Preparing for the MBE Exam requires a solid grasp of mortgages and security devices, essential aspects of real property law. Understanding mortgage creation, enforcement, foreclosure processes, and rights of mortgagors and mortgagees is vital. This knowledge aids in navigating property transactions and creditor-debtor relationships, crucial for achieving a high MBE score.

Learning Objective

In studying "Mortgages and Security Devices" for the MBE Exam, you should aim to understand the legal framework surrounding mortgages, including the creation, transfer, and termination of mortgage interests. Analyze the distinctions between various security devices, such as deeds of trust, liens, and equitable mortgages. Evaluate the rights and obligations of both mortgagors and mortgagees, with attention to foreclosure processes, redemption rights, and deficiency judgments. Additionally, explore how statutory and judicial modifications influence mortgage law. Apply this knowledge to interpret real property scenarios, addressing common legal issues that arise in creditor-debtor relationships in MBE practice questions.

Overview of Mortgages

The Overview of Mortgages provides foundational knowledge about mortgages as a legal concept in real property law, primarily focusing on their purpose, types, and essential components.

Definition and Purpose

A mortgage is a legal agreement where a borrower (mortgagor) provides a lender (mortgagee) with a security interest in real property to secure a debt, typically a loan. The mortgage serves as collateral, ensuring that if the borrower defaults on their repayment obligations, the lender can foreclose on the property to recover the owed amount. Mortgages are fundamental in real estate transactions and financing, allowing borrowers to access significant funding to purchase or improve property while offering lenders a secured interest in the asset.

Types of Mortgages

There are two primary types of mortgage arrangements:

Traditional Mortgage: In this arrangement, the lender holds a lien on the property, which they can enforce through judicial foreclosure if the borrower defaults. The borrower retains legal title to the property and has possession until a foreclosure process occurs.

Deed of Trust: This is a common alternative to traditional mortgages, involving three parties—the borrower, lender, and a trustee. The trustee holds the title to the property in trust for the lender. In case of default, the trustee can initiate a non-judicial foreclosure, often a faster process than a judicial foreclosure.

Understanding these types helps identify the rights and procedures each entails, as well as their implications for both the borrower and the lender.

Essential Components

Mortgages typically contain several key elements:

Promissory Note: A document in which the borrower formally agrees to repay the loan under specified terms. It outlines the principal loan amount, interest rate, and repayment schedule.

Mortgage Document: This creates the lien on the property and outlines the lender's rights in case of default.

Interest Rate and Terms: Specifies the cost of borrowing and other payment terms, including fixed or variable interest rates and the term length.

Recording the Mortgage: Most jurisdictions require the mortgage to be recorded with a local government agency to provide public notice of the lender's interest, establishing priority over subsequent claims.

