15+ Journal Entry Examples

A journal entry is a personal record of experiences, thoughts, and reflections, written regularly in a journal or diary. It serves as a private space for self-expression and personal growth. Journal entries can vary in detail, capturing significant events or everyday musings. Different types of journal writing include visual communication journals, which use drawings and visuals, and bullet journals, which organize thoughts and tasks with bullet points.

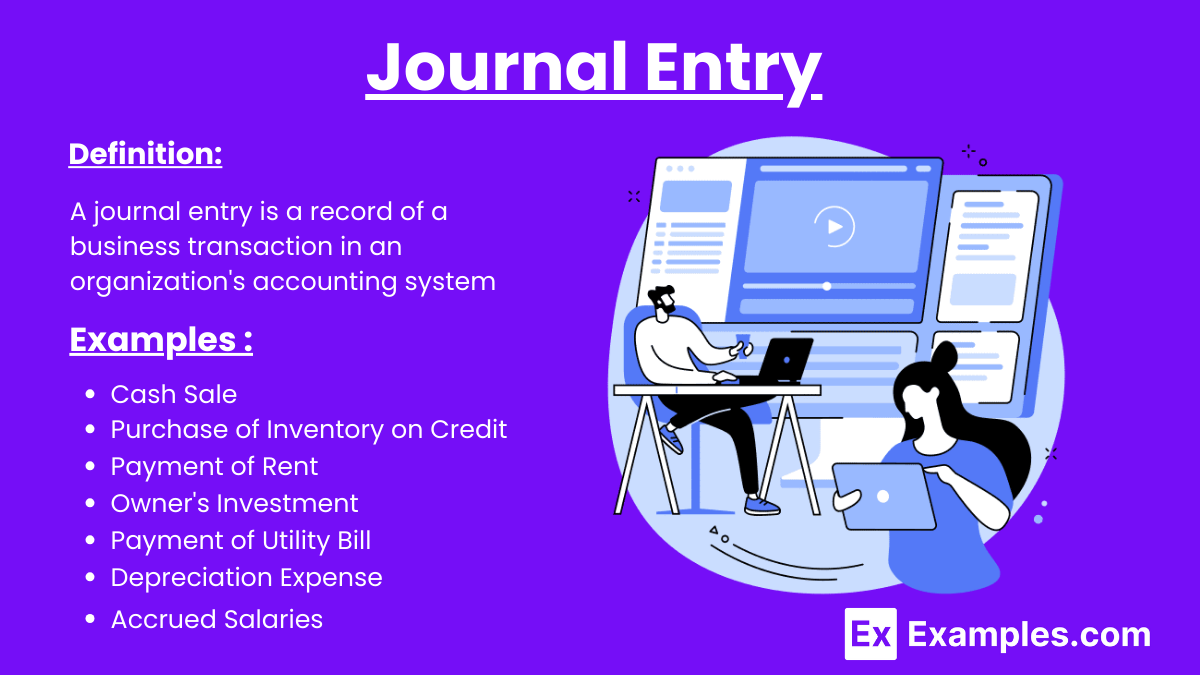

What is Journal Entry

A journal entry is a record of a business transaction in an organization’s accounting system. It involves the documentation of the financial activities of the business, capturing the details of each transaction, including the date, amounts debited and credited, a brief description, and the accounts affected. Each entry ensures the accounting equation (Assets = Liabilities + Equity) remains balanced.

Format of a Journal Entry

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| MM/DD/YYYY | [Account Name] | $X.XX | |

| [Account Name] | $X.XX | ||

| [Brief Description] |

Example :

