Preparing for the MBE Exam requires a thorough understanding of real estate contracts, a vital part of property law. Mastery of contract formation, terms, and enforcement, as well as nuances in deeds, financing, and transactions, is essential. This knowledge is key for excelling in real estate law and achieving a high MBE score.

Learning Objective

In studying "Real Estate Contracts" for the MBE Exam, you should learn to understand the formation, interpretation, and enforcement of contracts specific to real property transactions. Analyze elements such as offer, acceptance, consideration, and the statute of frauds as they apply to real estate contracts. Evaluate the legal implications of terms like contingencies, disclosures, and deeds, and consider how breaches, remedies, and defenses are handled. Additionally, explore how financing agreements, leases, and transfer documents play into real estate law, and apply your understanding to interpret contract scenarios in practice questions to improve your MBE performance.

Understanding Contract Formation in Real Estate

In real estate, the formation of a legally binding contract requires the same foundational elements as other types of contracts: offer, acceptance, and consideration, along with meeting specific legal requirements, such as the statute of frauds.

1. Offer and Acceptance

Offer: One party (often the buyer) proposes specific terms for the purchase, sale, or lease of property. This offer must be clear and definite, indicating the intent to form a binding agreement. For instance, an offer to purchase property at a stated price with certain conditions (like closing date and financing terms) sets the stage for a contract.

Acceptance: The other party (usually the seller) must accept the offer's terms unconditionally to form a contract. If the seller makes any changes or conditions, this is considered a counteroffer, which the buyer may then accept or reject. Mutual consent is key, and the acceptance must mirror the terms of the original offer.

2. Consideration

Definition: Consideration is the exchange of value between the parties, often involving money (such as a down payment or full purchase price) in exchange for property rights.

Real Estate Context: The buyer provides financial consideration, while the seller provides the property interest. Without this exchange, the contract lacks enforceability.

3. Statute of Frauds

Requirement for Written Contracts: The statute of frauds mandates that certain contracts, including real estate contracts, must be in writing to be enforceable. This requirement helps prevent misunderstandings and fraud by ensuring that terms are documented.

Elements of a Written Contract: A valid real estate contract should include essential details such as the names of the parties, property description, purchase price, and signature of the party to be charged (the person against whom enforcement is sought).

Exceptions: In rare cases, oral contracts might be enforceable if part performance can be proven (e.g., if the buyer has made significant improvements to the property or made partial payments with the seller’s acknowledgment).

4. Meeting of the Minds

Intent to Enter into Contract: Both parties must clearly understand and agree on the contract's terms, reflecting a "meeting of the minds." This mutual consent indicates that both parties are ready and willing to fulfill their respective obligations under the contract.

Interpretation and Enforceability of Real Estate Contracts

The interpretation and enforceability of real estate contracts depend on a clear understanding of the contract terms and ensuring the contract meets legal standards. Courts look at specific terms, the intent of the parties, and statutory requirements to determine whether a real estate contract is binding and enforceable. Let’s break down these critical components:

1. Key Contract Terms

Contingencies: Contingencies are conditions that must be met for the contract to move forward. Common contingencies in real estate contracts include financing (approval of a mortgage), inspection (property passing a certain level of inspection), and appraisal (property’s value meets or exceeds the sale price). If these contingencies are not met, the buyer or seller may have the right to terminate the contract.

Closing Date: This specifies when the property transaction will be finalized. Both parties are typically expected to complete all required actions (e.g., securing financing, signing documents) by this date.

Earnest Money: This deposit, paid by the buyer to demonstrate commitment, becomes a key term. If the buyer fails to meet contract terms without justification, the seller may retain the earnest money as liquidated damages.

2. Disclosures and Warranties

Seller Disclosures: In many jurisdictions, sellers are legally obligated to disclose known material defects with the property. Disclosures may include information on structural issues, environmental hazards, or past repairs. If a seller fails to disclose required information, the buyer may have grounds for rescission (canceling the contract) or damages.

