13+ Passive Income Examples

Passive income refers typically to the sources from where you derive money without doing or contributing much to it. It counts the money achieved from properties on rent or lease, partnership works, real estate, etc. In such a business, people no need to participate or involve actively. But passive income is taxable, which is not in all the cases of active income.

What is the Importance of Passive Income?

Passive income can be a great wealth-building tool for any individual. It is an additional incoming wealth for which you need to make no much effort. Apart from the effort and wealth, it has some more benefits attached to it. Like

- If you have so many passive income sources, it allows you not to work for others but giving little effort on your passive sources to earn more.

- It can make you financially stable and economically more than satisfied.

- Even if you lose your job, it is there to support your all expenses, and you are saved from stress.

- It helps you not to rely on anybody in your old age for your existence.

How one can Build Passive Income Sources?

There are several ideas and sources that you might use to get and earn passive income. Some of them are:

1. Real Estate Investment

Investing in real estate refers to the situation when you already have a house to stay, but you buy another and lease or rent it to tenants. This investment is one of the expensive ones and also gives good yields throughout its existence. But a little management and maintenance can give you a better amount than you may generally yield.

2. Starting a Blog or Channel

Nowadays, every person uses social media accounts, and so does they follow influential bloggers too. The more followers you have, the more profit you can derive. You do not even need to give it much time, but every day 2-3 hours can give you a decent extra income. You have to post some quality work or content your blog is themed on.

3. Offering Space for Other’s Storage

If you have enough space at your home or outside your home, you can give it to others who don’t have space in their homes. Your only job will be to see if the stuff and belongings of the other individual are safe from external threats, and you can get high payments for that. Like storing other’s vehicle in your empty garage and others.

4. Selling Digital Products

Nowadays, people prefer to buy digital products like forms, videos, etc. If you have learned or observed creating the product of a certain nature may give you good traffic on SEO, you may start designing and selling them.

5. Renting Out Items

It’s not necessary that you have to have an excellent property to get extra or passive income. If you have any useful items that people usually require in their day to day life, rent it out in the market. It might give you a certain amount of rent every month.

6. Investment

Investment here does not mean sowing the seeds to reap great foods but to secure your future by investing in secure and long-term stocks. This helps you to utilized your capital and save them from illogical expenses and save them for the retirement periods. But any unmatured or untimely withdrawal of the capital is charged with penalties.

8+ Passive Income Examples

1. Tax Planning for Passive Income Example

If you are planning to have some source or investment for getting the passive income you should know that most of the passive income is liable to taxes. So you should plan and strategize the investment property that can save you from high taxes so that you can save more for your retirement. If you are not understanding it getting the template mentioned here can explain this in simple words. So have a look at this template and build a smart passive income plan.

2. Passive Income and Passive Asset Example

If you are willing to invest in passive income and assets you first should understand what is passive sources of income. This example template can give you clear knowledge of that if you want. The frame has focussed on specifying and detailing the different assets that can give you passive income and how that can be achieved. So have a look at this template that even holds the potential to give you ideas on how to earn passive income online.

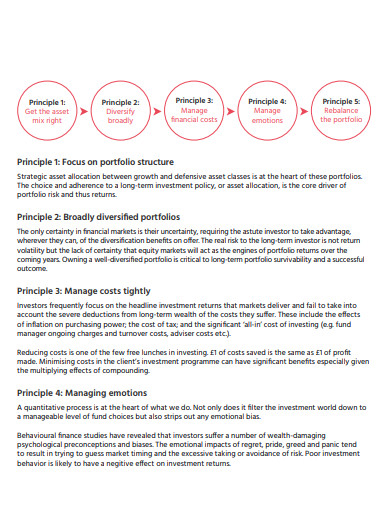

3. Passive Income Model Portfolio Example

4. Sample Tax Planning for Passive Income Example

5. Passive Investment Income Example

6. Passive Income for Companies Example

7. Passive Corporate Income Example

8. Passive Income Advantage Example

9. passive Income for Investors Example

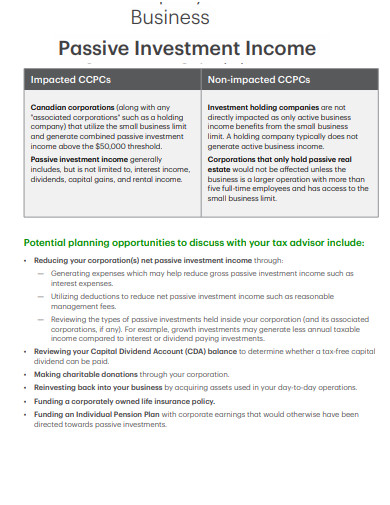

10. Business Passive Income

advisors.td.com

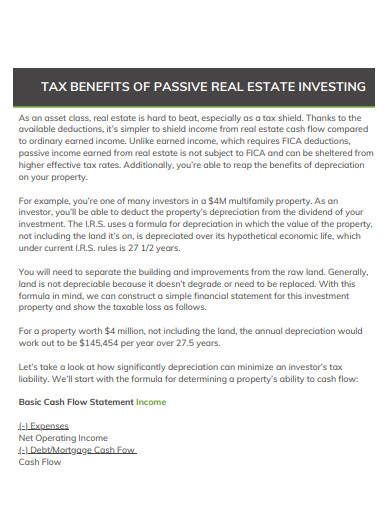

11. Real Estate Passive Income

mccompanies.com

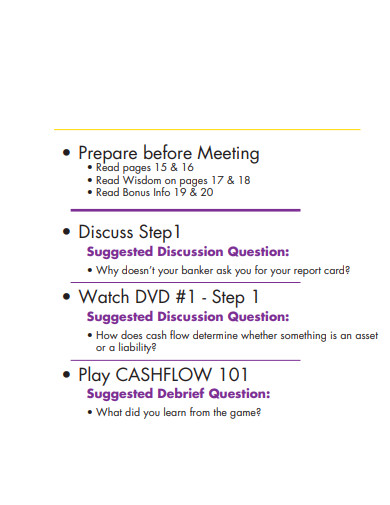

12. Cash Flow Passive Income

cashflow.ee

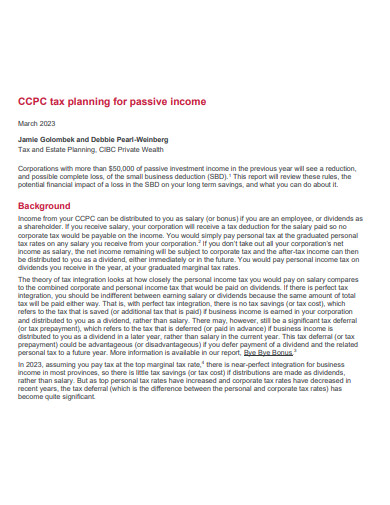

13. Investment Passive Income

cibc.com

14. Portfolio Passive Income

theprogenygroup.com