10+ Financial Goals Examples to Download

Having financial goals is part of our personal development goals. Financial goals help in managing our finances since it is a motivator to hustle hard. Sticking to your financial goals can be quite hard but once you make little successes every day, it actually feels rewarding and fulfilling.

If you still do not have any financial goals right now as you read this article, maybe it’s already time for you to set serious financial goals, or else your future will be as bleak as the night. Here are ten financial goals you can use to help you in one of your personal development goals.

1. Smart Financial Goals Template

10 Financial Goals Examples

2. Have an Emergency Fund

3. Get Out of Debt’s Suffocating Hold

4. Plan for Early Retirement

5. Have Multiple Sources of Income

6. Have an Insurance

7. End Any Addiction to Stuff That You May Have

8. A Plan to Do Work That You Love

9. Do Not Spend Beyond Your Means

Always spend within your means and needs. Buying a lot of unnecessary things you do not need is a trap called debt and you have to keep in mind that you have a financial goal not to have a single debt. Spending beyond your means that you would spend beyond your base pay or your salary and what does that mean? Debt. Always determine your needs even before you receive your pay so that you will not be able to think of buying unnecessary things.

10. Have a Budget and Stick to It

Having a budget always and unfailingly works wonders for your finance. If you only have one job and with a low salary at that, having a well-planned budget can make you look like you’re earning a million dollars a month. Budgeting can be a tough job to do especially if you have a low base pay but once you would figure out your needs as well as the things that you need to pay, you can easily budget. Make budgeting a habit. Budgeting can help you spend less and spend on unnecessary things less as well.

