9+ Private Equity Investment Examples to Download

What is Private Equity?

Private equity can be explained as investment funds or alternative investments that are used to buy companies and stocks but not recorded in public exchange. It describes the process of taking the private ownership of a company to reshape it properly for selling it at a profitable price. Private equity investments are made by different investors and each of them prefers their specific type of goals and strategies. The investors are generally the private equity firms, angel investors or venture capital.

What are the Advantages and Disadvantages of Private Equity?

Every practice or strategy retains some level of benefits and drawbacks with its usage and private equity is no exception to it.

Advantages

Private equity helps the companies and the startups by giving them access to liquidity against the traditional financial mechanism. It saves businesses from high-interest loans and other problems of financing and funding. It helps the firm and its several business attempts perform better by keeping it away from the public market.

Disadvantages

Private equity makes it difficult to get the holdings to be liquidated as it is always away from the public market. The pricing of the sales of the share is also not like the case of publicly listed companies, it is often decided by the negotiations between the sellers and the buyers. Even the private equity shareholder’s rights are not decided according to any particular governance framework but it differs different case to case.

9+ Private Equity Investment Examples

1. Investing in Private Equality

2. Private Equality Investing in India

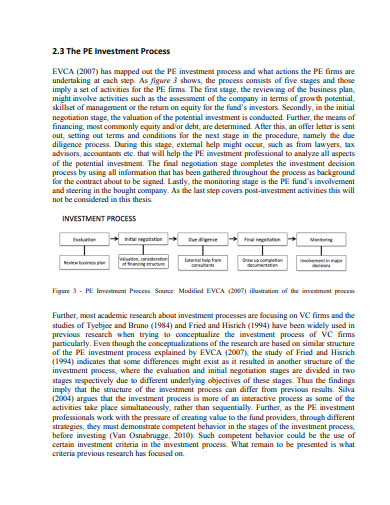

3. Private Equality Investment Process

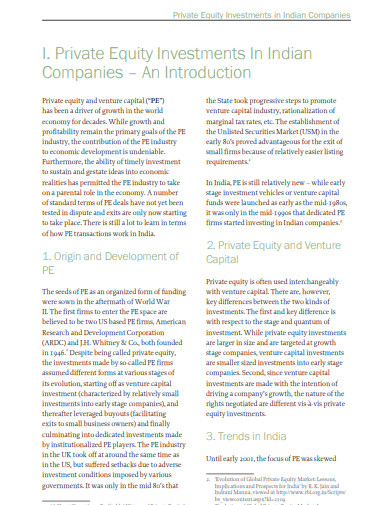

4. Private Equality Investment in India Companies

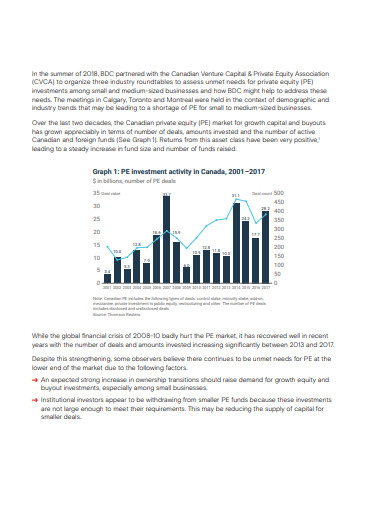

5. Private Equity Investment in Small and Medium Businesses

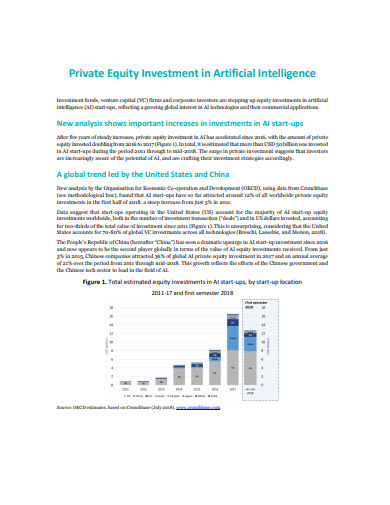

6. Private Equity Investment in AI

7. Private Equity Investment Professional

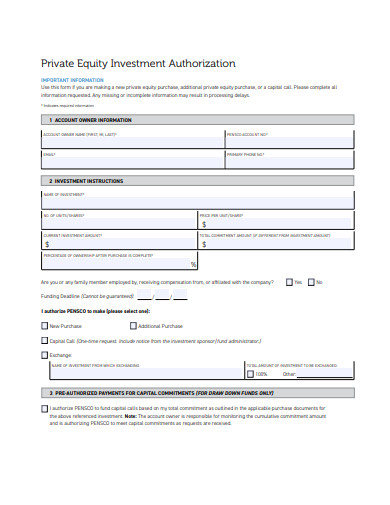

8. Private Equity Investment Authorisation Form

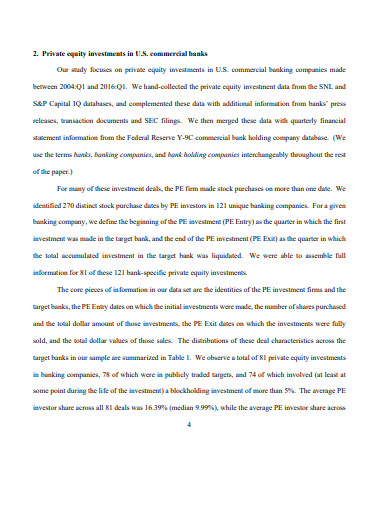

9. Private Equity Investment in Banks

10. Private Equality Investment in Financial Management

Private equity investment is a specific business class investment that is mostly funded by private firms and the venture capitals. This sort of business is always away from the public market and has high-profit chances. But the process of investment and return policy might be a little complicated. You can refer to this template if you want to have some idea on the process that covers all that you might want to know about.

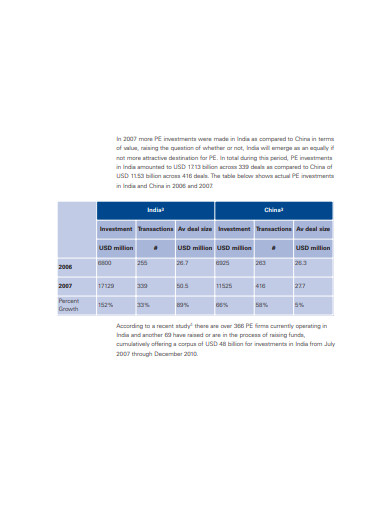

