10+ Stock Trading Investing Examples to Download

Investing or investment is a process of allocating money by putting into different financial products. While you invest, you actually do it with the motive of increasing the amount of money that you own. In financial terms, an investment will be the purchase of bonds, stocks, etc. A business or a company invests when it wants to expand it.

Types of Stock Trading

The process of buying and selling stock shares for the short term is called stock trading. There are two kinds of stock trading precisely:

-

Active Trading

When an investor wants to take advantage of the short term events. He usually places 10 or more trades per month. In this case, it is called active trading.

-

Day Trading

The day trading is a kind of approach by the investors that is they buy, sell and close their position of the same stock in the single trading day.

Differences between Trading and Investment

- Trading is buying stocks for a short period while investing is for a long period of time.

- The traders concentrate on stocks for a short time like weeks, days, etc. While the investors have a long term outlook and think in terms of years rather than months.

- If the price goes higher traders might end up selling the stocks, whereas the investment is done to increase or create wealth with the help of compound interest.

- The risk factor is higher in trading rather than in investment. In the act of investment, the process goes on in a steady manner and therefore takes time to develop. Therefore it involves a comparatively lower rate of risks.

10+ Stock Trading & Investing Examples

1. Difference Between Savings and Investing

2. Rules of Investing in Stock Market

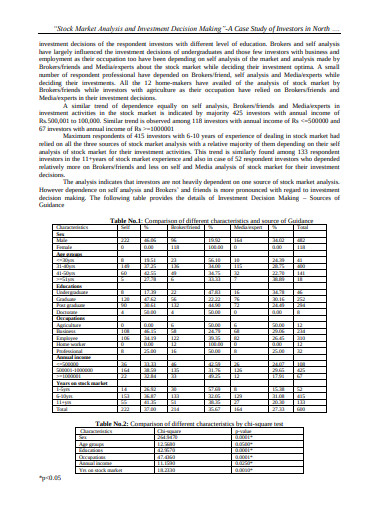

3. Stock Market Analysis and Investment Decision Making

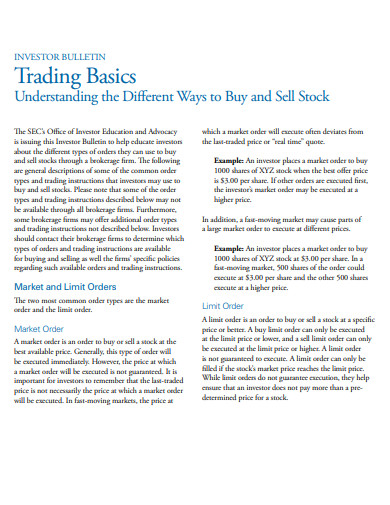

4. Trading Basics Example

5. Company Stock Trading Policy Example

6. Investor Sentiment and Stock Market

7. Stock Market Investment Trading Strategies Example

8. Basics of Investment

9. Trading and Investment Startige

10. Best 35 Stock Market Strategies

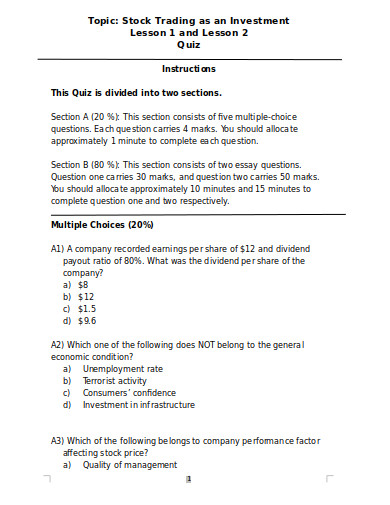

11. Stock Trading as an Investment Questionnaire

How Do You Invest in Stocks?

Step 1: Choose The Way of Investing

You may want to choose the stock and stock funds by yourself. Or else you may also

Step 2: Create an Investing Account

To invest in stocks, you need to have an investing account. You can either go for a brokerage account or through the help of a Robo adviser.

Step 3: Know the Difference Between Stock and Stock Mutual Funds

You need to know about the difference between the stock mutual fund and the individual stocks. That will help you to clearly know the essentials that you require and the fundamental steps that you need to take for that.

Step 4: Start the Investment Process

Then comes the most significant part of actually starting the investment process. Go for the effective strategies and approaches and start off with the investment process.

How to Start Investing with Little Money?

Step 1: Start Saving

This might seem a very difficult process, but you can start it in fewer amounts. To invest money you need to start saving first, as these two are quite similar activities. You can start with a minimum amount then keep increasing with time.

Step 2: Take the Help of a Robo Advisor

If you are someone who is totally new to the process of investing, then don’t worry! There is a Robo Adviser that can be relied on. It helps the completion of the process of investment

Step 3: Treasury Securities

Make sure you go for the treasury insecurities. These will not just help you to pay the interests but also make adjustments periodically in response to the inflation based on the changes occurred in the consumer price index.

Step 4: Employer’s Retirement Plan

4 Types of Investments

Shares:

Shares can be considered as growth investments, as these help your initial investments to grow and increase

Property:

Properties can also be growth investment because the value of properties like buildings, houses or lands keeps changing with time.

Cash:

The everyday bank accounts and the term deposits will be considered as cash. These

Fixed Interest:

Fixed interests can be the bonds that the governments or the companies take from the investors. They pay them with the proper rate of interest too.

Difference Between Stocks and Stock Mutual Funds

-

Cost of Investing

For investing in the stock market, you need to open a brokerage account. But in case of the mutual funds, you have to pay various charges. So the cost of investing differs in both.

-

Fluctuation in Investment

Investing in stocks leads to more fluctuation than in mutual funds. Because in case of stocks you invest in more than 10 to 15 stocks. Whereas mutual funds invest in at least 50-100 stocks. That is why the degree of fluctuation is less in the case of mutual funds.

-

Saving Tax

You will be able to receive a tax deduction up to 1.5 lakh if you invest in ELSS under mutual funds. So you can save the tax amount in a huge amount. But likewise, if you sell stock by investing directly in the stock market you are bound to pay an amount of tax whatsoever the situation is.

-

Monitoring

In the stock market, you need to monitor your stocks by yourself. Since it is a personal process, therefore you can’t have someone do that for you. But in case of mutual funds, there are managers that are appointed to look after the investments and then take the decisions of buying and selling on behalf of you.

-

Time Period for Investing

Since there is a fund manager to manage the mutual funds, therefore it takes a lot more time in stock investments. Also, a long process of research needs to be done in stock investments. So it does take time.

-

Ease in Process

The process of investment is quite easy in the mutual fund. But it comparatively takes more time for investing in a stock market. For a stock market, you need to open a brokerage account with the help of a stockbroker.