Trading Strategies for Beginners

A trading strategy is nothing but the methods and techniques employed by the traders to achieve some targets and goals in the buying-selling process. The strategies add several well-defined methods to control the plans, with proper investing objectives, managing the risks, etc. The most important aspect of trading is to accommodate all the methods and strategies in a properly crafted plan. And the planning includes several tasks of developing the trade, techniques for strategy making, investments and buying-selling techniques, etc.

What is a Trading Plan and how to Develop it?

A trading plan can be referred to as a navigation map for the several actions of the trade. The plan is made up based on certain needs, purpose, and objectives of the trade and thus helps to do the works accordingly. The plan needs to be based on logical reasoning and decisions. A finely crafted trading plan helps to simplify the workload of the trading process as you can move according to the pre-set parameters.

A trading plan adds several objectives and you can give a proper shape and identity to your trade in the market following the objectives set for the trade. Good planning can set trading discipline and level for your business and you can make changes in it again and again to improve it. The following are the steps that can establish a proper trading plan.

Step 1: Outline the Project

The trading project must be based on some buying and selling processes and other works. So the best way to prepare a plan is to summarize the different aspects of the trade you want to focus on and target.

Step 2: Decide the Timeframe

Every trade and business has a timeframe and limit. Thus before you start trading and importing-exporting your products decide the period you would deal with a particular project. The timeframe should also specify the periods which the consumers should access your platform at.

Step 3: Define Goals and Objectives

Every trade and business is being run with some goals and objectives to derive some benefit and at the end of the project. So before investing in the supply of products and services you should decide your objectives and choose your goals. The goals should be, in trade language, SMART (specific, measurable, attainable, relevant and time-bound).

Step 4: Risk Management

Every business and trade would encounter you with some or more risks in it. You have to make yourself prepared to face them and mitigate them. So while designing the plan always decide the limits of risk you are or can prepare your side to face and mitigate. The greater your trade venture would be the more you would be exposed to risks.

Step 5: Decide Investment capital

Trading asks for investment and capital thus you need to decide and arrange the capital that you can invest in the business. Investments can be made with small amounts but you should not go beyond what you can not afford to make greater investments.

Step 6: Assess the Market Knowledge

Before investing your savings and capital on any trade do proper market research and study the market condition for that particular trade properly. Study as more as you can about the market trends, the volatility of the market, when the market opens and closes, etc and then make the investments.

4+ Trading Strategies for Beginners Examples in PDF

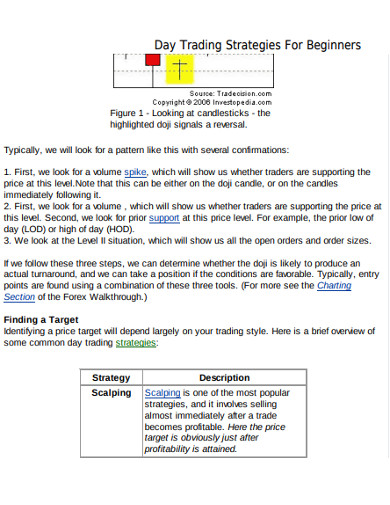

1. Day Trading Strategies For Beginners

2. Strategy and Future Studies for Beginners

3. General Strategy Pointers for Beginners Example

4. Sample Strategies for Beginners Example

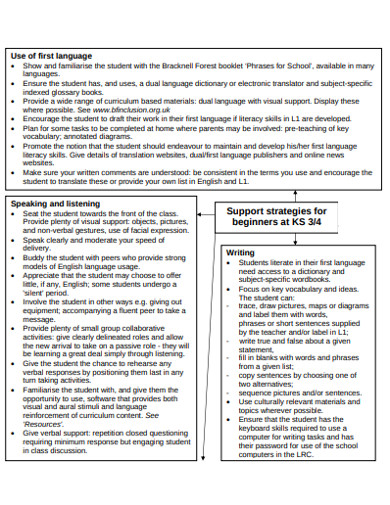

5. Strategies for Teaching Beginners Example

What are the Most Essential aspects of the Trading Plan?

The trading plan should always cover the following essential elements:

- A work summary

- Time commitment

- Goals and the targets

- Risk tolerance

- Capital available for trade

- Risk mitigation and management rules

- The chosen markets for trading

- the strategies

- Recording and documenting

What are Different Types of Trading Strategies?

There are several methods used to define different types of trading market strategies. Active trading is mainly popular for traders who are trying to beat the market average. The following four strategies are some of the most common active trade strategies.

1. Swing Trading

Swing trades makes into the trade scenario when an already established trend breaks. When a new trend tries to make its space for itself, usually the price volatility is seen always. the traders of this sort buy and sells while this volatility sets in. Swing trends don’t expire in a day but its life span is shorter than the trades of trends. The traders often make rules and regulations following some technical and fundamental analysis. The rules are based keeping in mind the perfect time which can be most fruitful for the trade. In a swing trading predicting the price, the move is not possible that is why this trading requires a market condition that is moving in a particular direction.

2. Day Trading

Day trading is one of the most used trading styles. It can be said that it is an advanced form of active trading itself. Day trading acts rapidly on the buying and selling the securities as it tries to cover the deal within the same day of the trade. The positions keep on being closed and open to be used and nothing is held overnight. As swift this trading is the more expertise it requires that is why often the market makers and the specialists are only seen to use this trading process. Electronic trading has given rise to some amateurs to use this strategy recently.

3. Position Trading

Position trading can be said as a buy and hold process but it is also considered active trading at times when being used by the advanced traders. This trading process uses long term charts combining with other market methods to target the contemporary trends of the contemporary market. It depends on the trend how long it would last and survive in the market.

4. Scalping

The active traders often use scalping trading strategy for its speed. It counts the different price gaps and the order flows in the trade. This strategy mainly works between buying at bidding and selling at the asking period. Scalping specialists take a little time in holding the position to avoid any sort of risk that comes with the strategy.