Implied and Express Warranties: Real estate contracts can include express warranties, such as the warranty of title, which guarantees that the seller has the right to transfer ownership without undisclosed claims or liens. In some cases, implied warranties—like the warranty of habitability in new home sales—may also apply, providing further assurance to the buyer.

3. Ambiguities in Contract Language

Plain Language Rule: Courts often interpret contract terms based on their ordinary meaning. If terms are clear and straightforward, they’re interpreted as written, and courts typically will not look beyond the document.

Ambiguities and Interpretation Against the Drafter: If contract language is ambiguous, courts may interpret the terms against the drafter, usually the party who prepared the contract (often the seller or their agent). This protects the other party (usually the buyer) from unclear terms that might disadvantage them.

Parol Evidence Rule: Generally, courts do not consider outside (or parol) evidence to interpret contract terms if the written contract appears to be complete and unambiguous. However, if terms are unclear or if there’s evidence of fraud or mistake, the court may consider additional evidence to clarify intent.

4. Legal Standards for Enforceability

Capacity and Competency: Parties entering into a real estate contract must be legally competent. This includes being of sound mind, not under duress, and of legal age. Contracts involving minors or individuals lacking mental capacity may not be enforceable.

Statute of Frauds: As previously discussed, real estate contracts must be in writing to be enforceable. A lack of a written agreement could invalidate the contract in court unless an exception applies.

Legality of Purpose: Real estate contracts must be for a legal purpose. A contract to sell property for illegal uses, such as prohibited development or unauthorized uses, would not be enforceable.

5. Remedies for Breach and Enforceability

Specific Performance: If a party breaches a real estate contract, the non-breaching party may seek specific performance, a remedy unique to real estate. This legal action compels the breaching party to fulfill their contractual obligations, such as transferring the property as agreed, because real estate is considered unique.

Monetary Damages: If specific performance is not possible or practical, the non-breaching party may seek damages for financial losses caused by the breach. This could include expenses like lost deposits or legal fees.

Rescission and Cancellation: In some cases, the non-breaching party may choose to cancel the contract and seek a return of any payments made, effectively restoring both parties to their pre-contract positions.