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 500.00 | |

| Sales Revenue | 500.00 | ||

| Sale of goods |

Examples of Journal Entry

1. Cash Sale:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 1,000 | |

| Sales Revenue | 1,000 | ||

| Sale of goods |

2. Purchase of Inventory on Credit:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Inventory | 5,000 | |

| Accounts Payable | 5,000 | ||

| Purchase of inventory |

3. Payment of Rent:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Rent Expense | 2,000 | |

| Cash | 2,000 | ||

| Payment of monthly rent |

4. Owner’s Investment:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 10,000 | |

| Owner’s Equity | 10,000 | ||

| Owner’s initial investment |

5. Payment of Utility Bill:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Utilities Expense | 300 | |

| Cash | 300 | ||

| Payment of utility bill |

6. Depreciation Expense:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Depreciation Expense | 500 | |

| Accumulated Depreciation | 500 | ||

| Recording monthly depreciation |

7. Accrued Salaries:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Salaries Expense | 3,000 | |

| Salaries Payable | 3,000 | ||

| Salaries accrued for June |

8. Interest Income:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 200 | |

| Interest Income | 200 | ||

| Interest received |

9. Insurance Expense:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Insurance Expense | 1,200 | |

| Prepaid Insurance | 1,200 | ||

| Amortization of prepaid insurance |

10. Equipment Purchase:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Equipment | 7,500 | |

| Cash | 7,500 | ||

| Purchase of new equipment |

Journal Entry Examples for Students

1. Cash Received from Parents for Allowance:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 50 | |

| Allowance Income | 50 | ||

| Weekly allowance from parents |

2. Purchase of School Supplies:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | School Supplies | 30 | |

| Cash | 30 | ||

| Buying notebooks and pens |

3. Lunch Expense at School:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Lunch Expense | 10 | |

| Cash | 10 | ||

| Payment for school lunch |

4. Part-Time Job Earnings:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 100 | |

| Part-Time Job Income | 100 | ||

| Weekly earnings from job |

5. Paying for a Bus Pass:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Transportation Expense | 20 | |

| Cash | 20 | ||

| Payment for monthly bus pass |

6. Saving Money in a Bank Account:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Bank Account | 100 | |

| Cash | 100 | ||

| Saving allowance in bank |

7. Buying a Textbook:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Textbooks | 60 | |

| Cash | 60 | ||

| Purchase of a math textbook |

8. Receiving Scholarship Money:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 500 | |

| Scholarship Income | 500 | ||

| Scholarship for tuition |

9. Paying for Online Course Subscription:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Education Expense | 30 | |

| Cash | 30 | ||

| Subscription to online course |

10. Receiving Gift Money for Birthday:

| Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

| 06/26/2024 | Cash | 75 | |

| Gift Income | 75 | ||

| Birthday gift money |

Journal Entry Questions with Answers

1. What was the highlight of your day and why?

- Answer: The highlight of my day was getting an A on my math test. I’ve been struggling with algebra, so I put in a lot of extra study time. Seeing that grade made all the hard work feel worth it and gave me confidence that I can tackle challenging subjects.

2. Describe a moment when you felt proud of yourself today.

- Answer: I felt proud of myself when I helped a classmate understand a difficult concept in our biology class. She was having trouble with the material, and I was able to explain it in a way that made sense to her. It felt good to be able to assist and see her relief and understanding.

3. What is something new you learned today?

- Answer: Today, I learned about the process of photosynthesis in my science class. It’s fascinating how plants convert sunlight into energy. I never realized how complex and essential this process is for life on Earth. I’m excited to learn more about plant biology.

4. How did you handle a challenging situation today?

Answer: I faced a challenging situation during our group project in history class. We had a disagreement about how to present our information. Instead of getting frustrated, I suggested we take a vote and then split the tasks based on our strengths. This helped us move forward and work more efficiently.

5. What are you looking forward to tomorrow?

- Answer: Tomorrow, I’m looking forward to our school’s annual talent show. I’ve been practicing a dance routine with my friends for weeks, and I can’t wait to perform it on stage. I’m a little nervous, but mostly excited to showcase our hard work and have fun with my classmates.

Journal Entry in Accounting

A journal entry in accounting is a fundamental component of the double-entry bookkeeping system, used to record business transactions in an organization’s financial records. Each journal entry must include the date of the transaction, the accounts affected, the amounts to be debited and credited, and a brief description of the transaction. The format ensures that for every debit, there is an equal and corresponding credit, maintaining the balance in the accounting equation (Assets = Liabilities + Equity). This meticulous recording process helps in tracking financial activities accurately and provides a clear audit trail.

Journal entries are first recorded in the general journal, a chronological log of all transactions, before being posted to the general ledger where transactions are categorized by account. This process is crucial for preparing accurate financial statements, which reflect the company’s financial position and performance. Adjusting journal entries are also made at the end of accounting periods to allocate income and expenses to the correct periods, ensuring that the financial statements comply with the accrual basis of accounting. Thus, journal entries serve as the backbone of a robust accounting system, enabling precise financial tracking and reporting.