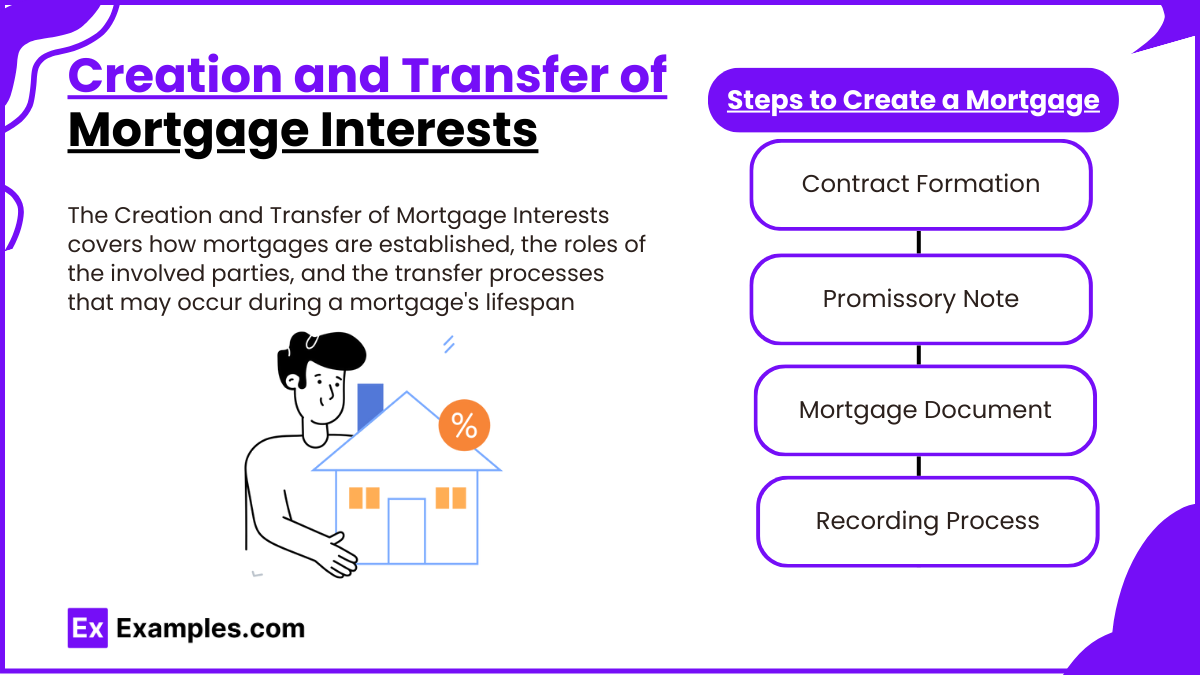

Creation and Transfer of Mortgage Interests

The Creation and Transfer of Mortgage Interests covers how mortgages are established, the roles of the involved parties, and the transfer processes that may occur during a mortgage's lifespan.

Steps to Create a Mortgage

Creating a mortgage involves a formal process where the borrower and lender enter a legal agreement to secure a loan with real property as collateral. This process includes:

Contract Formation: The borrower and lender agree on the loan terms, which include the principal amount, interest rate, repayment schedule, and consequences for default.

Promissory Note: The borrower signs a promissory note, committing to repay the loan under the agreed terms. This note represents the borrower’s personal liability.

Mortgage Document: The mortgage document establishes the lender’s security interest in the property, giving them the right to foreclose if the borrower defaults.

Recording Process: To protect the lender's interest, the mortgage is typically recorded with the local government. Recording provides public notice of the lender's claim on the property, establishing priority over subsequent liens or interests.

Parties Involved

Two primary parties are involved in a mortgage:

Mortgagor (Borrower): The individual or entity seeking the loan and pledging their property as collateral.

Mortgagee (Lender): The individual or entity providing the loan and holding a security interest in the property.

The mortgagee’s rights are contingent on the borrower meeting the terms set in the agreement. If the borrower defaults, the mortgagee can initiate foreclosure to recover the outstanding debt.

Transfer of Mortgage Interests

A mortgage can be transferred in several ways:

Assignment of Mortgage: The original lender (assignor) may transfer their interest in the mortgage to another party (assignee). This often occurs in the secondary mortgage market, where lenders sell mortgage loans to investors.

Assumption of Mortgage: When the borrower transfers ownership of the property, the new property owner may assume the mortgage, agreeing to take over the remaining debt and terms of the original mortgage. In an assumption, the original borrower may still retain some liability unless released by the lender.

Subject to Mortgage: If a property buyer takes the property "subject to" an existing mortgage, they take ownership without assuming personal liability for the debt. The original borrower remains responsible, but the lender can still foreclose on the property if payments cease.

Assignment and Assumption Implications

In both assignment and assumption scenarios, specific implications arise:

Assignment: When assigned, the new lender acquires all rights to collect payments and enforce the mortgage terms.

Assumption: If the mortgage is assumed, the new owner is liable for payments, potentially relieving the original borrower of responsibility, depending on lender approval.

Types of Security Devices

The Types of Security Devices are various legal mechanisms that secure a lender’s interest in real property. In mortgage law, these devices protect the lender’s ability to recover the loan amount if the borrower defaults.

1. Deeds of Trust

A deed of trust, also known as a trust deed, is a common alternative to a traditional mortgage. This arrangement involves three parties:

Trustor: The borrower, who pledges the property as collateral.

Beneficiary: The lender, who holds the beneficial interest.

Trustee: A neutral third party who holds the title to the property "in trust" for the lender until the loan is repaid.

If the borrower defaults, the trustee can initiate a non-judicial foreclosure on behalf of the lender, typically a faster and less costly process than a judicial foreclosure. This structure is common in states that allow non-judicial foreclosures, providing an expedited process for lenders to reclaim their security interest.