Every nation has some specific rules and regulations one private equity investment that the traders need to follow to be in the legal business frame. If you want to get some idea on the private equity investment in India this sample template on the schemes and regulations can help you to a good extent. This template has been framed with a comparison of the scheme between India and China.

Different private companies in India or other nations are always structured with different types of schemes. Every nation specifies more or less some regulatory steps on the investment process on private equity. If you want to have some idea of investing in Indian companies in private equity this template might help you. It has been framed with several specified descriptions of private equity investment in India and Indian companies.

An investment in any sort of business needs to be strategized according to the size of the business, the probable future performance, etc. Ir should be based upon studying all the aspects of the past and present performance of the business. If you want to make private equity investment choose this template that covers the investments in small and medium-sized businesses.

Private equity investments can be made in different types of fields and businesses. If you require to prepare a PE investment plan in Artificial Intelligence this template is the best option for you. This template can save a lot of your time that might go on understanding the structure which is already finely defined here. Or you can also have ideas on our private equity investment criteria. This would give you an idea of which businesses are capable and not capable of such investments.

Planning the private equity investment professionally for business or other purposes needs to be informative and summarising perfect. The given sample of the template does so and structures the different aspects and responsibilities of the after-investment period. You can refer to it while preparing your investment details. So have a look at the template today!

Private equity investments are made by different private firms and institutions that needs o be authorised by the authority or in-charge committee. The mentioned sample is an authorisation form of the investments if you too need to design such form for your firm or business use this template. This template might help you to reduce your work load as it covers several specifications of the investment.

Investments need to be strategized before being exercised in the market that is why this is the responsibility of the investors to monitor their capital to be utilised for what purposes. You can also have a look at this template that is designed focusing on the different requirements and processes of PE investments in commercial banks.

Private equity investments are made in different fields of practice and business. If you require some insights into PE investments in financial management choose this template. Designed with graphical representation and proper description of the process of the investment this template might guide your different decisions and trade steps.