10+ Special Revenue Funds Examples to Download

A special revenue fund refers to the funds kept specifically for a special or particular project within a government entity. The usage of the fund is restricted to any mere activity. And it provides a different level of accountability and transparency to the people who by their tax, supported the project. The special funds are often used for building libraries and schools and others.

How Special Revenue Fund can be Processed?

The special revenue fund can be processed and achieved by following certain stepwise methods that can maintain transparency and complete the project. The steps are the rules that a special revenue fund needs to follow:

Rule 1: Background

The background of the special revenue fund states that the fund should be used as ‘account for the proceeds of specific revenue sources. The sources that it states are legally restricted one any sort of expenditure for several specified purposes. This rule monitors and studies three issues that are what revenue sources are constituted by, what binds the legal restrictions, and what is a specified purpose.

Rule 2: Revenue Sources

A special revenue is a fund that a governmental authority prepares and keeps ready for different special situations and cases. The government frequently supply the existing resources and fund to different arisen purposes for public welfare. According to the Governmental Accounting Standards Board, the term proceeds for specified revenue resources implies restricted revenues. It doesn’t mean or applies the transfer of the existing resources. It states that when the fund is established the authority is free for transferring resources to fund. Thus in the context of the total inflows of the fund the basic revenue source remains a substantial portion.

Rule 3: Legal Restriction

Different authority and regulatory bodies define this rule with their different words respectively. NCGA defines the fact of revenue as the resources which are legally restricted to expenditure whereas for GASB restriction means the external legal limitations. But GASB also believed in using special funds is appropriate for sources that are subjected to self-imposed legal limits and commitments.

Rule 4: The Purpose

The governmental body or the authorities use specific revenue resources that help in funding the stabilized arrangements. This stabilization limits certain condition and situation that allows the usage of the resources rather than the expenditure. According to GASB the specified purpose that can get the support of the special fund is identified by limiting the situation in which resources can be extended. Thus for stabilization arrangements, a government can use special revenue funds.

Rule 5: Timing

The rules designed under GASB are required and directed by the government to be implemented within the fiscal year.

10+ Special Revenue Funds Examples

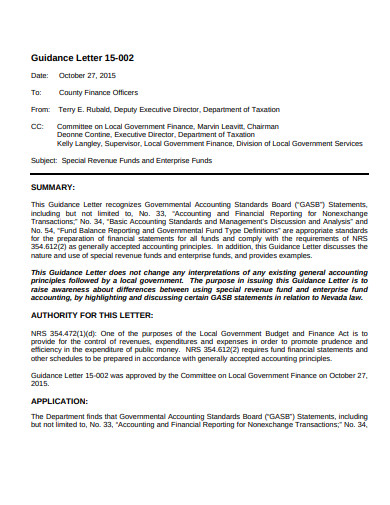

1. New Rules for Special Revenue Funds Examples

The special revenue funds are processed and operated by government authorities. The Authority regulates and manages the resource gathered from taxes and other revenue sources. Such resources are huge in amount and thus need to follow certain rules and regulations so as to be accountable and transparent to its taxpayers. If you want to know more about those rules following this special revenue fund template may help you to understand it more clearly!

2. Special Revenue Funds and Enterprise Funds Example

Special revenue funds are kept and preserved for some specific circumstances that may probably ask for it. But the fund is confined with different regulatory statements that it is bound to be followed. The given sample of the template can be used to understand the way special funds can be used. This might also help you to prepare a special revenue fund financial statements. So have a look at it before you take the stress!

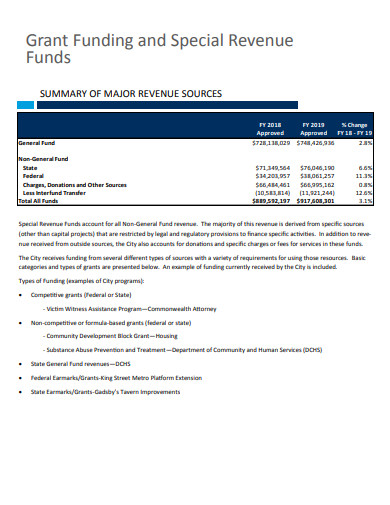

3. Grant Funding and Special Revenue Fund

Special revenue funds are processed following certain rules and regulations, mostly specified in special revenue fund GASB statements. If you are dealing with such funds you might need to understand and state the sources the revenue is coming from. Or you can refer to this template and simplify your task and reduce your workload.

