T Account Examples

A T Account is a fundamental tool in accounting used to visualize the effects of transactions on individual accounts. Shaped like the letter “T,” it has two sides: the left side for debits and the right side for credits. Each transaction is recorded in the T Account to ensure the accounting equation remains balanced. By clearly showing debits and credits, T Accounts help accountants track and manage financial data efficiently, making them essential for accurate financial reporting and analysis.

What are T Accounts?

T Accounts are visual representations used in accounting to track transactions. Each T Account has two sides: the left side for debits and the right side for credits. They help in recording and balancing financial data, ensuring accuracy in financial reporting and analysis.

T Account Examples

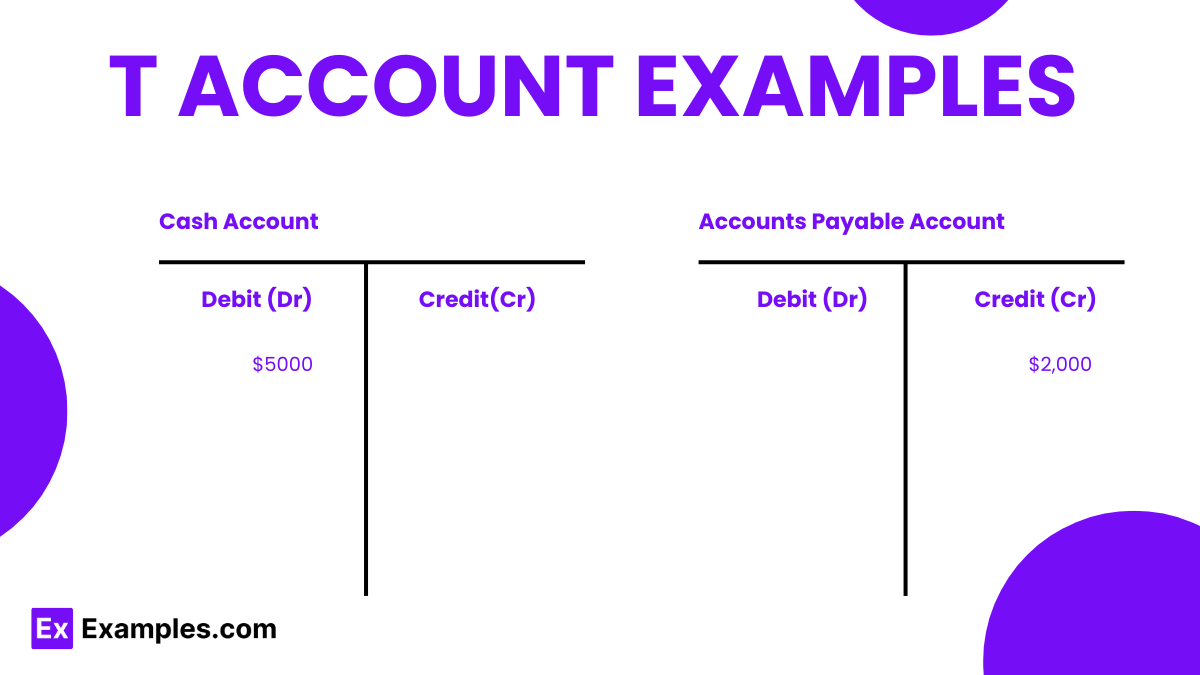

Example 1: Cash Account

Transaction: A business receives $5,000 in cash.

Cash Account T Account:

| Debit | Credit |

|---|---|

| $5,000 |

Example 2: Accounts Payable

Transaction: A business purchases supplies worth $2,000 on credit.

Accounts Payable T Account:

| Debit | Credit |

|---|---|

| $2,000 |

Example 3: Revenue

Transaction: A business earns $3,000 in revenue.

Revenue T Account:

| Debit | Credit |

|---|---|

| $3,000 |

Example 4: Expense

Transaction: A business pays $1,500 in rent.