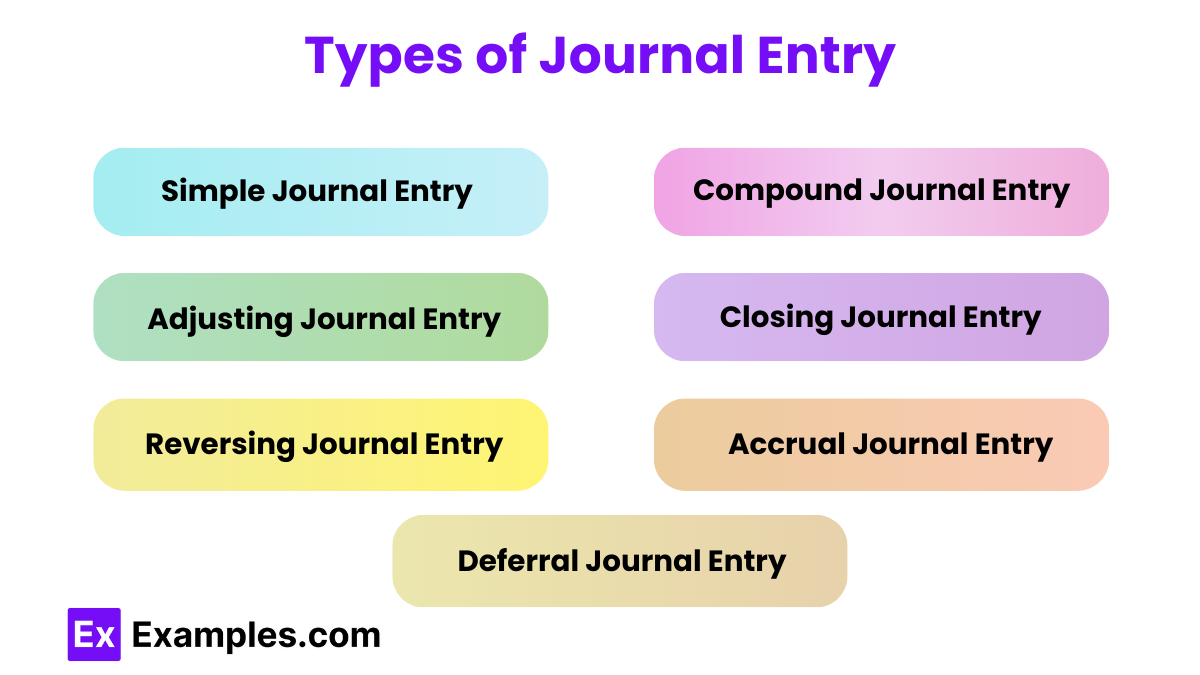

Types of Journal Entry

- Simple Journal Entry:A simple journal entry involves only two accounts – one debit and one credit. It is straightforward and easy to record, typically used for basic transactions.Example:

- Debit: Cash

- Credit: Sales Revenue

- Compound Journal Entry:A compound journal entry involves more than two accounts. It includes multiple debits, multiple credits, or both, in a single entry. This type is used for transactions that affect several accounts simultaneously.Example:

- Debit: Cash

- Debit: Accounts Receivable

- Credit: Sales Revenue

- Adjusting Journal Entry:Adjusting journal entries are made at the end of an accounting period to update account balances before preparing financial statements. They ensure that revenues and expenses are recorded in the correct accounting period, adhering to the accrual basis of accounting.Example:

- Debit: Depreciation Expense

- Credit: Accumulated Depreciation

- Closing Journal Entry:Closing journal entries are made at the end of an accounting period to transfer the balances of temporary accounts (revenues, expenses, and dividends) to permanent accounts (retained earnings). This process resets the temporary accounts to zero for the next accounting period.Example:

- Debit: Revenue

- Credit: Income Summary

- Debit: Income Summary

- Credit: Expenses

- Reversing Journal Entry:Reversing journal entries are made at the beginning of a new accounting period to reverse certain adjusting entries made at the end of the previous period. This simplifies the recording of transactions in the new period and avoids double-counting.Example:

- Debit: Salaries Payable

- Credit: Salaries Expense

- Accrual Journal Entry:Accrual journal entries are used to record revenues and expenses that have been earned or incurred but not yet recorded in the accounts. These entries are essential for the accrual basis of accounting.Example:

- Debit: Accounts Receivable

- Credit: Service Revenue

- Deferral Journal Entry:Deferral journal entries are used to record the postponement of recognition of revenues or expenses that have been received or paid but not yet earned or incurred. They are the opposite of accrual entries.Example:

- Debit: Prepaid Insurance

- Credit: Cash

Purpose of a Journal Entry

Journal entries serve various purposes, each offering significant benefits for both personal and academic growth. Whether you are a student, educator, or a professional, maintaining a journal can enhance your writing skills, encourage self-reflection, and provide a structured way to track progress and thoughts.