2. Equitable Mortgages

An equitable mortgage arises when an arrangement doesn’t meet all the formal requirements of a legal mortgage but still conveys a security interest. Courts may treat certain agreements, such as contracts for deed or unrecorded mortgages, as equitable mortgages based on the intent of the parties involved. For example, if a property owner transfers title to a lender as security for a loan without explicitly creating a mortgage, courts might enforce this arrangement as an equitable mortgage to protect the borrower’s rights and ensure equitable treatment.

Characteristics: Equitable mortgages rely on the intent to secure a debt rather than on formal mortgage documentation.

Foreclosure Rights: Courts can enforce foreclosure on equitable mortgages, allowing the lender to claim their interest even without a traditional mortgage structure.

3. Liens

Liens are legal claims or encumbrances on a property that secure the repayment of a debt. Unlike mortgages or deeds of trust, liens are typically statutory or judicial and can be imposed without the borrower’s consent. Types of liens include:

Mechanic’s Liens: Placed by contractors or suppliers for unpaid work on a property.

Judgment Liens: Imposed by a court following a judgment in favor of a creditor, allowing them to claim a debtor’s property to satisfy the debt.

Tax Liens: Created by government entities for unpaid property taxes or other tax obligations.

Each lien type may have different priority rules and foreclosure rights, often depending on the timing of the lien’s filing and state laws governing lien priority.

4. Land Sale Contracts (Contract for Deed)

Under a land sale contract, also known as a contract for deed, the buyer agrees to make payments directly to the seller over time, with the seller retaining legal title until the final payment is made. If the buyer defaults, the seller can reclaim the property without a traditional foreclosure. Land sale contracts are often treated similarly to mortgages, but courts may recognize unique rights for buyers, such as a right to cure default or limited redemption rights.

Characteristics: The buyer occupies the property, but legal title remains with the seller until full payment.

Default Rights: Sellers can often reclaim property more quickly than under a standard foreclosure process, although courts may provide equitable relief to buyers in cases of substantial payments.