Rent Expense T Account:

| Debit | Credit |

|---|---|

| $1,500 |

Example 5: Accounts Receivable

Transaction: A business sells goods worth $4,000 on credit.

Accounts Receivable T Account:

| Debit | Credit |

|---|---|

| $4,000 |

T Accounts and Trial Balance

- Record Transactions in T Accounts: Enter each transaction’s debits and credits in the corresponding T Accounts, a fundamental in finance.

- Sum Debits and Credits: Total the debits and credits for each T Account.

- Calculate Account Balances: Subtract total credits from total debits, including any voided check amounts, to determine each account’s balance.

- List Account Balances: Prepare a list of all account balances.

- Prepare Trial Balance: Ensure total debits equal total credits to verify the accuracy of the accounts.

How to Make a T Account

- Draw a T Shape: Draw a large T on your paper or spreadsheet.

- Label the Account Title: Write the account name at the top of the T.

- Label Debit and Credit Sides: Write “Debit” on the left side and “Credit” on the right side of the T.

- Record Transactions: Enter each transaction on the appropriate side (debit or credit) based on the account type.

- Sum Each Side: Add up the amounts on both the debit and credit sides.

- Determine the Balance: Subtract the smaller total from the larger to find the account balance.

How do you set up a T account in a ledger?

- Create Ledger Pages: Assign a separate page or section in your ledger for each account.

- Draw a T Shape: Draw a large T on each ledger page or section designated for an account.

- Write the Account Title: At the top of the T, write the name of the account (e.g., Cash, Accounts Payable).

- Label Debit and Credit Columns: Label the left column as “Debit” and the right column as “Credit.”

- Enter Transaction Dates:In the ledger, record the date of each transaction in the leftmost column to maintain an accurate operating budget.

- Record Transaction Amounts: Enter the transaction amounts in the appropriate debit or credit column, noting the corresponding details for each transaction.

Example

Ledger Page for Cash Account

| Cash Account | ||

|---|---|---|

| Date | Debit | Credit |

| Jan 1 | $5,000 | |

| Jan 3 | $1,200 | |

| Jan 5 | $800 | |

| Jan 7 | $500 |

Why Do Accountants Use T Accounts?

- Visual Clarity: T Accounts provide a clear visual representation of transactions, making it easier to see debits and credits.

- Organize Transactions: They help organize transactions by separating them into debits and credits for each account.

- Ensure Accuracy: T Accounts help ensure that the accounting equation (Assets = Liabilities + Equity) remains balanced.

- Simplify Recording: They simplify the recording process, making it easier to track and manage financial data.

- Identify Errors: Using T Accounts helps identify and correct errors in the ledger by clearly showing discrepancies.

- Facilitate Analysis: They make it easier to analyze account balances and transaction effects, aiding in financial decision-making.

- Prepare Financial Statements: T Accounts serve as a foundation for preparing accurate financial statements by summarizing account balances.

T-account for Accounts Payable

| Accounts Payable |

|---|

| Debit |

| Payment to Supplier |

| Payment to Vendor |

| Total Debit |

T-account for Accounts Receivable

| Accounts Receivable |

|---|

| Debit |

| Sale on Credit |

| Service Rendered |

| Sale on Credit |

| Total Debit |

How to balance a T Account?

- Record Transactions: Enter all transactions into the T Account, listing debits on the left side and credits on the right side.

- Sum the Debit Side: Add up all the amounts listed on the debit side of the T Account.

- Sum the Credit Side: Add up all the amounts listed on the credit side of the T Account.

- Compare Totals: Compare the total amounts from the debit and credit sides.

- Calculate the Difference: Subtract the smaller total from the larger total to find the balance.

- Enter the Balance: Write the balance on the side with the smaller total to make both sides equal.

- Double-Check: Ensure that the sum of debits equals the sum of credits after entering the balance.

Debits and Credits for T Accounts

- Identify Account Type: Determine the type of account (asset, liability, equity, revenue, or expense).