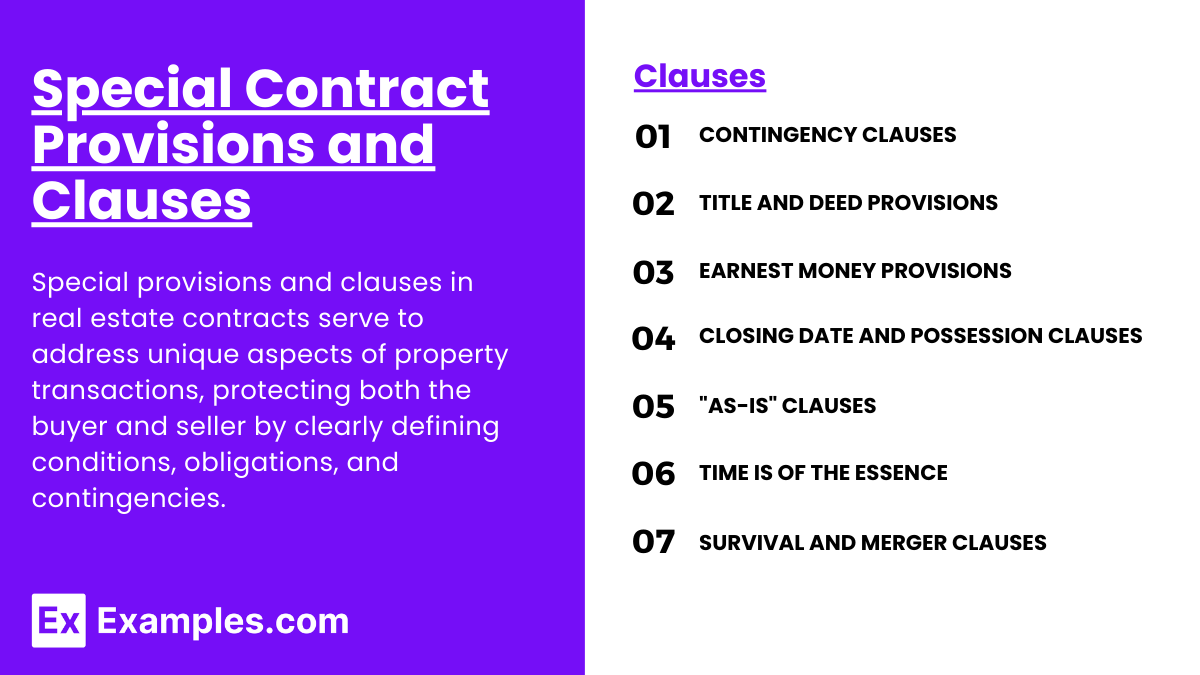

Special Contract Provisions and Clauses

Special provisions and clauses in real estate contracts serve to address unique aspects of property transactions, protecting both the buyer and seller by clearly defining conditions, obligations, and contingencies. Understanding these clauses is essential, as they can significantly impact the enforceability and outcome of the transaction.

1. Contingency Clauses

Financing Contingency: This clause allows the buyer to back out of the contract if they cannot secure financing within a specified time. The buyer is usually required to apply for a mortgage and make reasonable efforts to obtain the necessary loan. If financing falls through, the buyer can withdraw without penalty.

Inspection Contingency: This provision gives the buyer the right to have the property inspected and to cancel or renegotiate the contract if significant issues are found. The buyer can ask the seller to fix the issues or adjust the price, or they can withdraw if the inspection reveals problems that impact the property’s value or safety.

Appraisal Contingency: This protects the buyer if the property is appraised below the purchase price. If the appraisal is low, the buyer may be able to renegotiate or withdraw. This clause is especially important in situations where financing is tied to the property’s appraised value.

2. Title and Deed Provisions

Title Warranty Clauses: In real estate transactions, the seller typically assures the buyer that they hold clear, marketable title to the property. Title warranties protect the buyer against claims from third parties and undisclosed encumbrances. Depending on the type of deed (e.g., warranty deed or quitclaim deed), the seller’s obligations vary, with warranty deeds providing the most comprehensive protection.

Encumbrance Disclosure: The seller is generally required to disclose any encumbrances, such as liens, easements, or restrictive covenants, that could affect the buyer’s rights to the property. These clauses ensure that the buyer is aware of any restrictions on their use of the property.

Recording Clause: This clause obligates the buyer to officially record the deed with the appropriate government office (e.g., county recorder) to ensure public recognition of ownership. Recording the deed also protects the buyer from claims by others who may acquire an interest in the property after the transaction.

3. Earnest Money Provisions

Amount and Purpose of Earnest Money: Earnest money is a deposit made by the buyer to show their commitment to purchasing the property. The contract should specify the amount of earnest money, when it’s due, and where it will be held (often in an escrow account) until closing.

Forfeiture of Earnest Money: If the buyer breaches the contract without justification, they may forfeit the earnest money to the seller as liquidated damages. This clause defines the conditions under which the seller can keep the deposit, offering compensation for the time the property was off the market.

Return of Earnest Money: If contingencies are not met, the earnest money may be returned to the buyer. For instance, if the buyer cannot secure financing or if the property fails inspection, they can usually recover their deposit without penalty.

4. Closing Date and Possession Clauses

Specified Closing Date: The contract typically includes a closing date when both parties are expected to finalize the transaction. This clause holds both parties accountable to meet the deadline, ensuring the timely transfer of ownership.

Extension Provisions: Sometimes, the buyer or seller may need more time to fulfill their obligations. An extension clause can allow for a mutually agreed-upon delay, typically specifying the conditions under which an extension is permissible.