Self-Reflection and Personal Growth

One of the primary purposes of a journal entry is to foster self-reflection. By writing regularly, you can gain deeper insights into your thoughts, emotions, and behaviors. This practice helps you:

- Understand personal experiences: Reflecting on daily events can help you understand your reactions and emotions.

- Set and achieve goals: Writing down your goals and tracking your progress can increase motivation and accountability.

- Identify patterns: Recognizing recurring themes in your entries can highlight areas for personal growth or concern.

Academic Improvement

For students, journal entries can significantly enhance academic performance. They provide a platform to:

- Improve writing skills: Regular writing practice helps improve vocabulary, grammar, and overall writing fluency.

- Enhance critical thinking: Analyzing and reflecting on academic content or personal experiences fosters critical thinking skills.

- Record learning progress: Journals allow students to track their learning journey, making it easier to review and reflect on past lessons.

Emotional Expression

Journaling is an excellent outlet for expressing emotions. This can be particularly beneficial for:

- Stress relief: Writing about stressful experiences can be a therapeutic way to manage stress and anxiety.

- Emotional clarity: Journaling helps in organizing and clarifying thoughts and feelings, leading to better emotional understanding.

- Mental health: Regular journaling has been shown to improve mental health by providing a safe space to explore and express emotions.

Professional Development

In a professional context, journal entries can aid in career growth and development. They help professionals:

- Reflect on work experiences: Analyzing daily work experiences can lead to better job performance and satisfaction.

- Track professional achievements: Documenting successes and challenges provides a record of professional growth and accomplishments.

- Plan and strategize: Writing down ideas and strategies can improve planning and decision-making processes.

Creativity and Idea Generation

Journals are a fertile ground for creativity. They enable individuals to:

- Brainstorm ideas: Writing freely can lead to the generation of new and innovative ideas.

- Develop creative projects: Keeping track of creative thoughts and project plans helps in developing and executing creative endeavors.

- Explore new perspectives: Reflecting on different topics can lead to a broader and more diverse understanding of the world.

Journal Entry Rules

Creating effective journal entries involves following some essential rules. These guidelines will help you maximize the benefits of journaling and maintain a structured, meaningful record.

- Write Regularly

- Aim to write daily or on a consistent schedule.

- Establish a routine to make journaling a habit.

- Be Honest and Authentic

- Write truthfully about your thoughts and feelings.

- Avoid censoring yourself; authenticity is key.

- Keep It Private

- Ensure your journal is a safe space for personal expression.

- Store it securely to maintain privacy.

- Use a Comfortable Format

- Choose a format that suits you, whether digital or physical.

- Select a journal or platform that feels comfortable and inviting.

- Date Every Entry

- Start each entry with the date for easy reference.

- Helps track progress and reflect on past entries.

- Be Specific and Detailed

- Include details to provide context and depth.

- Describe events, emotions, and thoughts thoroughly.

- Reflect and Analyze

- Take time to reflect on your entries.

- Analyze patterns, behaviors, and insights.

- Stay Organized

- Use headings, bullet points, or numbered lists to structure your writing.

- Keep entries clear and easy to read.

- Avoid Judgment

- Write without judging your thoughts or feelings.

- Embrace the process of self-expression and exploration.

- Be Consistent but Flexible

- Stick to your routine, but allow flexibility if needed.

- Adjust your approach as your needs and preferences evolve.

FAQ’s

What are the main components of a journal entry?

A journal entry includes the date, accounts involved, debit and credit amounts, and a brief description of the transaction.

How do you format a journal entry?

List the date, debit account(s) with amounts, then credit account(s) with amounts, followed by a brief description of the transaction.

What is a debit in a journal entry?

A debit increases assets or expenses and decreases liabilities, equity, or revenue in the accounts.

What is a credit in a journal entry?

A credit increases liabilities, equity, or revenue and decreases assets or expenses in the accounts.

What is double-entry bookkeeping?

A system where each transaction affects at least two accounts, with debits equaling credits, ensuring balanced accounts.

