10+ Ratio Analysis for Financial Statements Examples to Download

A quantitative method to know a company’s liquidity, the efficiency in operation, the profits earned by the company. This is usually done by making a comparison of the various financial statements. While you are about to do financial planning and analysis you need to go for the ratio analysis at first. The ratio analysis helps to know the strengths and the weakness of the firm. Likewise, it will help to work on the areas that require progress and development. Unlike the value of the dollar that keeps fluctuating, the presence of a ratio gives a constant and standardised measure to interpret. Therefore, for the financial analysis for business evaluation, the ratio analysis is an important essential.

10+ Ratio Analysis for Financial Statements Examples

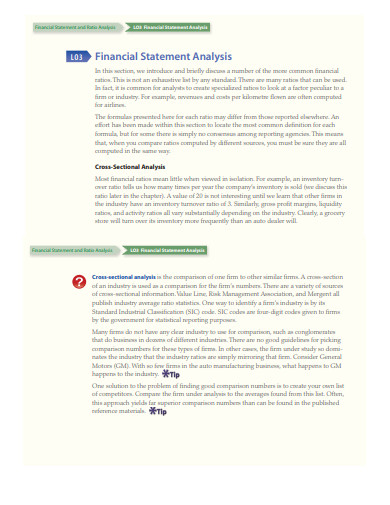

1. Financial Statements Process Example

2. Financial Statements and Ratio Analysis

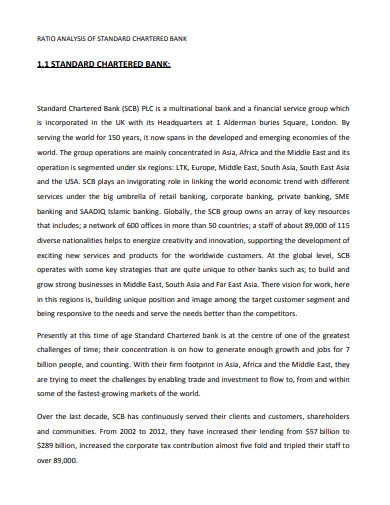

3. Ratio Analysis of Standard Chartered Bank

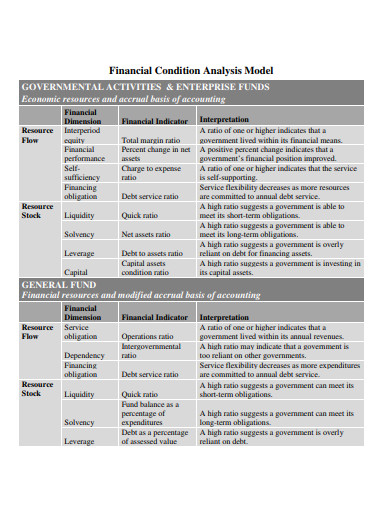

4. Financial Condition Analysis Model Example

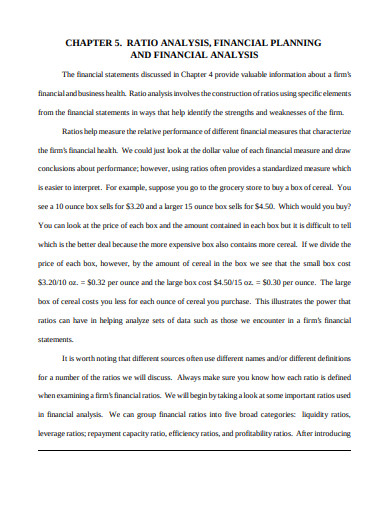

5. Ratio Analysis, Financial Planning and Financial Analysis

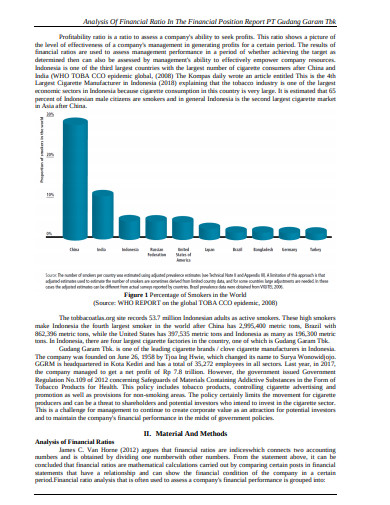

6. Analysis of Financial Ratio in Financial Position Report

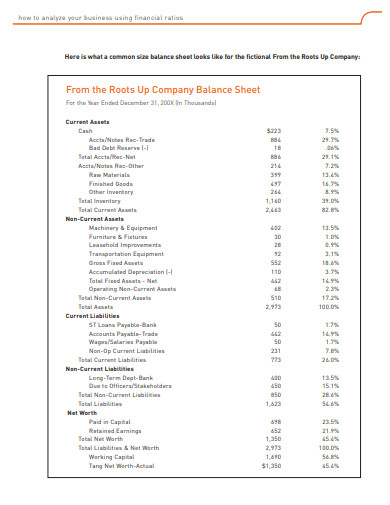

7. How to Analysis Business using Financial Ratio

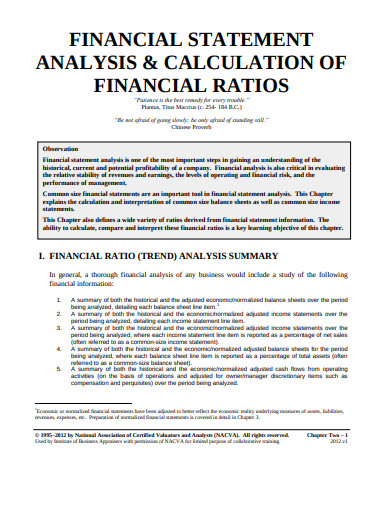

8. Financial Statement Analysis and Financial Ratio

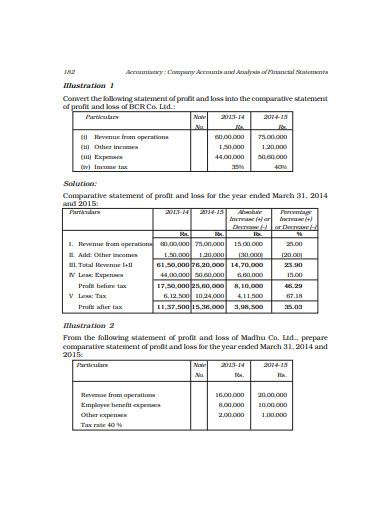

9. Analysis of Financial Statement Example

10. Types of Financial Ratios

11. Financial Statement Analysis Example

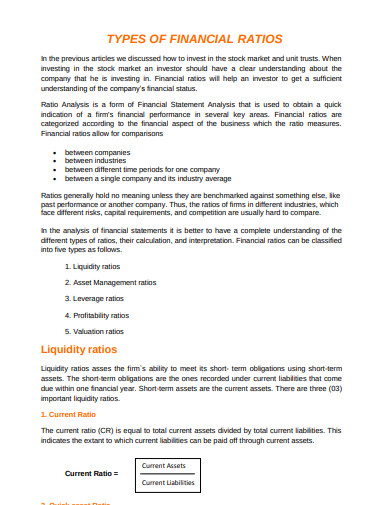

Types of Financial Ratios

-

Liquidity Ratio

The liquidity ratio is all about the firm’s capability to meet the financial obligations that are short-termed. In other words, these are the ones that can determine how quickly the firm’s current assets can be turned into cash so that the liability can be paid on time.

-

Leverage Ratio

The leverage ratio helps to find and know the amount of capital that comes in the form of debt. The leverage ratio also analyses the capability of the firm to meet its financial obligations.

-

Repayment Capacity Ratio

When a firm examines its debt in terms of flows, then it is done by the repayment ratios.

-

Efficiency Ratio

Efficiency ratios are the ones that help to measure the efficiency of the firms, in which it manages its assets.

-

Profitability Ratio

The profitability ratios examine the efficiency of the firms in generating profits.What is the Current Ratio Analysis?

