4 Personal Finance Essentials Examples to Download

Personal finance refers to the management and monitoring of your different types of capital and income sources, going out or coming in your hand. It covers investments, savings, revenues, budgeting, banking, mortgages, retirements planning, insurance investments, etc. Personal finance not always refers to a single individual and his or her financings but often the industries and firms that primarily focus on financing and investing. Such firms also advise borrowers about financial and investment opportunities.

What Personal Finance Essentials Requires?

Personal finance essential is an informative and educational journey to understand the Four Pillars of Money – Earning, Saving/Investing, Spending, and Charity. It requires different steps to follow while engaging in the process.

- To become financially literate to understand the odds and evens of the business to make savvy decisions on financing.

- To focus on meeting personal financial interests and goals.

- To monitor the financial cash flow and other situations.

- To make a proper financial plan to fight against several financial constraints in the business.

- To strategize investment of every single penny.

What are the Important Dos of Personal Finance Essentials?

Step 1: 50/20/30 Rule

According to the US senator Elizabeth Warren, the concept of 50/20/30 rule can be used to budgeting the personal finance of an individual’s earnings and for a firm’s finance management. The rule says that 50% of the entire generated capital should be used for the liabilities and different activities operations. 30% of it should go to developing and attracting more investors or consumers. And, 20% should go in savings that can be used in any worse or needy situation.

Draw a Line between Insurance and Investment

Insurances are a type of investments but you can not expect it to be as proper investments as its returns can be beaten by the inflation. That is why while buying insurance taking the decision critically by comparing its profit to other financial policies is very important. The policy must have a term cover and a health cover to secure the individual and the business.

Be Prepared for Crisis

Predicting the difficult and worse situations in business is not possible at times and once they occur suddenly coping with them looks even more difficult. That is why being prepared to deal with the contingencies can make your business go smooth. Certain situations might require some extra fundings too, here your savings can help to save your financing.

Track Your Finance

Ask for clear communication on the investment or finances that you have made in different stocks from the firm. As a financer, you have the complete right to track your capital where is it being utilized. There are different tools available in the market to support you in this tracking process.

Lesser Portfolio Actions Equals to Higher Portfolio Value

Not all the volatile situation in your financed business needs to act upon. Best performing stocks and funds can also give negative results at times and sometimes for a long time. But all these are the parts and parcels of a business and not all the crises can be helped out with any action. as a financer considering the negative performance of the funds and sticking to your financial plan is important at times.

3+ Personal Finance Essentials Examples

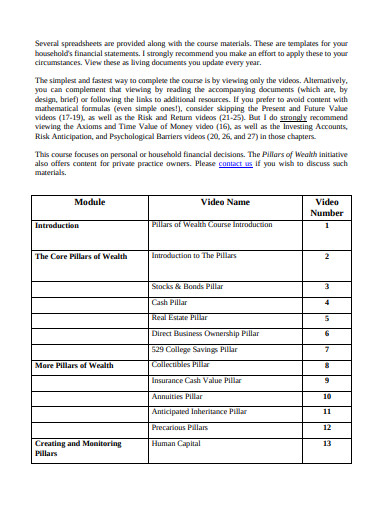

1. Personal Finance Essentials for Medical Professionals

Financing any business or firm needs to preceded by proper financial planning. You have to be financially literate enough to plan and make an impactful decision in financing. The mentioned sample of the template is a properly planned document that can make you understand the possible dynamics of personal finance and its essentials. It can also help you get ideas on preparing a financial report easily.

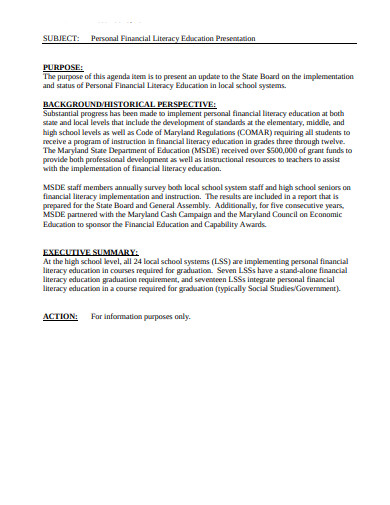

2. Personal Financial Literacy Education

Personal financing is an effective way to increase your capital and develop yourself or your firm. The mentioned template here can help you out on understanding the process and its different aspects and importance easily. The frame covers the subject in such a way that it could literate you on its different elements and you might feel its relevance in your day to day life. So, have a look at it today!

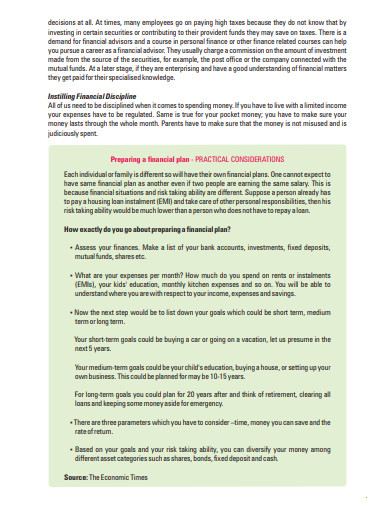

3. Personal Finance for School Students

Personal finance essentials, apart from the good health of the business, can also guide the individuals to plan and finance their personal activities. You can also refer to the sample here that talks about educating common individuals on the subject and liberating them. You would be able to understand the importance and purpose of having such a process in your life so check the frame out today!

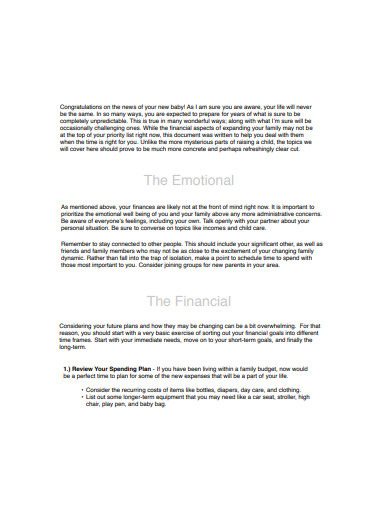

4. Finance Essentials for Parents

A personal finance essential might play different roles for the different individuals depending on their socio-political status. Thus we suggest you refer to this template that focuses on the different roles and specifies their different responsibilities. So, check this template out today!