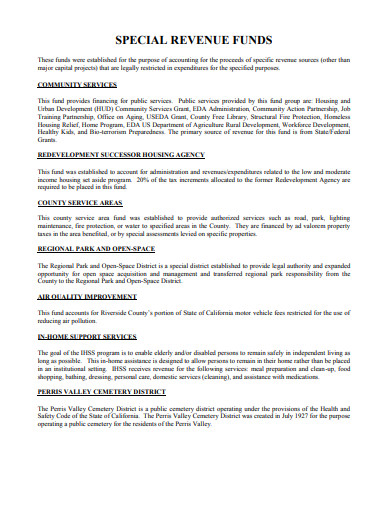

4. Special Revenue Funds Example

Special revenue funds are extracted from the different revenue-generating sources in a government entity that is used for specific purposes. This purpose has to have some common public interest. It also states different other specifications and statements. If you want to know more about it you can choose this template that can explain the process to you and you might be able to prepare special revenue fund accounting.

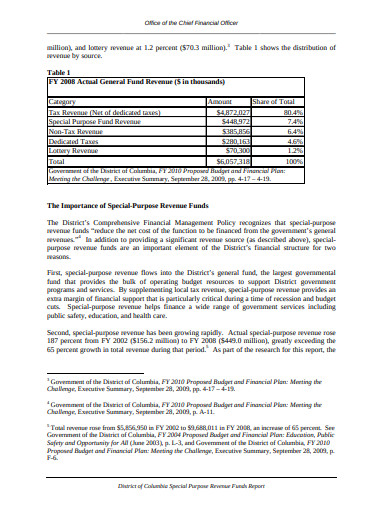

5. Special Revenue Funds Report Example

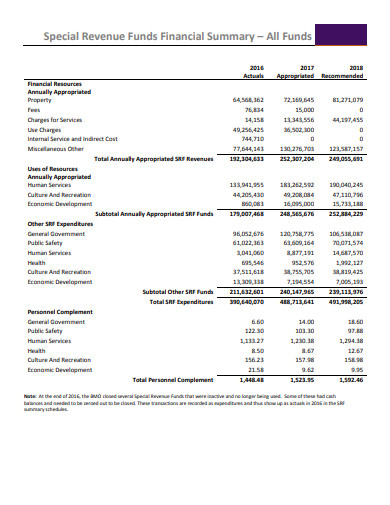

6. Special Revenue Funds Financial Report

7. Special Revenue Funds Account Example

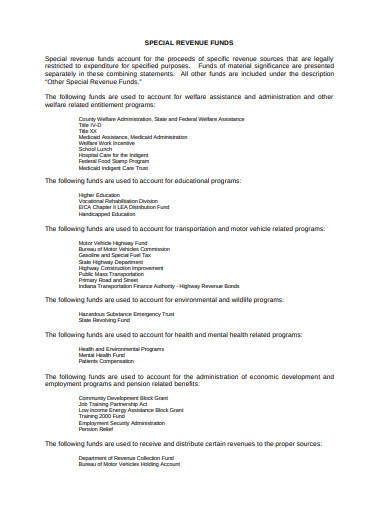

8. New Guidance on Special Revenue and Capital Projects Funds

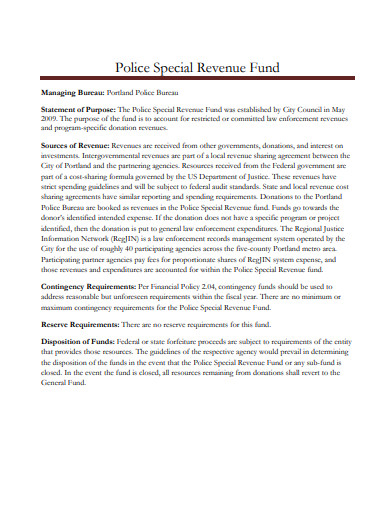

9. Police Special Revenue Fund Example

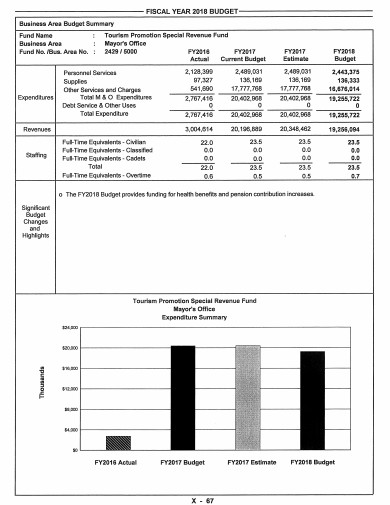

10. Tourism Special Revenue Fund Yearly Budget

11. Proposed Special Revenue Fund Budget

10+ Special Revenue Funds Examples to Download

A special revenue fund refers to the funds kept specifically for a special or particular project within a government entity. The usage of the fund is restricted to any mere activity. And it provides a different level of accountability and transparency to the people who by their tax, supported the project. The special funds are often used for building libraries and schools and others.

How Special Revenue Fund can be Processed?

