10+ Investment Portfolio Examples to Download

The investment portfolios are used in the business to mean the assets and stocks that a trader or the businessmen or the business house owners and have invested in. This portfolio includes real estate and other assets details, stocks and securities, funds, exchange-traded funds, etc. This sort of portfolio is designed to make a profit gradually side by side observing what it has invested.

10+ Investment Portfolio Examples

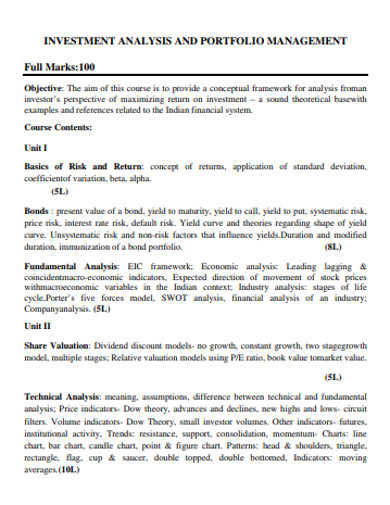

1. Investment Analysis and Portfolio Management

An investment portfolio is one of the most important document that a investor or trader should have. The process of designing it might not be known to all thus you can follow the model portfolio example template mentioned here. This template has added almost all the important aspects of process that might help you to do the investment analysis and maintain a perfect portfolio.

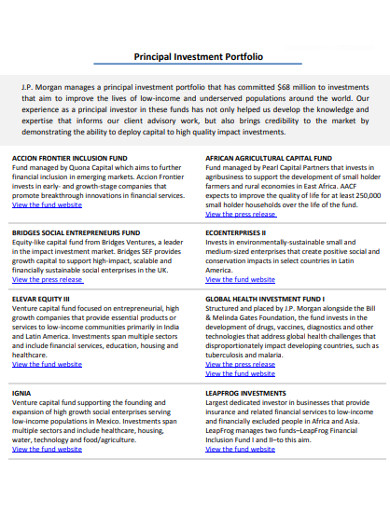

2. Principal Investment Portfolio Example

Designing a portfolio might take time if you lack ideas on how to frame the different specifications required in it. If you need ideas on framing one you can refer to this professional portfolio example template. This has specifically and precisely mentioned the details that a professional investment portfolio should contain.

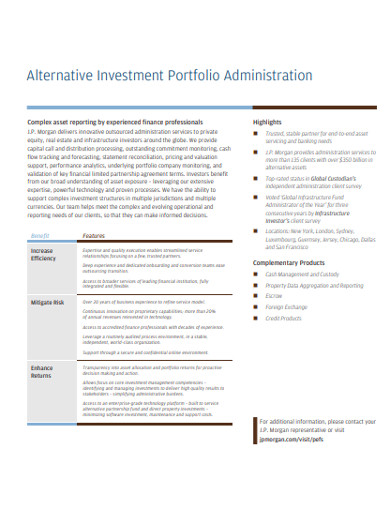

3. Alternative Investment Portfolio Administration

Other investments apart from the traditional investments like stocks and bonds are often known as alternative investments. An alternative investment portfolio is required to the investors to verify their investment portfolio and hedge against volatility. If you want to frame such an portfolio this example is perfect to give you many insights on that so choose this today!

4. Bank investment Portfolio Example

Almost all sort of business needs to indulge in investments and if you invest preparing a proper portfolio of the investment is important. If you want to frame an attractive portfolio for your bank investments this example template might simplify your tasks and reduce your workload.

5. Investment Portfolio Performance Report Example

If you are designing a company portfolio for your firm and its several performances, try to focus on all the aspects of the activities taken place in the trade. Or you can choose this template that is designed covering all the required aspects and can give you insight into the framing and signifying the different details.

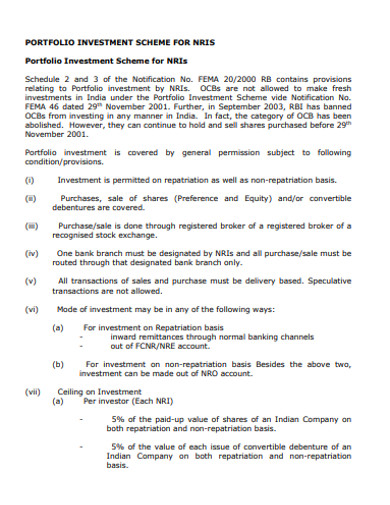

6. Investment Portfolio Scheme Example

Framing a investment portfolio scheme for the firm or the party that you are making an agreement with can help your side to be protected by different circumstances. The mentioned sample template on investment portfolio scheme design example carries some of the important aspects that has to be mentioned in a proper portfolio.

