10+ Financial Action Plan Examples to Download

No company or business wants to admit bankruptcy. Even if you want to make your own income, you yourself would rather find a way than to admit bankruptcy in the end. This is why when you have your own business or you simply want to save up for a better financial future, you will stop at nothing to find a way to avoid being bankrupt. To avoid the problem of being bankrupt. But what can you do? You can do a lot of things and hope they work out for you or you can make your own financial action plan. Why risk something knowing you are not able to predict or to find out if it works, when you can plan how you are going to do it. With that being said, here are some examples of a financial action plan you can count on.

10+ Financial Action Plan Examples

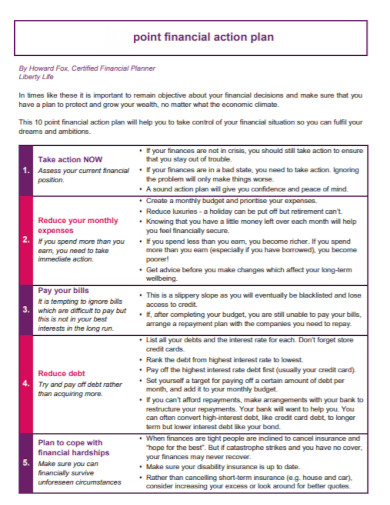

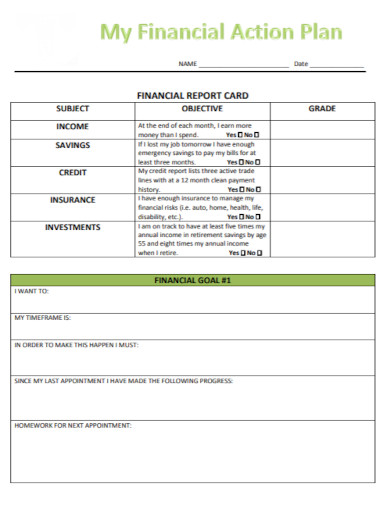

1. Personal Financial Action Plan Template

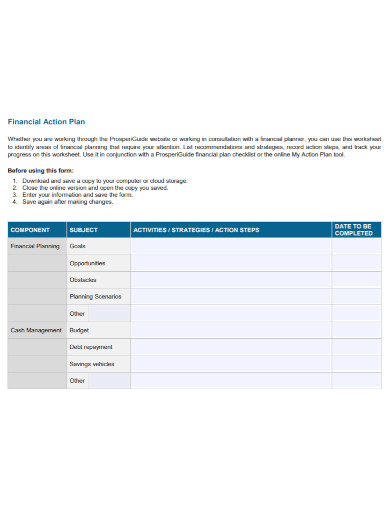

2. General Financial Action Plan

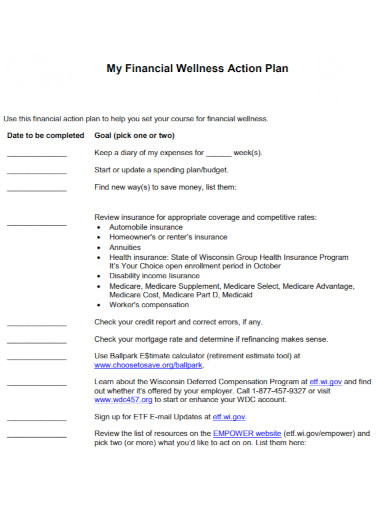

3. Financial Wellness Action Plan

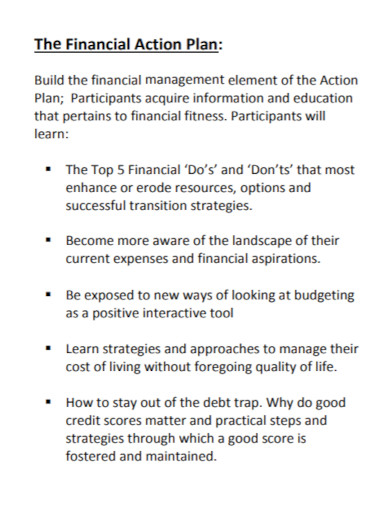

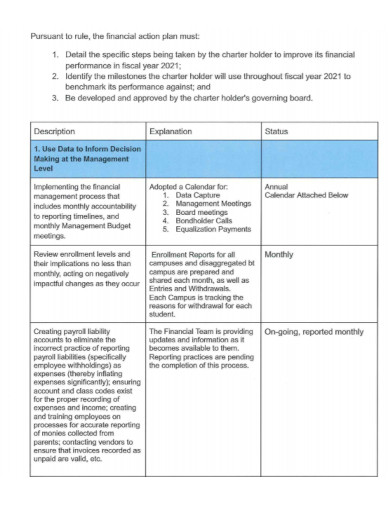

4. Financial Management Action Plan

5. Financial Plan of Action

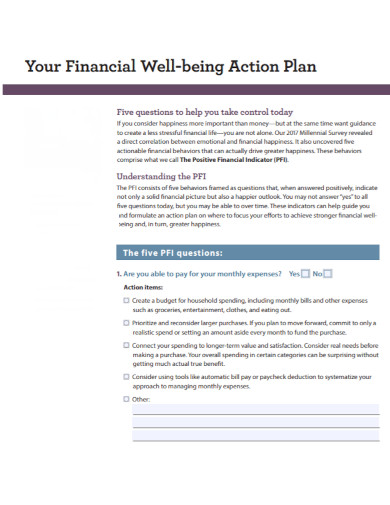

6. Financial Well-being Action Plan

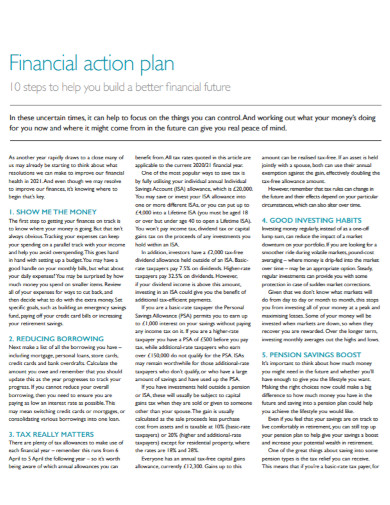

7. Financial Future Action Plan

8. Printable Financial Action Plan

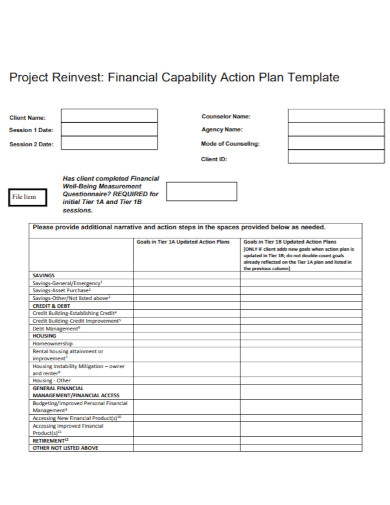

9. Financial Capability Action Plan

10. Financial Action Plan in PDF

11. Financial Strategy Action Plan

What Is a Financial Action Plan?

A financial action plan is a type of action plan that helps you manage the money you have earned, either through working in a company or business, or the money you earned through doing business. The entire purpose for the action plan is to help you manage, direct and make sure that how you budget, spend your money and how you manage it will be fruitful and towards your own personal goals. In addition to that, a financial action plan helps you figure out how you can manage and save up your money but as you make the action plan, remember to write down the goals you want to achieve, and the strategies that will help you achieve.

How to Make a Financial Action Plan

Your financial problems will be resolved when you make your financial action plan. You may ask how and this will show you as it will also depend on how you make it. Since your financial action plan is going to be the tool that helps you manage your financial problems and turn them into something more productive, here are some steps to show you on how to make a good financial action plan.

1. Write Down Your Personal Information