The special revenue fund can be processed and achieved by following certain stepwise methods that can maintain transparency and complete the project. The steps are the rules that a special revenue fund needs to follow:

Rule 1: Background

The background of the special revenue fund states that the fund should be used as ‘account for the proceeds of specific revenue sources. The sources that it states are legally restricted one any sort of expenditure for several specified purposes. This rule monitors and studies three issues that are what revenue sources are constituted by, what binds the legal restrictions, and what is a specified purpose.

Rule 2: Revenue Sources

A special revenue is a fund that a governmental authority prepares and keeps ready for different special situations and cases. The government frequently supply the existing resources and fund to different arisen purposes for public welfare. According to the Governmental Accounting Standards Board, the term proceeds for specified revenue resources implies restricted revenues. It doesn’t mean or applies the transfer of the existing resources. It states that when the fund is established the authority is free for transferring resources to fund. Thus in the context of the total inflows of the fund the basic revenue source remains a substantial portion.

Rule 3: Legal Restriction

Different authority and regulatory bodies define this rule with their different words respectively. NCGA defines the fact of revenue as the resources which are legally restricted to expenditure whereas for GASB restriction means the external legal limitations. But GASB also believed in using special funds is appropriate for sources that are subjected to self-imposed legal limits and commitments.

Rule 4: The Purpose

The governmental body or the authorities use specific revenue resources that help in funding the stabilized arrangements. This stabilization limits certain condition and situation that allows the usage of the resources rather than the expenditure. According to GASB the specified purpose that can get the support of the special fund is identified by limiting the situation in which resources can be extended. Thus for stabilization arrangements, a government can use special revenue funds.

Rule 5: Timing

The rules designed under GASB are required and directed by the government to be implemented within the fiscal year.

10+ Special Revenue Funds Examples

1. New Rules for Special Revenue Funds Examples

gfoa.org

Details

File Format

PDF

Size: 576 KB

The special revenue funds are processed and operated by government authorities. The Authority regulates and manages the resource gathered from taxes and other revenue sources. Such resources are huge in amount and thus need to follow certain rules and regulations so as to be accountable and transparent to its taxpayers. If you want to know more about those rules following this special revenue fund template may help you to understand it more clearly!

2. Special Revenue Funds and Enterprise Funds Example

tax.nv.gov

Details

File Format

PDF

Size: 821 KB

Special revenue funds are kept and preserved for some specific circumstances that may probably ask for it. But the fund is confined with different regulatory statements that it is bound to be followed. The given sample of the template can be used to understand the way special funds can be used. This might also help you to prepare a special revenue fund financial statements. So have a look at it before you take the stress!

3. Grant Funding and Special Revenue Fund

alexandriava.gov

Details

File Format

PDF

Size: 740 KB

Special revenue funds are processed following certain rules and regulations, mostly specified in special revenue fund GASB statements. If you are dealing with such funds you might need to understand and state the sources the revenue is coming from. Or you can refer to this template and simplify your task and reduce your workload.

4. Special Revenue Funds Example

auditorcontroller.org

Details

File Format

PDF

Size: 164 KB

Special revenue funds are extracted from the different revenue-generating sources in a government entity that is used for specific purposes. This purpose has to have some common public interest. It also states different other specifications and statements. If you want to know more about it you can choose this template that can explain the process to you and you might be able to prepare special revenue fund accounting.

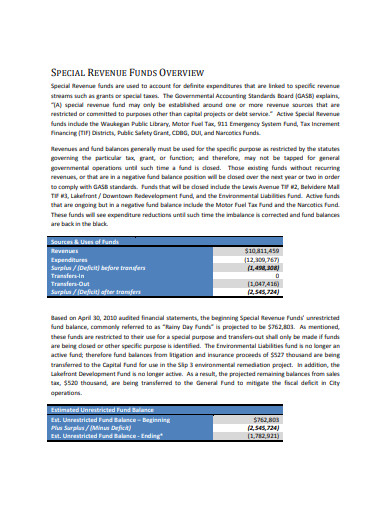

5. Special Revenue Funds Report Example

cfo.dc.gov

Details

File Format

PDF

Size: 726 KB

6. Special Revenue Funds Financial Report

denvergov.org

Details

File Format

PDF

Size: 767 KB

7. Special Revenue Funds Account Example

in.gov

Details

File Format

PDF

Size: 3 KB

8. New Guidance on Special Revenue and Capital Projects Funds

gfoa.org

Details

File Format

PDF

Size: 475 KB

9. Police Special Revenue Fund Example

portlandoregon.gov

Details

File Format

PDF

Size: 63 KB

10. Tourism Special Revenue Fund Yearly Budget

houstontx.gov

Details

File Format

PDF

Size: 322 KB

11. Proposed Special Revenue Fund Budget

waukeganil.gov

Details

File Format

PDF

Size: 186 KB