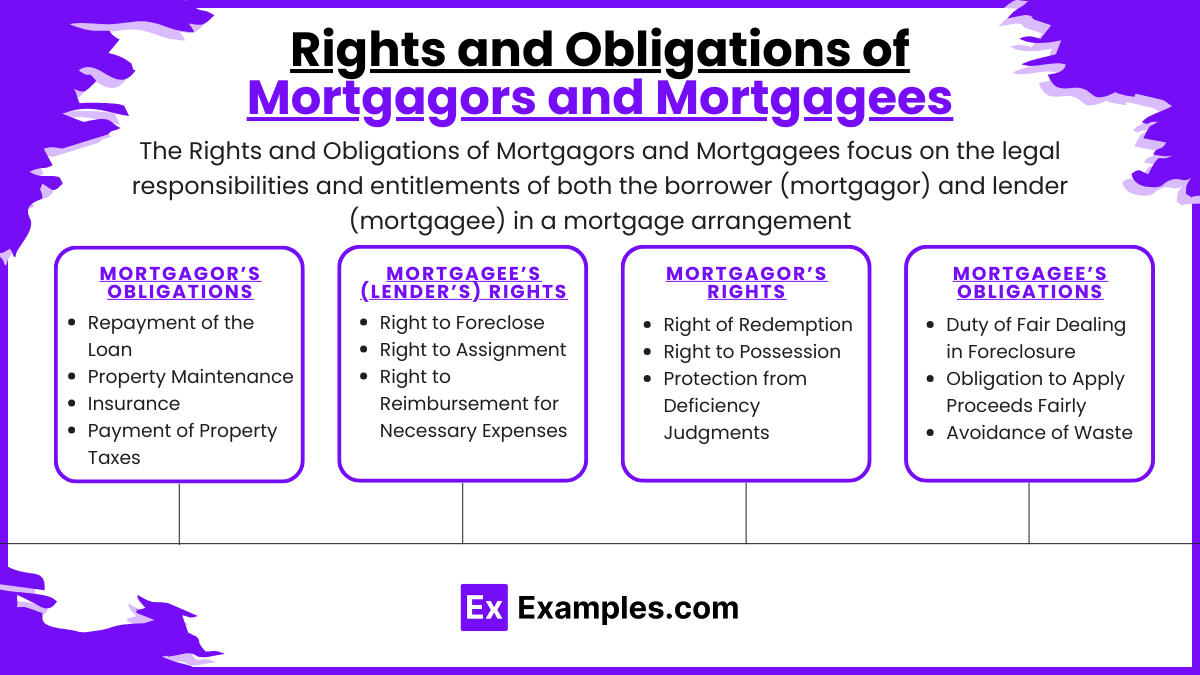

Rights and Obligations of Mortgagors and Mortgagees

The Rights and Obligations of Mortgagors and Mortgagees focus on the legal responsibilities and entitlements of both the borrower (mortgagor) and lender (mortgagee) in a mortgage arrangement.

1. Mortgagor’s (Borrower’s) Obligations

The mortgagor has several key responsibilities under the mortgage contract, primarily aimed at protecting the lender's security interest in the property.

Repayment of the Loan: The most fundamental obligation is to make timely payments on the loan according to the terms specified in the promissory note. Failure to make payments can result in default, potentially leading to foreclosure.

Property Maintenance: The mortgagor is generally required to keep the property in good condition. Neglect or damage to the property can decrease its value, impacting the lender’s security. Many mortgage agreements stipulate that borrowers maintain the property to preserve its value.

Insurance: Mortgagors are often required to carry property insurance. This protects the lender’s collateral in case of significant damage (e.g., fire, flood). The insurance requirement ensures that the property can be restored if damaged, maintaining its value as security.

Payment of Property Taxes: Mortgagors must keep property taxes up to date. If taxes go unpaid, the government may place a tax lien on the property, which often takes priority over the mortgage lien, jeopardizing the lender’s interest.

Failure to fulfill these obligations can lead to default, giving the mortgagee the right to pursue foreclosure and other remedies.

2. Mortgagee’s (Lender’s) Rights

The mortgagee’s rights are largely designed to protect their financial interest in the property. These rights ensure that the lender can recover the loan amount if the borrower defaults.

Right to Foreclose: If the mortgagor defaults on the loan, the mortgagee has the right to foreclose on the property. This involves selling the property through a foreclosure process (judicial or non-judicial, depending on the state and mortgage type) to recover the outstanding debt.

Right to Assignment: The mortgagee can transfer or assign the mortgage to another lender or investor. This right allows the original lender to sell their interest in the loan, often as part of the secondary mortgage market. The assignee acquires the same rights and obligations as the original lender.

Right to Reimbursement for Necessary Expenses: If the mortgagee incurs costs to preserve the property’s value (e.g., paying overdue taxes or making emergency repairs), they can add these expenses to the loan balance. This ensures that the lender is not financially harmed by the borrower’s failure to maintain the property.

3. Mortgagor’s Rights

The mortgagor also has certain rights that protect their interests in the property, even in cases of default.

Right of Redemption: Most states allow the mortgagor the right to “redeem” the property by paying off the full mortgage balance before foreclosure (equitable right of redemption). Some states also permit a statutory right of redemption, allowing the borrower to redeem the property even after a foreclosure sale, within a specified time frame.

Right to Possession: Generally, the mortgagor retains possession of the property as long as they are not in default. This means that even though the mortgagee holds a security interest, the borrower has the right to live in or use the property until foreclosure.

Protection from Deficiency Judgments: In some states, if the foreclosure sale proceeds do not fully cover the outstanding mortgage balance, the lender cannot pursue the mortgagor for the remaining balance. This is often referred to as “anti-deficiency protection” and varies by state.

4. Mortgagee’s Obligations

The mortgagee has certain obligations to act in good faith and in a commercially reasonable manner.

Duty of Fair Dealing in Foreclosure: When foreclosing on a property, the mortgagee must generally conduct the process fairly. For instance, they must provide proper notice and follow state-specific foreclosure procedures. Courts may intervene if they find that the lender did not act in good faith.

Obligation to Apply Proceeds Fairly: After a foreclosure sale, the mortgagee is required to apply the sale proceeds first to cover the costs of the sale, then to the loan balance. Any remaining proceeds are returned to the mortgagor.