Possession Date: This clause defines when the buyer is entitled to take possession of the property. While possession often occurs on the closing date, there may be exceptions, such as allowing the seller extra time to vacate or granting early possession to the buyer under specific conditions.

5. "As-Is" Clauses

Definition of "As-Is": An “as-is” clause indicates that the buyer accepts the property in its current condition, with no obligation on the seller to make repairs or provide warranties regarding the property’s state.

Limitations of "As-Is" Clauses: Although "as-is" clauses limit the seller’s responsibility, they don’t absolve the seller from disclosing known defects. Many states require sellers to disclose material defects that could affect the property’s value or safety, regardless of an "as-is" condition.

6. Time is of the Essence

Purpose: A "time is of the essence" clause emphasizes that deadlines in the contract are strict, and failure to meet them constitutes a breach. This clause creates a sense of urgency, particularly for completing tasks such as financing, inspections, or closing.

Consequences: If either party fails to perform by the specified dates, they may be in breach, potentially leading to the termination of the contract or claims for damages.

7. Survival and Merger Clauses

Survival of Obligations: This clause specifies which obligations (e.g., warranties, representations) will continue after closing. For example, a survival clause might ensure that the seller’s obligation to remedy title defects persists beyond the transaction’s completion.

Merger Clause: A merger clause, also known as an integration clause, states that the written contract is the final and complete agreement between the parties. This clause prevents either party from later claiming that oral agreements or promises outside of the contract are enforceable.

Breach, Remedies, and Defenses in Real Estate Contracts

In real estate contracts, a breach occurs when one party fails to fulfill their contractual obligations, leading to potential legal remedies for the non-breaching party. Understanding the types of breaches, available remedies, and possible defenses helps parties navigate disputes and protects their rights. Here’s a detailed look at each aspect:

1. Types of Breach in Real Estate Contracts

Material Breach: A material breach is a significant violation that goes to the heart of the contract, depriving the non-breaching party of the main benefits. For example, if the seller cannot provide clear title or the buyer fails to secure financing, it’s considered a material breach, and the non-breaching party may terminate the contract and seek remedies.

Minor Breach: Also known as a partial or immaterial breach, a minor breach does not substantially affect the contract’s overall purpose. For instance, if the seller misses a deadline for providing certain documents but the closing is unaffected, it may be a minor breach. In such cases, the non-breaching party may seek damages but typically cannot terminate the contract.

Anticipatory Breach: This occurs when one party indicates they will not fulfill their obligations before the actual breach occurs. For example, if a buyer notifies the seller in advance that they cannot complete the purchase, this anticipatory breach allows the seller to seek remedies immediately, even before the scheduled closing.

2. Remedies for Breach of Real Estate Contracts

Specific Performance: Since real estate is considered unique, courts often grant specific performance as a remedy, requiring the breaching party to fulfill their contractual obligations. For example, if a seller backs out without justification, the buyer may seek specific performance to compel the seller to transfer the property as agreed.

Monetary Damages: When specific performance isn’t practical or desired, the non-breaching party can seek monetary damages to compensate for financial losses. There are two primary types:

Compensatory Damages: These cover the direct losses resulting from the breach. For instance, if the buyer loses deposits or incurs additional costs, compensatory damages may be awarded.

Consequential Damages: In some cases, a breach may cause secondary losses, such as missed opportunities or additional financing costs. Consequential damages aim to cover these indirect impacts but are typically only awarded if they were foreseeable at the time of contract formation.

Liquidated Damages: Many real estate contracts include a liquidated damages clause, specifying a predetermined amount the breaching party must pay. Earnest money deposits often serve as liquidated damages if the buyer breaches without justification, allowing the seller to retain the deposit as compensation.

Rescission and Restitution: In cases of mutual consent or fraud, the contract may be rescinded, canceling it and restoring both parties to their original positions. The breaching party returns any funds received, and the non-breaching party returns any property or benefits acquired under the contract.