What is a compound journal entry?

A compound journal entry involves more than two accounts, with multiple debits and/or credits in one entry.

When is a journal entry made?

A journal entry is made at the time of the transaction or at the end of an accounting period for adjustments.

How are journal entries posted to the ledger?

Entries are transferred from the journal to individual accounts in the general ledger, maintaining the chronological order.

What is an adjusting journal entry?

Adjusting entries are made at the end of an accounting period to allocate income and expenses to the correct period.

What errors can occur in journal entries?

Common errors include incorrect amounts, wrong accounts, omission of entries, or misclassification of debits and credits.

15+ Journal Entry Examples

A journal entry is a personal record of experiences, thoughts, and reflections, written regularly in a journal or diary. It serves as a private space for self-expression and personal growth. Journal entries can vary in detail, capturing significant events or everyday musings. Different types of journal writing include visual communication journals, which use drawings and visuals, and bullet journals, which organize thoughts and tasks with bullet points.

What is Journal Entry

A journal entry is a record of a business transaction in an organization’s accounting system. It involves the documentation of the financial activities of the business, capturing the details of each transaction, including the date, amounts debited and credited, a brief description, and the accounts affected. Each entry ensures the accounting equation (Assets = Liabilities + Equity) remains balanced.

Format of a Journal Entry

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

MM/DD/YYYY | [Account Name] | $X.XX | |

[Account Name] | $X.XX | ||

[Brief Description] |

Example :

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 500.00 | |

Sales Revenue | 500.00 | ||

Sale of goods |

Examples of Journal Entry

1. Cash Sale:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 1,000 | |

Sales Revenue | 1,000 | ||

Sale of goods |

2. Purchase of Inventory on Credit:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Inventory | 5,000 | |

Accounts Payable | 5,000 | ||

Purchase of inventory |

3. Payment of Rent:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Rent Expense | 2,000 | |

Cash | 2,000 | ||

Payment of monthly rent |

4. Owner’s Investment:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 10,000 | |

Owner’s Equity | 10,000 | ||

Owner’s initial investment |

5. Payment of Utility Bill:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Utilities Expense | 300 | |

Cash | 300 | ||

Payment of utility bill |

6. Depreciation Expense:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Depreciation Expense | 500 | |

Accumulated Depreciation | 500 | ||

Recording monthly depreciation |

7. Accrued Salaries:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Salaries Expense | 3,000 | |

Salaries Payable | 3,000 | ||

Salaries accrued for June |

8. Interest Income:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 200 | |

Interest Income | 200 | ||

Interest received |

9. Insurance Expense:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Insurance Expense | 1,200 | |

Prepaid Insurance | 1,200 | ||

Amortization of prepaid insurance |

10. Equipment Purchase:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Equipment | 7,500 | |

Cash | 7,500 | ||

Purchase of new equipment |

Journal Entry Examples for Students

1. Cash Received from Parents for Allowance:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 50 | |

Allowance Income | 50 | ||

Weekly allowance from parents |

2. Purchase of School Supplies:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | School Supplies | 30 | |

Cash | 30 | ||

Buying notebooks and pens |

3. Lunch Expense at School:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Lunch Expense | 10 | |

Cash | 10 | ||

Payment for school lunch |

4. Part-Time Job Earnings:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 100 | |

Part-Time Job Income | 100 | ||

Weekly earnings from job |

5. Paying for a Bus Pass:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Transportation Expense | 20 | |

Cash | 20 | ||

Payment for monthly bus pass |

6. Saving Money in a Bank Account:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Bank Account | 100 | |

Cash | 100 | ||

Saving allowance in bank |

7. Buying a Textbook:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Textbooks | 60 | |

Cash | 60 | ||

Purchase of a math textbook |

8. Receiving Scholarship Money:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 500 | |

Scholarship Income | 500 | ||

Scholarship for tuition |

9. Paying for Online Course Subscription:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Education Expense | 30 | |

Cash | 30 | ||

Subscription to online course |

10. Receiving Gift Money for Birthday:

Date | Account Titles and Explanation | Debit | Credit |

|---|---|---|---|

06/26/2024 | Cash | 75 | |

Gift Income | 75 | ||

Birthday gift money |

Journal Entry Questions with Answers

1. What was the highlight of your day and why?

Answer: The highlight of my day was getting an A on my math test. I’ve been struggling with algebra, so I put in a lot of extra study time. Seeing that grade made all the hard work feel worth it and gave me confidence that I can tackle challenging subjects.