Avoidance of Waste: Mortgagees are obligated to avoid actions that might reduce the value of the collateral property, as this could harm both the borrower’s and lender’s interests.

Statutory and Judicial Modifications of Mortgage Law

Statutory and Judicial Modifications of Mortgage Law refer to legal changes aimed at protecting borrowers and ensuring fair practices in mortgage transactions. These modifications impact the rights and remedies available to both borrowers and lenders.

Anti-Deficiency Legislation: Some states have laws limiting a lender's ability to pursue a deficiency judgment, which is a claim for the remaining balance if a foreclosure sale does not cover the full loan amount. Anti-deficiency statutes protect borrowers from excessive financial burdens after foreclosure.

Fair Foreclosure Laws: These laws require lenders to follow specific procedures to ensure fair treatment during foreclosure, including proper notice and, in some cases, offering opportunities to cure defaults. Fair foreclosure statutes provide borrowers with more transparency and procedural protections.

Judicial Interpretations: Courts often shape mortgage law through case rulings that address evolving issues in foreclosure, borrower protections, and lender rights. Judicial modifications can expand or limit the application of mortgage terms, providing more nuanced borrower protections based on fairness and equity.

Examples

Example 1

A homeowner obtains a mortgage to purchase a new property, signing a promissory note and mortgage document with a bank. The bank becomes the mortgagee and holds a lien on the property, which serves as collateral until the loan is paid in full.

Example 2

A buyer purchases a property using a deed of trust instead of a traditional mortgage. In this arrangement, the buyer is the trustor, the bank is the beneficiary, and a third party acts as the trustee, holding the title. If the buyer defaults, the trustee can initiate a non-judicial foreclosure on behalf of the bank.

Example 3

A contractor files a mechanic’s lien against a property after the homeowner fails to pay for completed renovations. The lien serves as a security device, allowing the contractor to claim an interest in the property until payment is received. If unpaid, the lien may lead to foreclosure to satisfy the debt.

Example 4

A property owner uses a land sale contract, agreeing to monthly payments to the seller, who retains legal title until the contract is fully paid. If the buyer defaults, the seller can reclaim the property without going through a traditional foreclosure, as the buyer has not yet obtained title.

Example 5

A lender files a tax lien on a property after the owner neglects to pay property taxes. The tax lien gives the government a priority claim on the property over other debts, potentially leading to a tax foreclosure if the taxes remain unpaid.

Practice Questions

Question 1

Which of the following best describes a deed of trust in a mortgage transaction?

A. A direct contract between the borrower and lender without a third party

B. An arrangement where a third party holds title on behalf of the lender until the debt is repaid

C. A mortgage that does not require foreclosure procedures

D. A promissory note given by the borrower to secure a loan

Answer: B

Explanation: A deed of trust involves three parties: the borrower (trustor), the lender (beneficiary), and a trustee who holds the title until the loan is repaid. If the borrower defaults, the trustee can initiate a non-judicial foreclosure, which often simplifies the foreclosure process for the lender. This setup differentiates it from a traditional mortgage, which directly involves only the borrower and lender.

Question 2

A borrower fails to pay for a major home renovation, and the contractor places a lien on the property. What type of lien is this?

A. Judicial lien

B. Mechanic’s lien

C. Tax lien

D. Equitable lien

Answer: B

Explanation: A mechanic’s lien is a specific type of lien filed by contractors, suppliers, or laborers when payment for work done on a property is not received. This lien serves as a security device, allowing the contractor to claim an interest in the property until paid. It differs from judicial liens (from court judgments) and tax liens (for unpaid taxes).

Question 3

Which of the following statements is true regarding anti-deficiency laws?

A. They require the borrower to pay any remaining loan balance after foreclosure.

B. They prevent lenders from pursuing borrowers for any remaining loan balance after a foreclosure sale.

C. They mandate the lender to obtain a court order before foreclosure.

D. They guarantee that borrowers can retain property ownership after foreclosure.

Answer: B

Explanation: Anti-deficiency laws protect borrowers by preventing lenders from pursuing deficiency judgments for any remaining loan balance if a foreclosure sale does not cover the total debt. These laws vary by state and aim to limit the financial burden on borrowers after losing their property through foreclosure.