3. Defenses Against Breach of Real Estate Contracts

Fraud: If one party was deceived or misled into signing the contract, they might claim fraud as a defense. For example, if the seller knowingly concealed significant property defects, the buyer may argue that fraud justifies canceling the contract.

Misrepresentation: Misrepresentation occurs when false statements are made about a material fact that the other party relied upon. Unlike fraud, misrepresentation doesn’t require intent to deceive; however, if the buyer relied on incorrect information about the property’s condition or value, they may have grounds for rescission or damages.

Duress or Undue Influence: A contract is voidable if one party was coerced into the agreement under duress (e.g., threats) or undue influence (e.g., pressure by someone in a position of power). If proven, this defense allows the affected party to void the contract.

Mistake: If both parties entered the contract under a mutual mistake about a fundamental fact, such as property boundaries, they may seek rescission. A unilateral mistake, where only one party is mistaken, is typically not sufficient for rescission unless the other party knew or should have known of the mistake.

Unconscionability: If a contract is grossly unfair or one-sided, the disadvantaged party may claim unconscionability. Courts rarely enforce unconscionable contracts, especially if one party had no bargaining power or didn’t fully understand the terms.

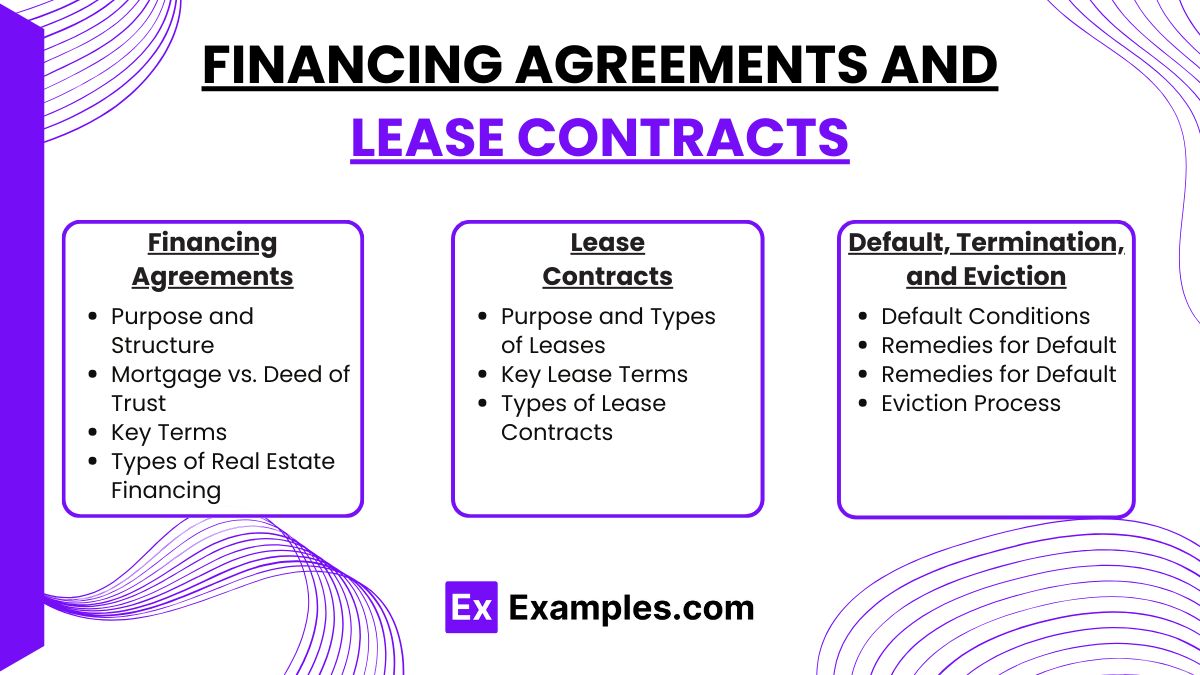

Financing Agreements and Lease Contracts

Financing agreements and lease contracts are fundamental components of real estate transactions, covering the purchase and leasing of property. They provide specific terms related to payments, rights, and obligations of each party involved. Understanding these agreements is crucial, as they dictate the financial arrangements, ownership conditions, and the legal framework for property use.