2. Describe a moment when you felt proud of yourself today.

Answer: I felt proud of myself when I helped a classmate understand a difficult concept in our biology class. She was having trouble with the material, and I was able to explain it in a way that made sense to her. It felt good to be able to assist and see her relief and understanding.

3. What is something new you learned today?

Answer: Today, I learned about the process of photosynthesis in my science class. It’s fascinating how plants convert sunlight into energy. I never realized how complex and essential this process is for life on Earth. I’m excited to learn more about plant biology.

4. How did you handle a challenging situation today?

Answer: I faced a challenging situation during our group project in history class. We had a disagreement about how to present our information. Instead of getting frustrated, I suggested we take a vote and then split the tasks based on our strengths. This helped us move forward and work more efficiently.

5. What are you looking forward to tomorrow?

Answer: Tomorrow, I’m looking forward to our school’s annual talent show. I’ve been practicing a dance routine with my friends for weeks, and I can’t wait to perform it on stage. I’m a little nervous, but mostly excited to showcase our hard work and have fun with my classmates.

Journal Entry in Accounting

A journal entry in accounting is a fundamental component of the double-entry bookkeeping system, used to record business transactions in an organization’s financial records. Each journal entry must include the date of the transaction, the accounts affected, the amounts to be debited and credited, and a brief description of the transaction. The format ensures that for every debit, there is an equal and corresponding credit, maintaining the balance in the accounting equation (Assets = Liabilities + Equity). This meticulous recording process helps in tracking financial activities accurately and provides a clear audit trail.

Journal entries are first recorded in the general journal, a chronological log of all transactions, before being posted to the general ledger where transactions are categorized by account. This process is crucial for preparing accurate financial statements, which reflect the company’s financial position and performance. Adjusting journal entries are also made at the end of accounting periods to allocate income and expenses to the correct periods, ensuring that the financial statements comply with the accrual basis of accounting. Thus, journal entries serve as the backbone of a robust accounting system, enabling precise financial tracking and reporting.

Types of Journal Entry

Simple Journal Entry:A simple journal entry involves only two accounts – one debit and one credit. It is straightforward and easy to record, typically used for basic transactions.Example:

Debit: Cash

Credit: Sales Revenue

Compound Journal Entry:A compound journal entry involves more than two accounts. It includes multiple debits, multiple credits, or both, in a single entry. This type is used for transactions that affect several accounts simultaneously.Example:

Debit: Cash

Debit: Accounts Receivable

Credit: Sales Revenue

Adjusting Journal Entry:Adjusting journal entries are made at the end of an accounting period to update account balances before preparing financial statements. They ensure that revenues and expenses are recorded in the correct accounting period, adhering to the accrual basis of accounting.Example:

Debit: Depreciation Expense

Credit: Accumulated Depreciation

Closing Journal Entry:Closing journal entries are made at the end of an accounting period to transfer the balances of temporary accounts (revenues, expenses, and dividends) to permanent accounts (retained earnings). This process resets the temporary accounts to zero for the next accounting period.Example:

Debit: Revenue

Credit: Income Summary

Debit: Income Summary

Credit: Expenses

Reversing Journal Entry:Reversing journal entries are made at the beginning of a new accounting period to reverse certain adjusting entries made at the end of the previous period. This simplifies the recording of transactions in the new period and avoids double-counting.Example:

Debit: Salaries Payable

Credit: Salaries Expense

Accrual Journal Entry:Accrual journal entries are used to record revenues and expenses that have been earned or incurred but not yet recorded in the accounts. These entries are essential for the accrual basis of accounting.Example:

Debit: Accounts Receivable

Credit: Service Revenue

Deferral Journal Entry:Deferral journal entries are used to record the postponement of recognition of revenues or expenses that have been received or paid but not yet earned or incurred. They are the opposite of accrual entries.Example:

Debit: Prepaid Insurance

Credit: Cash

Purpose of a Journal Entry

Journal entries serve various purposes, each offering significant benefits for both personal and academic growth. Whether you are a student, educator, or a professional, maintaining a journal can enhance your writing skills, encourage self-reflection, and provide a structured way to track progress and thoughts.