A current ratio is a kind of liquidity ratio that measures a company’s capability to pay short term obligations, therefore the ones within a year. The fact that current assets can get converted into cash within a very short term, is proof that companies or firms with more number of current assets will be able to pay off the current liabilities.

Importance of Ratio Analysis

- The ratio analysis helps you to know and understand the financial results of any firm.

- With the help of ratio analysis, the managers will be able to know the strengths and weaknesses. From those, the strategies and goals can also be made.

- The complicated accounting systems and financial statements can be easily understood with the help of ratio analysis.

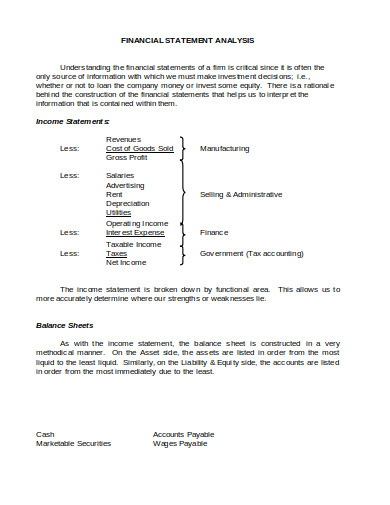

Types of Financial Analysis

-

External Analysis

When there is no access to the accounting information, then the analysis is done on the basis of published financial statements.

-

Internal Analysis

The motive of this analysis is to let the top departments know about the decisions and the information of the finance department. The analysis is done by the finance and accounting department.

-

Short Term Analysis

This kind of analysis consists of both the current assets and current liabilities., which in return helps to know the cash position.

-

Horizontal Analysis

When you compare the financial statements of a number of years, then it is considered as horizontal analysis. Dynamic analysis and horizontal analysis are used synonymously.

-

Vertical Analysis

When the financial ratios are required to calculate a single year, then it is called a vertical analysis.

Financial Tools and Techniques

-

Comparative Financial Statements

This is an analysis that is used to make a comparison between two financial statements. While drawing the comparative analysis, it helps to draw the conclusions, know the performances, etc.

-

Statement of Changes in Working Capital

This statement helps to know the information of the working capital. If you deduct the current liabilities from the current assets, then you will get the net working capital.

-

Trend Analysis

This is used in horizontal analysis. It helps to know and see whether the financial scenario of a business is growing or coming down. The ratios of different items of the financial analysis of different periods are calculated first, and then the comparison is done.

-

Ratio Analysis

This is the most popular and the best way to analyse the financial statements. It helps to know a company’s liquidity, the efficiency in operation, the profits earned by the company.