1. Financing Agreements

Purpose and Structure: Financing agreements are contracts that outline the terms under which a buyer borrows money to purchase property. The buyer (borrower) agrees to repay the loan, typically over a set period, with interest, while the lender (often a bank or mortgage company) holds a lien on the property as collateral until the loan is fully repaid.

Mortgage vs. Deed of Trust: In many states, financing agreements take the form of either a mortgage or a deed of trust. A mortgage involves a direct relationship between borrower and lender, whereas a deed of trust includes a neutral third party (the trustee) who holds the property title until the borrower repays the loan.

Key Terms in Financing Agreements:

Principal and Interest: The principal is the amount borrowed, while interest is the cost of borrowing, calculated as a percentage of the principal. The financing agreement specifies how principal and interest payments are structured, often as monthly payments over a set term (e.g., 15 or 30 years).

Amortization: This term describes how the loan is gradually paid off over time, with each payment covering interest and gradually reducing the principal. Many real estate loans are fully amortizing, meaning the loan is paid in full by the end of the term.

Prepayment Penalty: Some financing agreements include a penalty if the borrower repays the loan early. Lenders may include this to recoup potential interest lost from early payoff.

Default and Foreclosure: If the borrower fails to make payments, the lender may initiate foreclosure to repossess and sell the property to recover the loan amount. The financing agreement typically outlines the conditions under which foreclosure can occur.

Types of Real Estate Financing:

Fixed-Rate Mortgages: These loans have a fixed interest rate over the life of the loan, meaning payments remain constant, making them predictable for budgeting.

Adjustable-Rate Mortgages (ARMs): ARMs have interest rates that adjust periodically based on market conditions. The initial rate may be lower, but it can increase, which may lead to higher payments over time.

Interest-Only Loans: These loans allow borrowers to pay only interest for a specific period, after which they must begin paying principal. While initially more affordable, they can become costly once principal payments begin.

Balloon Payments: Some loans feature smaller monthly payments with a large final payment, or "balloon," at the end. This structure may suit buyers planning to refinance or sell before the balloon payment is due.

2. Lease Contracts

Purpose and Types of Leases: Lease contracts are agreements that outline the terms for renting property, specifying the rights and obligations of the landlord (lessor) and tenant (lessee). Leases apply to residential, commercial, and industrial properties and can vary based on the property type and rental arrangement.

Key Lease Terms:

Lease Term: This defines the duration of the lease, which can be fixed (e.g., one year) or month-to-month. Fixed-term leases provide stability, while month-to-month leases offer flexibility but allow for termination with notice.

Rent Amount and Payment Schedule: The lease specifies the rent amount, due date, and payment frequency (usually monthly). It may also outline penalties for late payments.

Security Deposit: Tenants typically pay a security deposit to cover potential damages or unpaid rent. The lease should state the deposit amount, conditions for its return, and how it can be applied by the landlord.

Maintenance and Repairs: Leases generally outline maintenance responsibilities. For residential leases, landlords often handle major repairs, while tenants handle minor issues. Commercial leases may require tenants to maintain or improve the property.

Use Restrictions: Leases often specify permitted uses for the property, particularly in commercial leases. Restrictions prevent tenants from engaging in activities that could damage the property or violate zoning laws.

Types of Lease Contracts:

Gross Lease: In a gross lease, the tenant pays a fixed rent, while the landlord covers operating expenses, such as property taxes and maintenance. This arrangement is common in residential leases.

Net Lease: Under a net lease, the tenant pays rent plus some or all property expenses (e.g., taxes, insurance, maintenance). Variants include single, double, and triple net leases, with tenants assuming more expenses in each type.