7. Investment Evaluation Portfolio Example

A portfolio design undergoes several processes before being finalized as it carries all the important aspects a required. The mentioned template on investment portfolio is one that is inscribed with the proper structure of what details needs to be filled within a investment portfolio. It is a evaluation study by an expert in the field. You can choose this template for your purpose or you can also refer to our professional career portfolio examples.

8. Sample Investment Portfolio Example

Many operational bodies and companies has to follow certain rules and regulations as specified in the scheme of the regulatory body. If you to need to design an investment scheme template framing all the regulatory details this template might be of a great help to you. So choose this detailed template today to shape your investment portfolio scheme.

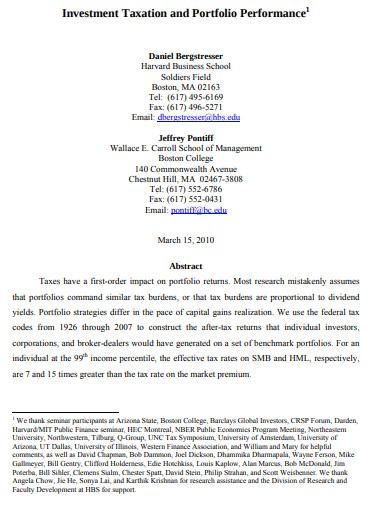

9. Investment Taxation and Portfolio Performance

An investment portfolio is one of the very important document of a business house. And while framing it you have to be careful with the details you frame in it. You can also use this template to analyze the taxes and the investments that needs to be briefed in the portfolio minutely. So download this sample and simplify your works today!

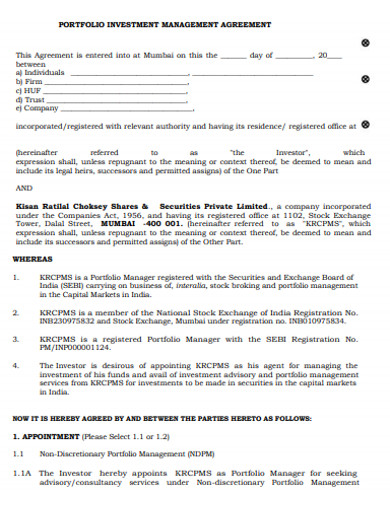

10. Investment Portfolio Management Agreement

While signing a deal with the other party for managing an investment portfolio the agreement document needs to be shaped with all the important clauses and statements. You can download this template if you want to shape your agreement document quickly. It has been shaped with the specifications that would help you to shape your investment details.

11. Sample Investment portfolio Example

What is Investment Portfolio Diversification And why it is Important?

Investment portfolio diversification promotes the traders to invest in more than one firm or company or one field of business. This is a proven technique in business science that guarantees to minimize the risks in the business and helps the investors to meet their decided business goals. There are different advantages of the investment diversification that benefits the trade apart from reducing the risks like,

- It improves the chances of growth and success in the business.

- By diversifying the investment you may face loss in one but the other stocks can save you from the loss of the former.

- It helps to invest not so huge capital in different businesses.

- This investment follows risk-reward combination like the gilt-edge that is low risk, low yield, or the junk bonds that are high risk, high yield or other income streams.

Some of the common investment portfolio diversification are:

- Company or organization investment – Never invest in one company or organization because businesses can take a turn and may cause big losses if you invest in a single firm.

- Sector Investment – Different sector investment is similar to business investment. If you diversify your investment in different sectors whether if one causes loss the other would support the security margin.

- Investment location diversification – If your business is big enough then spread it to different nations in different stocks as it would not be confined in particular rules and regulations of business of one nation.

- Assets diversification is also important – The investment portfolio should be designed with not only similar types of assets but it should be a mixture of different assets.

- Over diversification is harmful – Diversification can profit you on your investment but over-diversification can lead to increase risk and face loss in getting the returns.

Framing an investment portfolio for an international business trading might need to be framed minutely and with different specifications. if you have faced something of that sort choose this template and make your work easy today!