Self-Reflection and Personal Growth

One of the primary purposes of a journal entry is to foster self-reflection. By writing regularly, you can gain deeper insights into your thoughts, emotions, and behaviors. This practice helps you:

Understand personal experiences: Reflecting on daily events can help you understand your reactions and emotions.

Set and achieve goals: Writing down your goals and tracking your progress can increase motivation and accountability.

Identify patterns: Recognizing recurring themes in your entries can highlight areas for personal growth or concern.

Academic Improvement

For students, journal entries can significantly enhance academic performance. They provide a platform to:

Improve writing skills: Regular writing practice helps improve vocabulary, grammar, and overall writing fluency.

Enhance critical thinking: Analyzing and reflecting on academic content or personal experiences fosters critical thinking skills.

Record learning progress: Journals allow students to track their learning journey, making it easier to review and reflect on past lessons.

Emotional Expression

Journaling is an excellent outlet for expressing emotions. This can be particularly beneficial for:

Stress relief: Writing about stressful experiences can be a therapeutic way to manage stress and anxiety.

Emotional clarity: Journaling helps in organizing and clarifying thoughts and feelings, leading to better emotional understanding.

Mental health: Regular journaling has been shown to improve mental health by providing a safe space to explore and express emotions.

Professional Development

In a professional context, journal entries can aid in career growth and development. They help professionals:

Reflect on work experiences: Analyzing daily work experiences can lead to better job performance and satisfaction.

Track professional achievements: Documenting successes and challenges provides a record of professional growth and accomplishments.

Plan and strategize: Writing down ideas and strategies can improve planning and decision-making processes.

Creativity and Idea Generation

Journals are a fertile ground for creativity. They enable individuals to:

Brainstorm ideas: Writing freely can lead to the generation of new and innovative ideas.

Develop creative projects: Keeping track of creative thoughts and project plans helps in developing and executing creative endeavors.

Explore new perspectives: Reflecting on different topics can lead to a broader and more diverse understanding of the world.

Journal Entry Rules

Creating effective journal entries involves following some essential rules. These guidelines will help you maximize the benefits of journaling and maintain a structured, meaningful record.

Write Regularly

Aim to write daily or on a consistent schedule.

Establish a routine to make journaling a habit.

Be Honest and Authentic

Write truthfully about your thoughts and feelings.

Avoid censoring yourself; authenticity is key.

Keep It Private

Ensure your journal is a safe space for personal expression.

Store it securely to maintain privacy.

Use a Comfortable Format

Choose a format that suits you, whether digital or physical.

Select a journal or platform that feels comfortable and inviting.

Date Every Entry

Start each entry with the date for easy reference.

Helps track progress and reflect on past entries.

Be Specific and Detailed

Include details to provide context and depth.

Describe events, emotions, and thoughts thoroughly.

Reflect and Analyze

Take time to reflect on your entries.

Analyze patterns, behaviors, and insights.

Stay Organized

Use headings, bullet points, or numbered lists to structure your writing.

Keep entries clear and easy to read.

Avoid Judgment

Write without judging your thoughts or feelings.

Embrace the process of self-expression and exploration.

Be Consistent but Flexible

Stick to your routine, but allow flexibility if needed.

Adjust your approach as your needs and preferences evolve.

FAQ’s

What are the main components of a journal entry?

A journal entry includes the date, accounts involved, debit and credit amounts, and a brief description of the transaction.

How do you format a journal entry?

List the date, debit account(s) with amounts, then credit account(s) with amounts, followed by a brief description of the transaction.

What is a debit in a journal entry?

A debit increases assets or expenses and decreases liabilities, equity, or revenue in the accounts.

What is a credit in a journal entry?

A credit increases liabilities, equity, or revenue and decreases assets or expenses in the accounts.

What is double-entry bookkeeping?

A system where each transaction affects at least two accounts, with debits equaling credits, ensuring balanced accounts.

What is a compound journal entry?

A compound journal entry involves more than two accounts, with multiple debits and/or credits in one entry.

When is a journal entry made?

A journal entry is made at the time of the transaction or at the end of an accounting period for adjustments.

How are journal entries posted to the ledger?

Entries are transferred from the journal to individual accounts in the general ledger, maintaining the chronological order.

What is an adjusting journal entry?

Adjusting entries are made at the end of an accounting period to allocate income and expenses to the correct period.

What errors can occur in journal entries?

Common errors include incorrect amounts, wrong accounts, omission of entries, or misclassification of debits and credits.