Writing down your personal information will also include your contact details, your financial status and of course the taxes that you have. The purpose for this is to make an outline for your action plan. To find a better strategy to help you out. To get to that, everything about you must be written first.

2. Add Your Financial Goals for the Action Plan

What is your goal or what is your end goal when you write your action plan? Of course the end goal will be to know how to save, how to manage and how to spend your finances correctly. Goals may differ, but the general kind is to plan how to deal with your money. When you think of this as your goal, moving along, you will also have to think about the objectives. What your objectives will be, will also define your goal.

3. Add a Timeframe for Your Financial Plan

Adding a timeframe will help you stick to your planning. It is not impossible to reach a certain time frame and a certain amount of financial help. Of course when you make your timeframe, it should also be possible. Possible enough for you to do it. This is your timeframe, this timeframe is made for you, and not for everyone else. So when you write it down, write it in an honest way on how long you can stick to it. Avoid making yourself a timeframe that does not suit you.

4. Stick To Your Goal as Much as Possible

It is understandable that setting up a financial plan and a financial goal can be difficult. Sticking to a timeframe can also sound like a challenge. But if you are meticulous enough and disciplined enough to follow through your financial action plan, everything will be worth it. So stick to the timeframe and your goal as much as possible. You will see results in no time.

FAQs

What is a financial action plan?

A financial action plan is a kind of action plan that helps cater to your financial needs.

Why is a financial action plan important?

When you are having difficulties with your finances, making the action plan actually helps you. It serves as a guide for what you can do before you do it.

How do you make a financial action plan?

Download any of the templates above, edit them. Stick to your action plan as much as possible.

It is a known fact that money can sometimes be a difficult thing to save, but easy to spend. This often leads to a lot of credit card issues, a lot of budgets going wrong and of course financial issues along the way. To avoid any of this from happening to you, you must know how to save, budget and of course manage your finances. For that, you will need to make a financial action plan.

![10+ Financial Action Plan Examples [ Company, Employee, Business ]](https://images.examples.com/wp-content/uploads/2021/06/10-Financial-Action-Plan-Examples-Company-Employee-Business-.jpg)