- Apply Debit and Credit Rules:

- Assets and Expenses: Increase with debits, decrease with credits.

- Liabilities, Equity, and Revenue: Increase with credits, decrease with debits.

- Record Debit Entries:For increases in asset and expense accounts, or decreases in liability, equity, and revenue accounts, enter amounts on the left side (debit side) of the T Account, such as recording a deposit receipt.

- Record Credit Entries: For increases in liability, equity, and revenue accounts, or decreases in asset and expense accounts, enter amounts on the right side (credit side).

- Balance the Account: Ensure the total debits equal the total credits by summing both sides and calculating the balance if needed.

T Account Ledger

| Date | Account | Debit | Credit | Description |

|---|---|---|---|---|

| Jan 1 | Cash | $5,000 | Initial investment | |

| Jan 3 | Accounts Payable | $2,000 | Purchase of supplies | |

| Jan 5 | Revenue | $3,000 | Service income | |

| Jan 7 | Rent Expense | $1,500 | Payment of rent | |

| Jan 10 | Accounts Receivable | $4,000 | Sales on credit | |

| Jan 12 | Cash | $800 | Payment to supplier | |

| Jan 15 | Cash | $500 | Miscellaneous expenses |

T-Account Balance Sheet

| Account | Debit | Credit |

|---|---|---|

| Assets | ||

| Cash | $5,000 | $1,300 |

| Accounts Receivable | $4,000 | |

| Equipment | $7,500 | |

| Total Assets | $16,500 | $1,300 |

| Liabilities | ||

| Accounts Payable | $2,000 | |

| Notes Payable | $5,000 | |

| Total Liabilities | $7,000 |

Advantages of T Accounts

- Visual Clarity: T Accounts provide a clear and straightforward visual representation of transactions, making it easy to see debits and credits.

- Simplified Tracking: They simplify tracking financial transactions by separating them into debits and credits, which helps in maintaining organized records.

- Error Detection: Using T Accounts helps in quickly identifying and correcting errors, as discrepancies between debits and credits are easily noticeable.

- Balance Verification: They assist in ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced by clearly showing the total debits and credits.

- Facilitates Learning: T Accounts are an excellent educational tool for beginners in accounting, helping them understand the double-entry system.

- Efficient Analysis: They make it easier to analyze the effects of transactions on individual accounts, aiding in financial decision-making and reporting.

- Preparation of Financial Statements: T Accounts serve as a foundation for preparing accurate financial statements by summarizing account balances systematically.

Disadvantages of T accounts

- Limited Complexity: T Accounts can become cumbersome and hard to manage with complex transactions and numerous accounts.

- Manual Errors: Recording transactions manually in T Accounts increases the risk of human errors.

- Time-Consuming: Creating and balancing T Accounts manually can be time-consuming, especially for large volumes of transactions.

- Lack of Automation: T Accounts do not integrate with automated accounting systems, making them less efficient for modern accounting practices.

- Not Scalable: They are not ideal for large businesses with extensive accounting needs due to their simplicity.

- No Real-Time Data: T Accounts do not provide real-time financial data, hindering timely decision-making.

Why is it called a T Account?

Because it resembles the shape of the letter “T.”

What are the two sides of a T Account?

The left side is for debits, and the right side is for credits.

What is the purpose of a T Account?

To organize and simplify the recording of transactions.

How do you increase an asset account?

By recording the amount on the debit side.

How do you increase a liability account?

By recording the amount on the credit side.

How do you decrease an expense account?

By recording the amount on the credit side.

What goes on the debit side of a revenue account?

Decreases in revenue are recorded on the debit side.

What goes on the credit side of an expense account?

Decreases in expenses are recorded on the credit side.

How do you balance a T Account?

By ensuring the total debits equal the total credits.

Can T Accounts be used for all types of accounts?

Yes, T Accounts can be used for assets, liabilities, equity, revenue, and expenses.