpose of passive portfolio management is to focus on generating returns that can resemble the chosen index. This approach doesn’t follow proactively.

How to do Portfolio Management?

Following some rules and elements, you can do effective portfolio management.

- First of all, manage the assets and its capital generation as desired by understanding the asset quality and capability.

- The asset allocation of mix assets can help to manage risk and can offer high returns.

- Spending in diversified stocks that covers broad assets can save you from many unpredictable future performance possibilities losses.

- Diversification can both profit you and risk you, but taking risks is a part of business and trade.

Tips for Investment Analysis and Portfolio Management

- First understand and then invest.

- Always keep a margin of safety to manage an mitigate risks and crisis.

- Be logical and rational while managing and analyzing the data.