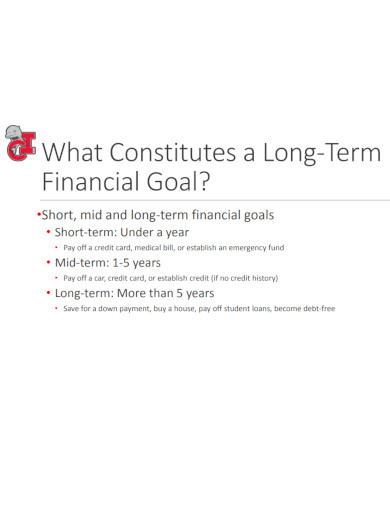

11. Long Term Financial Goals

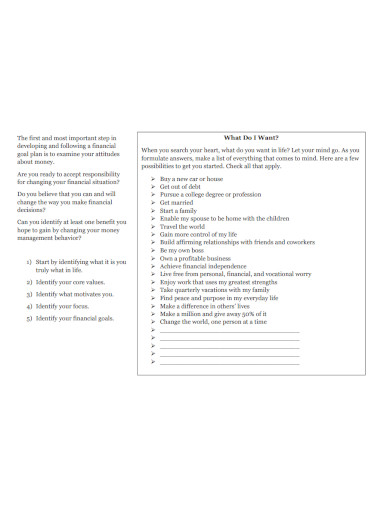

12. Financial Goal Setting

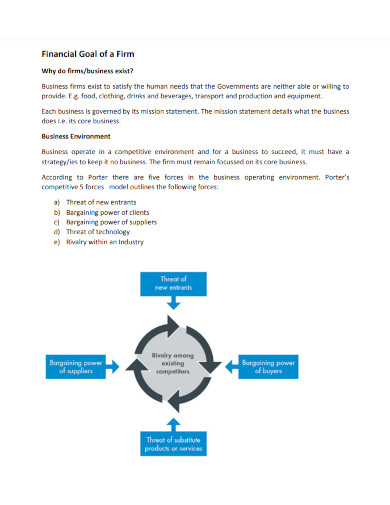

13. Financial Goal of a Firm

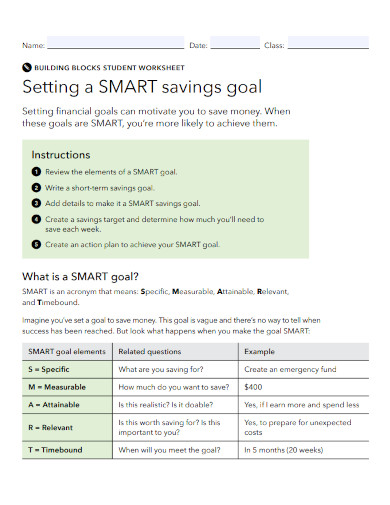

14. Setting a Smart Savings Financial Goal

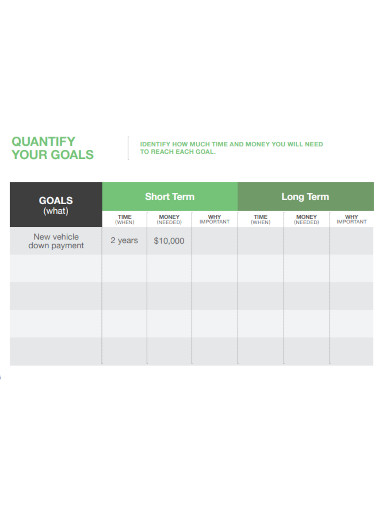

16. Finacial Goal Planning Worksheet

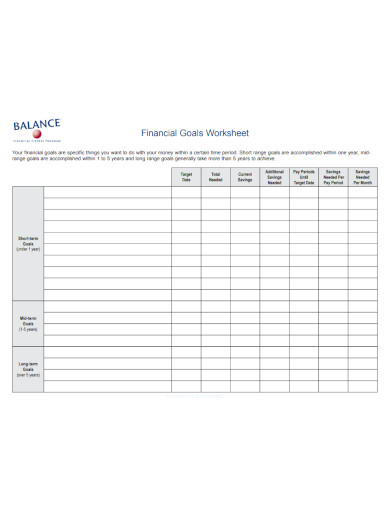

17. Financial Goals Worksheet

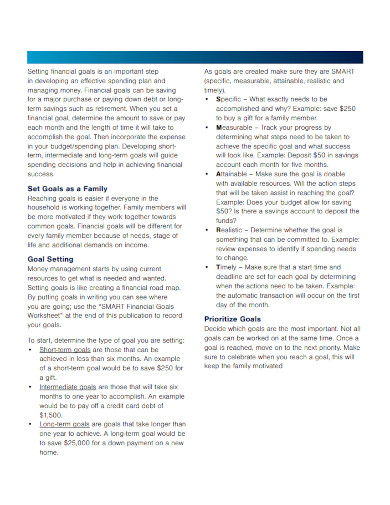

18. Financial Planning and Goal Setting

19. Sample Setting Smart Financial Goals

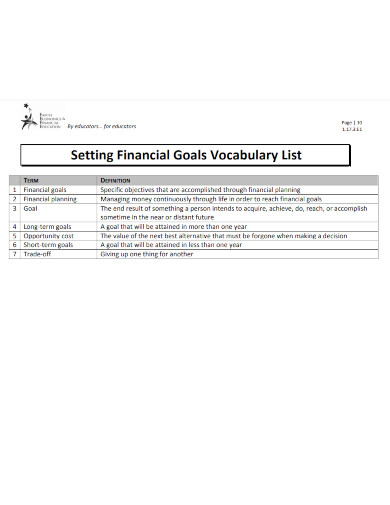

20. Setting Financial Goals Vocabulary List

21. Setting Financial and Investment Goals

22. Five Financial Goals for New Year

23. Financial Goal Tips for Women

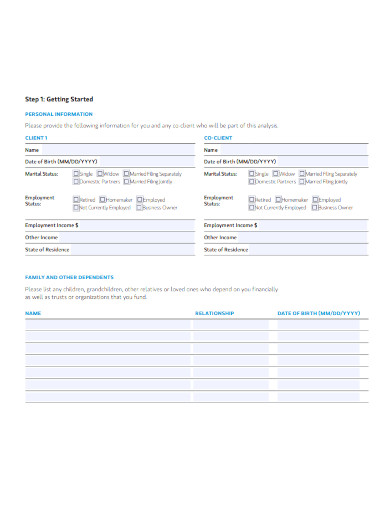

24. Financial Goal Analysis and Financial Plan

25. Creating a Personal Financial Goal Plan

26. Achieve Financial Goals Example

What are Financial Goals?

Even if you already have a job, it is still good if you have another source of income. Let’s say your life goal or career goal is to have your main source of income is to be used for your needs, such as to pay for food, bills, and your savings and your other sources of income can be used for your leisure and you can also use it for your savings.

Financial goals are specific, measurable, and time-bound targets that an individual sets for their financial future. These goals can range from short-term objectives, such as paying off a credit card debt or saving for a vacation, to long-term goals, such as buying a house, saving for retirement, or building a sustainable investment portfolio. The purpose of financial goals is to provide direction and motivation in managing personal finances and to help individuals achieve greater financial stability and security over time. By setting clear financial goals and developing a plan to achieve them, individuals can better manage their money, reduce financial stress, and work towards a more prosperous future so they don’t resort to borrowing money from others again to pay off the lent money used for their mortgage notes. You may also see work goals.

How do you make Financial Goals?

Here are some steps to help you make financial goals:

Step 1: Identify your priorities

Determine what’s most important to you in your financial life. This could be paying off debt, saving for a down payment on a house, or building up your retirement savings.

Step 2: Make your goals SMART

SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Make sure your goals meet these criteria. For example, instead of saying “I want to save money,” make your goal more specific by saying “I want to save $5,000 for a down payment on a house within the next two years.”

Step 3: Break down your goals

Break your big goals into smaller, more manageable ones. For example, if your long-term goal is to save $50,000 for retirement, you could break it down into smaller goals of saving $5,000 each year.

Step 5: Create a plan

Determine the steps you need to take to achieve your goals. This might include creating a budget, increasing your income, or reducing your expenses.

Step 6: Monitor your progress

Regularly review your progress towards your goals and make adjustments as necessary. This can help you stay on track and make any necessary changes to your plan.

Step 7: Celebrate your successes

Celebrate when you achieve your goals, whether it’s paying off a debt or reaching a savings milestone. This can help keep you motivated and focused on achieving your next financial goal.

FAQs

Why is it important to set financial goals?

Setting financial goals helps you clarify what you want to achieve with your money and provides a roadmap for achieving your desired financial outcomes. It also helps you track your progress and make adjustments along the way.

How do I measure my progress toward my financial goals?

Measure your progress by tracking your income, expenses, and savings over time. You can use financial tools like budgeting apps, spreadsheets, and online calculators to help you track your progress.

What if my financial goals change over time?

It’s normal for your financial goals to change as your circumstances change. Regularly reviewing and updating your goals can help ensure they remain relevant and achievable. Be open to adjusting your goals as necessary to ensure you are on track to achieve your desired financial outcomes.

In conclusion, setting financial goals is a powerful tool that can help you create a roadmap towards greater financial stability and success. By identifying what you want to achieve financially and breaking down your goals into smaller, achievable steps, you can build a strong foundation for your financial future. Whether you’re saving for a down payment on a house or planning for retirement, financial goals can help you stay focused, motivated, and on track towards achieving your desired financial outcomes. With the right mindset, tools, and strategies, anything is possible when it comes to reaching your financial goals.