Percentage Lease: Typically used in retail, a percentage lease requires the tenant to pay a base rent plus a percentage of their sales revenue. This benefits landlords when the tenant’s business succeeds and can reduce rent when sales are low.

Ground Lease: A ground lease is a long-term lease for land where the tenant builds on the land and assumes responsibility for improvements. These leases often last decades and are commonly used for commercial developments.

3. Default, Termination, and Eviction

Default Conditions: A lease contract specifies conditions under which a tenant is in default, such as non-payment of rent or violating lease terms. For financing agreements, default usually involves missed payments.

Remedies for Default: In lease contracts, landlords may issue a notice to cure the default or proceed with eviction. In financing agreements, the lender may initiate foreclosure proceedings.

Termination Clauses: Leases and financing agreements often include conditions for early termination. Leases may allow termination with notice for month-to-month agreements or with penalties for fixed-term leases. Financing agreements typically require full payment of the remaining loan balance for early termination.

Eviction Process: If a tenant defaults and does not cure the breach, the landlord may seek a court order for eviction. The process varies by jurisdiction but typically requires notice, a court hearing, and, if granted, the physical removal of the tenant by law enforcement.

Examples

Example 1

A buyer enters into a real estate contract to purchase a home contingent on obtaining financing. The contract includes a financing contingency clause that allows the buyer to withdraw if they cannot secure a loan within 30 days. If financing is denied, the buyer can back out without penalty, and any earnest money deposit is refunded.

Example 2

A seller signs a real estate contract with a buyer and agrees to provide a warranty deed at closing. This deed guarantees that the seller has clear title to the property and that no undisclosed liens or encumbrances exist. If title defects are discovered, the seller must remedy them to complete the sale.

Example 3

A lease contract for commercial property specifies that the tenant will pay a base rent plus a percentage of their monthly sales, known as a percentage lease. This arrangement benefits the landlord when the tenant’s business is profitable and provides the tenant with flexibility if sales fluctuate.

Example 4

A real estate purchase contract includes an inspection contingency allowing the buyer to conduct a property inspection within 10 days. If the inspection reveals issues, the buyer may request repairs, renegotiate the price, or withdraw from the contract without forfeiting their deposit.

Example 5

A ground lease agreement is signed between a landowner and a commercial developer, allowing the developer to build and operate on the land for 99 years. The developer agrees to pay an annual ground rent and assumes responsibility for maintaining the improvements made on the leased land.

Practice Questions

Question 1

Which of the following clauses in a real estate contract allows a buyer to withdraw from the agreement if they cannot secure a loan?

A. Inspection Contingency

B. Financing Contingency

C. Title Warranty

D. Earnest Money Provision

Answer: B. Financing Contingency

Explanation: A financing contingency clause provides the buyer with the option to withdraw from the contract if they are unable to secure financing within a specified time frame. This protects the buyer from being obligated to purchase the property without an approved loan. Other clauses, like the inspection contingency, address different conditions of the contract.

Question 2

A warranty deed in a real estate contract primarily guarantees which of the following?

A. The buyer has secured financing

B. The property has no undisclosed liens

C. The inspection reveals no issues

D. The earnest money deposit is refunded

Answer: B. The property has no undisclosed liens

Explanation: A warranty deed guarantees that the seller has a clear title to the property, free of any undisclosed liens or encumbrances. This assures the buyer that there are no third-party claims that could affect their ownership rights. It does not pertain to financing, inspections, or earnest money.

Question 3

In a percentage lease, how is the tenant’s rent generally determined?

A. Fixed monthly amount only

B. Percentage of monthly sales plus base rent

C. Security deposit plus monthly payments

D. Single lump sum at the start of the lease

Answer: B. Percentage of monthly sales plus base rent

Explanation: A percentage lease requires the tenant to pay a base rent along with a percentage of their monthly sales, which is common in retail leases. This structure allows the landlord to share in the tenant’s business success while providing the tenant flexibility if sales vary.